Introduction

In the realm of financial markets, options trading stands out as a complex but potentially lucrative strategy. At its core lie intricate formulas that guide traders in making informed decisions. From calculating risk to maximizing returns, these formulas are the backbone of successful options trading.

Image: riset.guru

Take the example of Emily, an aspiring options trader. She stumbled upon a tantalizing opportunity to purchase a stock at a bargain price in the future. However, uncertainty lurked in the air – the stock’s price could skyrocket or plummet. Undeterred, Emily sought solace in the wisdom of options trading formulas, empowering her with insights and reducing the inherent risk.

Dissecting Options Trading Formulas

Options trading formulas provide a quantitative framework to analyze option contracts, enabling traders to assess their value, predict their behavior, and manage their risk.

Black-Scholes Model

Considered the cornerstone of options pricing, the Black-Scholes model employs a stochastic differential equation to determine the fair value of an option. It takes into account factors such as the underlying asset’s price, time to expiration, volatility, and risk-free interest rate.

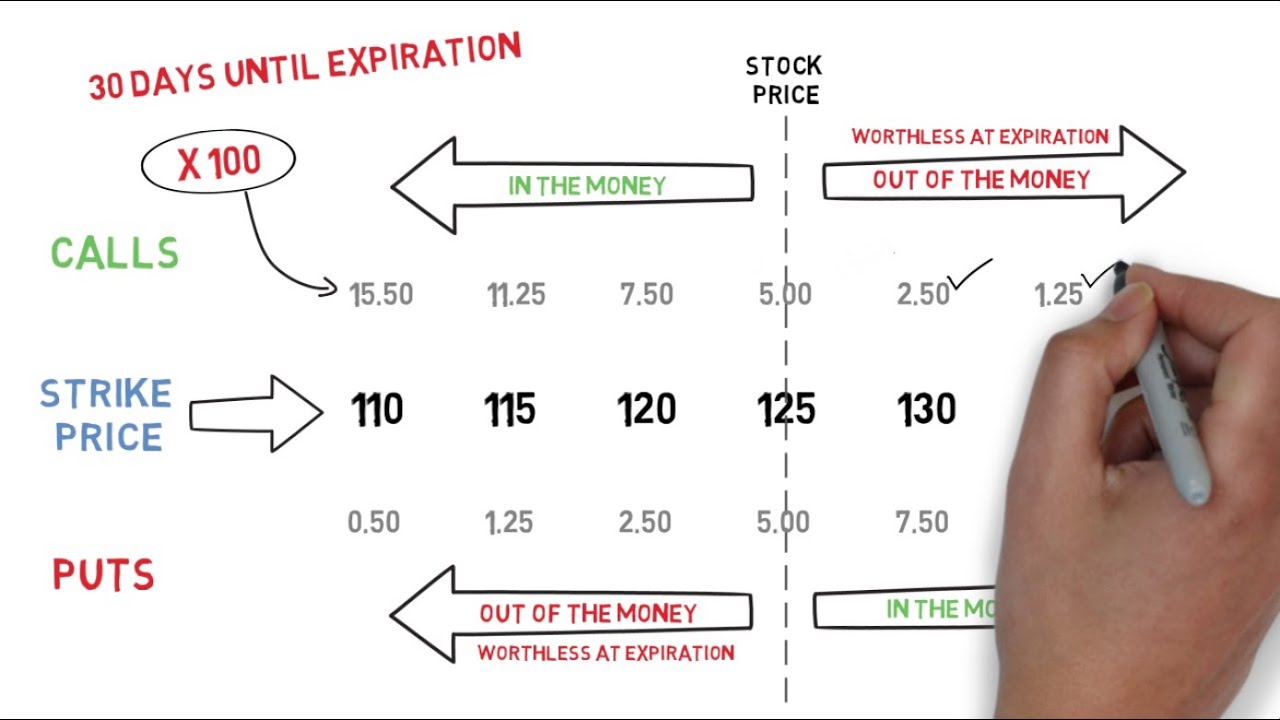

Greeks

Greeks are metrics derived from the option’s price that measure its sensitivity to changes in various underlying variables. They include parameters like delta, gamma, theta, vega, and rho, each providing traders with valuable insights into the option’s behavior.

