Unlocking Hidden Investment Opportunities

In the ever-evolving landscape of finance, options trading has emerged as a powerful tool for investors seeking to enhance returns and manage risk. While traditionally associated with sophisticated traders, options are now accessible to a wider audience through Individual Retirement Accounts (IRAs). By exploring the intricacies of options trading within IRAs, this article aims to empower investors with the knowledge and insights necessary to navigate this complex yet potentially lucrative realm.

Image: us.etrade.com

Understanding the Dynamics of Options

At its core, an option is a financial contract that grants an investor the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This flexibility offers a myriad of strategic possibilities, allowing investors to tailor their investments to their unique objectives. Call options provide the right to buy an asset at a specified price (the strike price), while put options afford the right to sell. The time value attached to options also presents opportunities for profit, especially amid market volatility.

Options Trading in IRA Accounts: A Gateway to Tax-Advantaged Returns

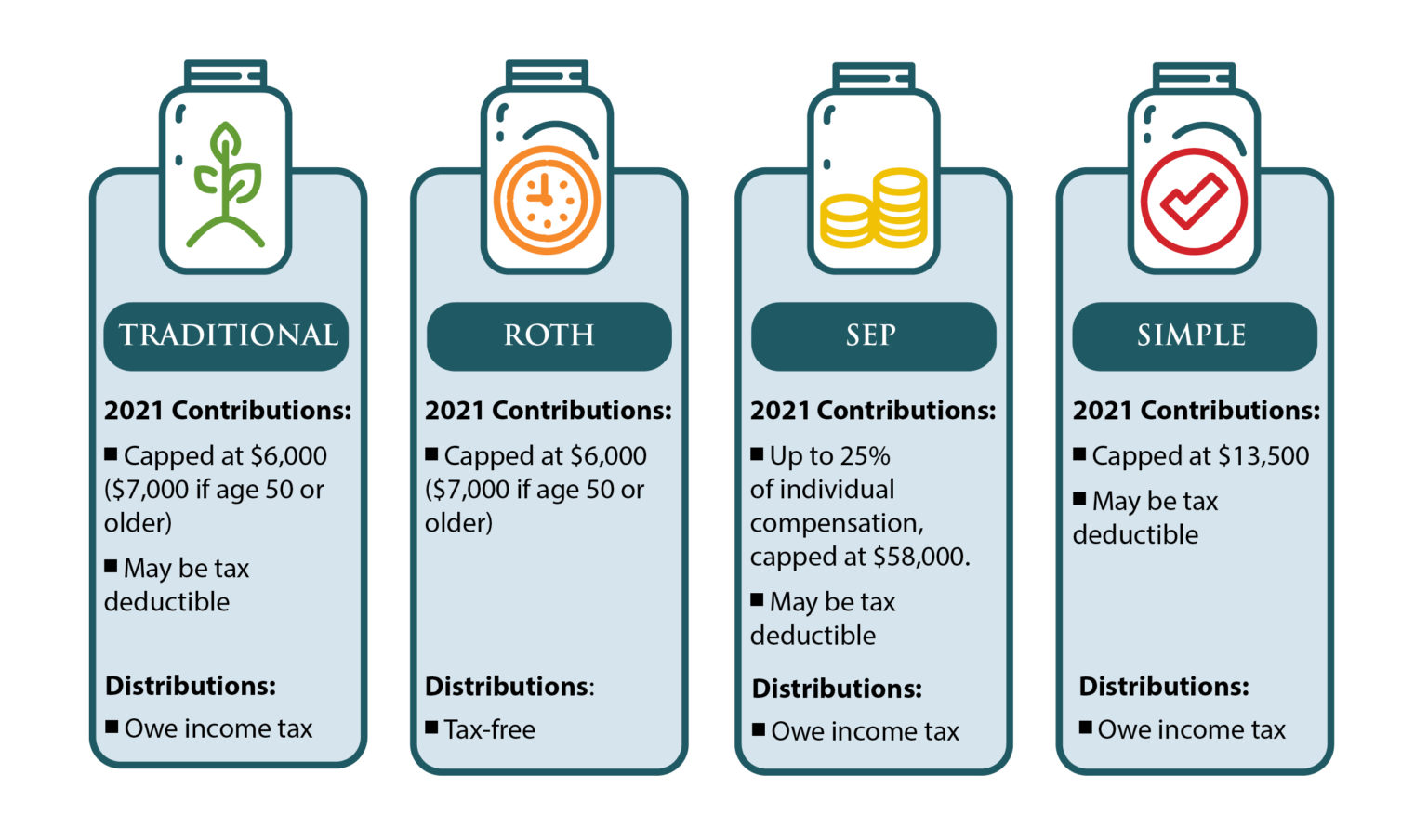

The interplay between options trading and IRAs opens up a world of tax-advantaged investment possibilities. By utilizing an IRA for options trading, investors can leverage tax-deferred or tax-free growth, depending on the type of IRA account held. This significant tax benefit can compound over time, bolstering investment returns. However, it’s crucial to note that options trading in IRAs is subject to specific rules and regulations, including margin restrictions and the potential for prohibited transactions.

Deciphering the Matrix of Call Options

Stepping into the realm of call options, investors assume the position of potential buyers of an underlying asset at a set strike price. If the market price of the asset exceeds the strike price before the option’s expiration date, the option holder can exercise the right to buy the asset at the lower strike price, capturing the difference as profit. As long as the underlying asset continues to appreciate, the potential gains can accumulate through the duration of the option’s life.

Image: optionstradingiq.com

Mastering the Mechanisms of Put Options

Delving into the world of put options, investors take on the role of potential sellers of an underlying asset at a predefined strike price. In this scenario, if the asset’s market price falls below the strike price prior to expiration, the option holder can exercise the right to sell the asset at the higher strike price, generating a profit from the price disparity. Amidst market downturns, put options can serve as a valuable hedging strategy, offering protection against potential losses.

Implementing Options Trading Strategies

The versatility of options trading empowers investors with a vast repertoire of strategies, ranging from conservative to aggressive approaches. Covered calls, for instance, involve selling a call option while simultaneously holding the underlying asset, aiming to generate additional income through option premiums. Cash-secured puts, on the other hand, entail selling a put option while possessing the financial resources to purchase the underlying asset, capitalizing on potential price declines.

Navigating the Options Trading Landscape: Prudent Considerations

While options trading can provide significant opportunities, it’s essential to proceed with prudent considerations. The inherent leverage associated with options magnifies both potential gains and losses, demanding a disciplined investment approach. Thorough research, meticulous analysis, and a clear comprehension of the risks involved are paramount to maximizing investment returns while mitigating downside exposure.

Options Trading In Ira Account

Image: preferredtrustcompany.com

Conclusion

Embracing options trading within the confines of an IRA can unlock a treasure trove of investment opportunities. By harnessing the power of tax-advantaged growth, investors can amplify their returns and optimize their portfolios. However, navigating this complex realm requires a deep understanding of options dynamics, strategic planning, and a discerning approach to risk management. With meticulous due diligence and a commitment to continuous learning, investors can venture into options trading with confidence, unlocking the potential for financial success.