In the fast-paced world of finance, options trading has emerged as a formidable tool for investors seeking enhanced returns. With its potential for both profit and risk, understanding the intricacies of options trading is crucial for successful navigation in this dynamic market. In this article, we delve into the world of options trading within the IBD framework, exploring its underlying principles, strategies, and expert insights to equip you with a comprehensive understanding of this exciting investment approach.

Image: twitter.com

Options trading involves the exchange of contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price and time. These contracts, known as options, can be either calls or puts. A call option grants the buyer the right to buy the underlying asset, while a put option provides the right to sell. The underlying asset can vary from stocks to commodities to currencies, offering traders a wide range of investment opportunities.

IBD in Options Trading

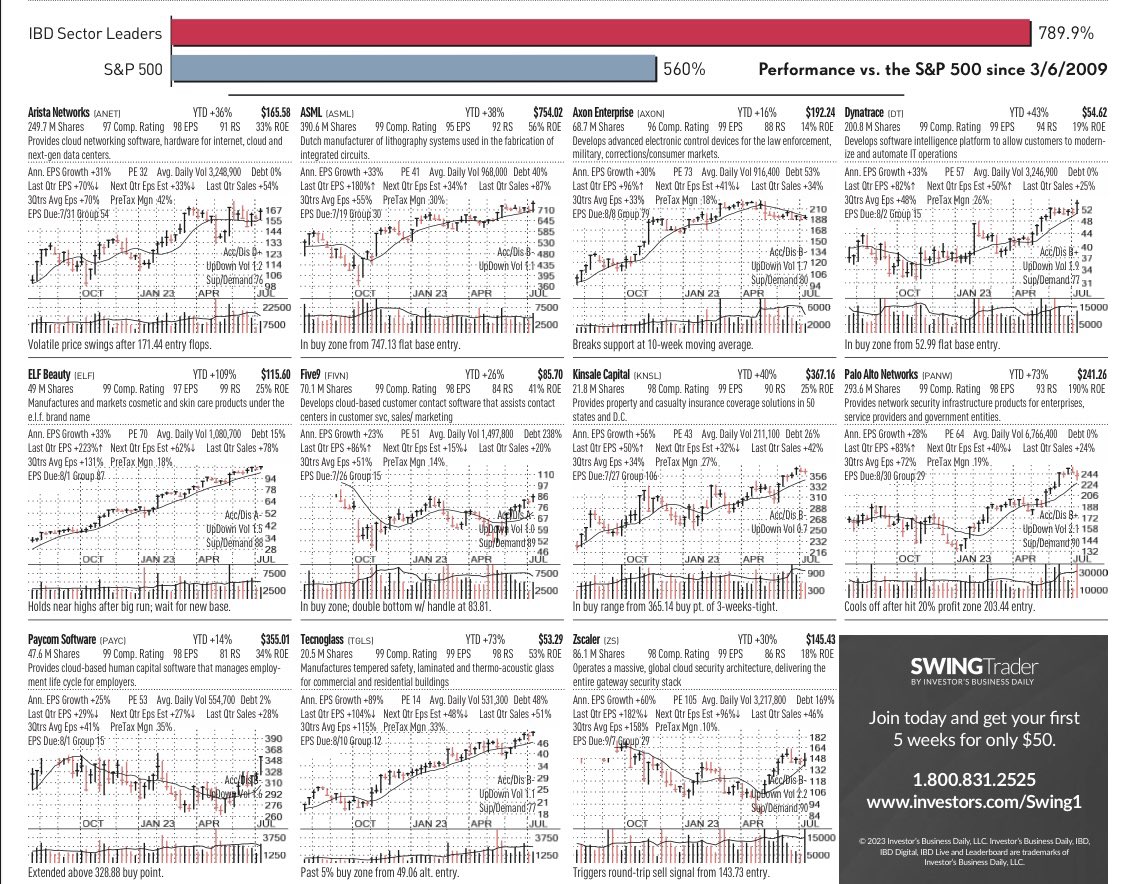

IBD, or Investor’s Business Daily, is a renowned provider of financial data and analysis. They have developed a specific approach to options trading known as the IBD Method. This method utilizes technical analysis, including chart patterns, to identify potential trading opportunities. The IBD Method focuses on identifying stocks with strong growth potential and incorporates options strategies to enhance returns while managing risk.

Key Concepts in Options Trading

Expiration Date and Strike Price

Every options contract has an expiration date and a strike price. The expiration date is the date on which the option contract expires and becomes worthless if not exercised. The strike price is the price at which the underlying asset can be bought or sold when the option is exercised.