Image: www.youtube.com

Monte Carlo Simulation

Monte Carlo simulation is a probabilistic technique used to assess the potential outcomes of an options strategy. By generating a multitude of possible scenarios, it helps traders estimate the likelihood of different profit and loss outcomes.

The Evolving Landscape of Options Trading Formulas

As markets evolve, so too do the formulas that govern options trading. Advancements in data analytics and computing power have spawned a new generation of sophisticated algorithms.

For instance, machine learning techniques are increasingly applied to develop predictive models that enhance option pricing accuracy. These models analyze historical data, identifying patterns and anomalies to improve decision-making.

Expert Advice for Aspiring Options Traders

Unlocking the transformative power of options trading formulas demands a delicate balance of knowledge and experience. Here’s invaluable advice to propel your trading journey to greater heights:

Master the Fundamentals

Lay a solid foundation by comprehending the theoretical underpinnings of options trading, including the types of options, pricing models, and risk management strategies.

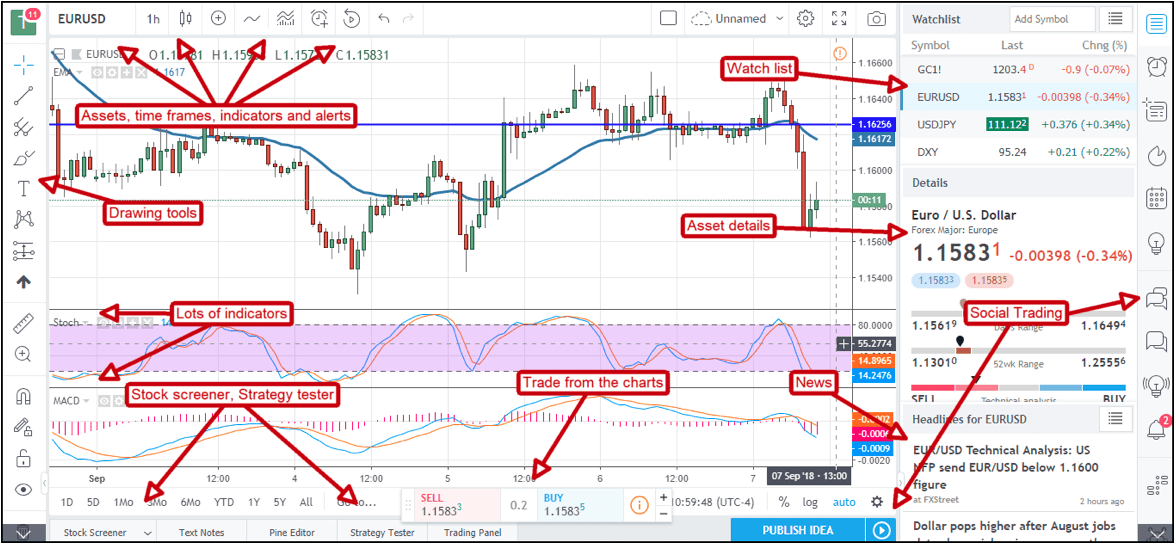

Utilize Technology Wisely

Embrace the power of advanced trading platforms and software that seamlessly integrate options trading formulas. These tools automate calculations, streamline analysis, and empower traders with real-time insights.

Frequently Asked Questions

Q: How can I improve my accuracy in options trading?

A: Enhance your understanding of options pricing models, incorporate historical data analysis, and stay updated with market trends and news.

Q: What are the key risks associated with options trading?

A: Options trading carries inherent risks, including potential losses that may exceed the initial investment, and it’s crucial to manage these risks effectively through prudent risk management strategies.

Options Trading Formulas

Image: imcourse.net

Conclusion

Mastering options trading formulas grants traders a competitive edge in navigating the intricate world of financial markets. Embrace the knowledge, harness the power of technology, and adhere to sound advice for a transformative options trading experience.

Are you ready to delve into the fascinating world of options trading formulas and unlock its potential for financial growth? Embark on this enriching journey, and let these formulas guide your path to success.