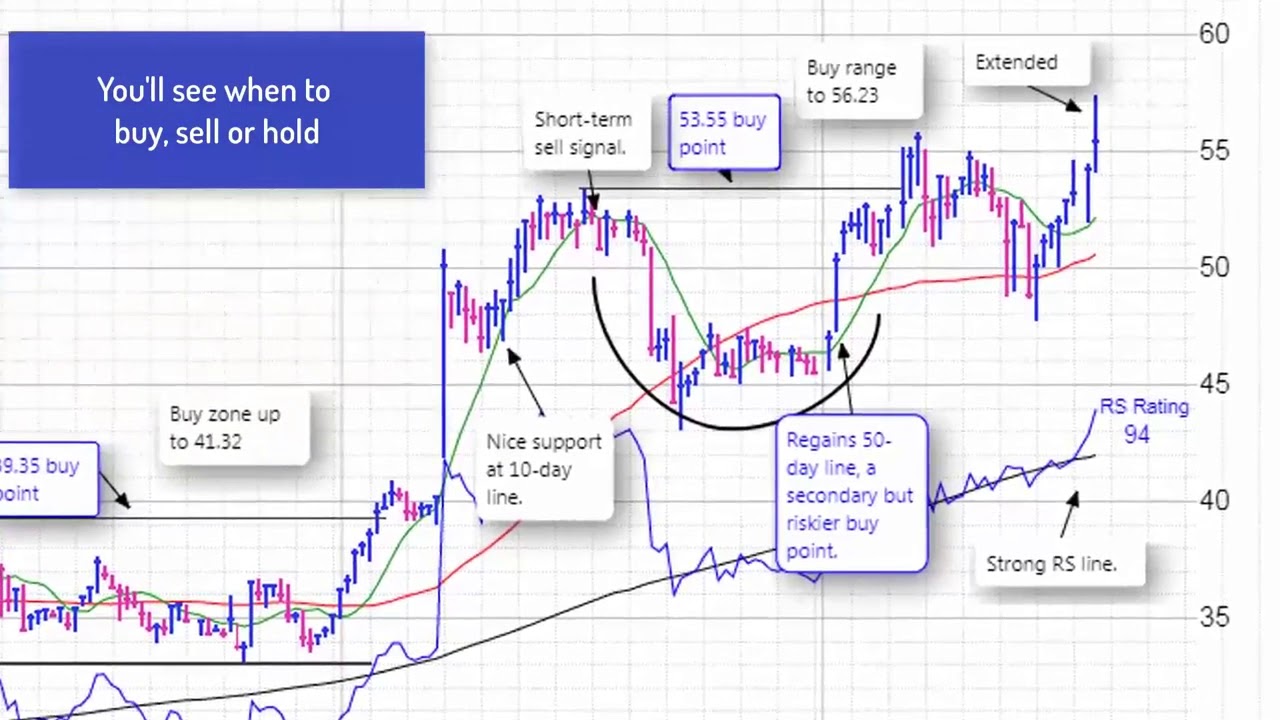

Image: tradingetfs.com

Option Premium

When purchasing an option, the buyer pays a premium to the seller. This premium represents the cost of acquiring the right to buy or sell the underlying asset at the specified strike price.

Understanding Time Value and Volatility

The value of an option is influenced by two key factors: time value and volatility. Time value is the value remaining in an option contract as it approaches its expiration date. Volatility measures the potential for price fluctuations in the underlying asset.

Strategies and Considerations

There are numerous options trading strategies available, each tailored to specific market conditions and risk tolerance levels. Some common strategies include:

- Covered Call: Selling a call option against a stock the investor owns.

- Cash-Secured Put: Selling a put option while holding cash to purchase the underlying asset if the option is exercised.

- Iron Condor: Selling both a call and a put option at different strike prices while buying a call and put option at even further strike prices.

When employing options strategies, careful consideration of the following factors is crucial:

- Risk Management: Understand the potential risks associated with options trading and implement strategies to mitigate them.

- Market Conditions: Analyze market trends and economic indicators to determine the suitability of specific options strategies.

- Time Horizons: Match your trading strategies with your investment time horizons, considering both short-term and long-term goals.

Expert Tips and Advice

Drawing upon insights from experienced traders and industry experts, here are some valuable tips and advice for successful options trading:

- Thorough Research: Conduct thorough research on the underlying asset, market conditions, and potential risks before entering any trades.

- Start Small: Begin with small trades until you gain confidence and experience in options trading.

- Trade with Discipline: Stick to your trading plan and avoid making emotional or impulsive decisions.

- Monitor Your Trades: Regularly monitor your trades and make adjustments as market conditions change.

Understanding these expert recommendations and adopting a disciplined approach will significantly enhance your Chancen of success in options trading.

FAQs

- Q: What are the benefits of options trading?

- A: Options trading provides potential for enhanced returns, flexibility in trading strategies, and the ability to both profit from rising and falling markets.

- Q: What are the risks of options trading?

- A: Options trading involves significant risk of losing the entire investment. It is crucial to understand and manage these risks before engaging in options trading.

- Q: How do I get started with options trading?

- A: To get started with options trading, open an account with a brokerage firm that supports options trading. Conduct thorough research and consider consulting with a financial advisor.

- Q: What is the IBD Method in options trading?

- A: The IBD Method combines technical analysis and options strategies to identify strong stocks and enhance returns while managing risk.

Options Trading Ibd

Image: www.youtube.com

Conclusion

Options trading within the IBD framework offers investors a powerful tool to navigate the financial markets. By understanding the concepts, strategies, and expert advice outlined in this article, you can make informed decisions and potentially enhance your investment returns. Whether you are new to options trading or looking to advance your skills, embracing the IBD Method can provide valuable insights and direction.

Are you ready to explore the exciting world of options trading? If so, consider delving deeper into the IBD Method and incorporating these strategies into your investment approach. With thorough research, disciplined decision-making, and careful risk management, you can harness the power of options trading to achieve your financial goals and potentially realize substantial returns.