As I ventured into the realm of investing, I stumbled upon the intriguing world of options trading. Seeking a platform that would empower me to explore this fascinating arena, I turned to Robinhood, renowned for its user-friendly interface and empowering features. Embark on this journey with me as I dissect options trading on Robinhood, providing you with a comprehensive guide that will equip you to navigate this dynamic trading landscape.

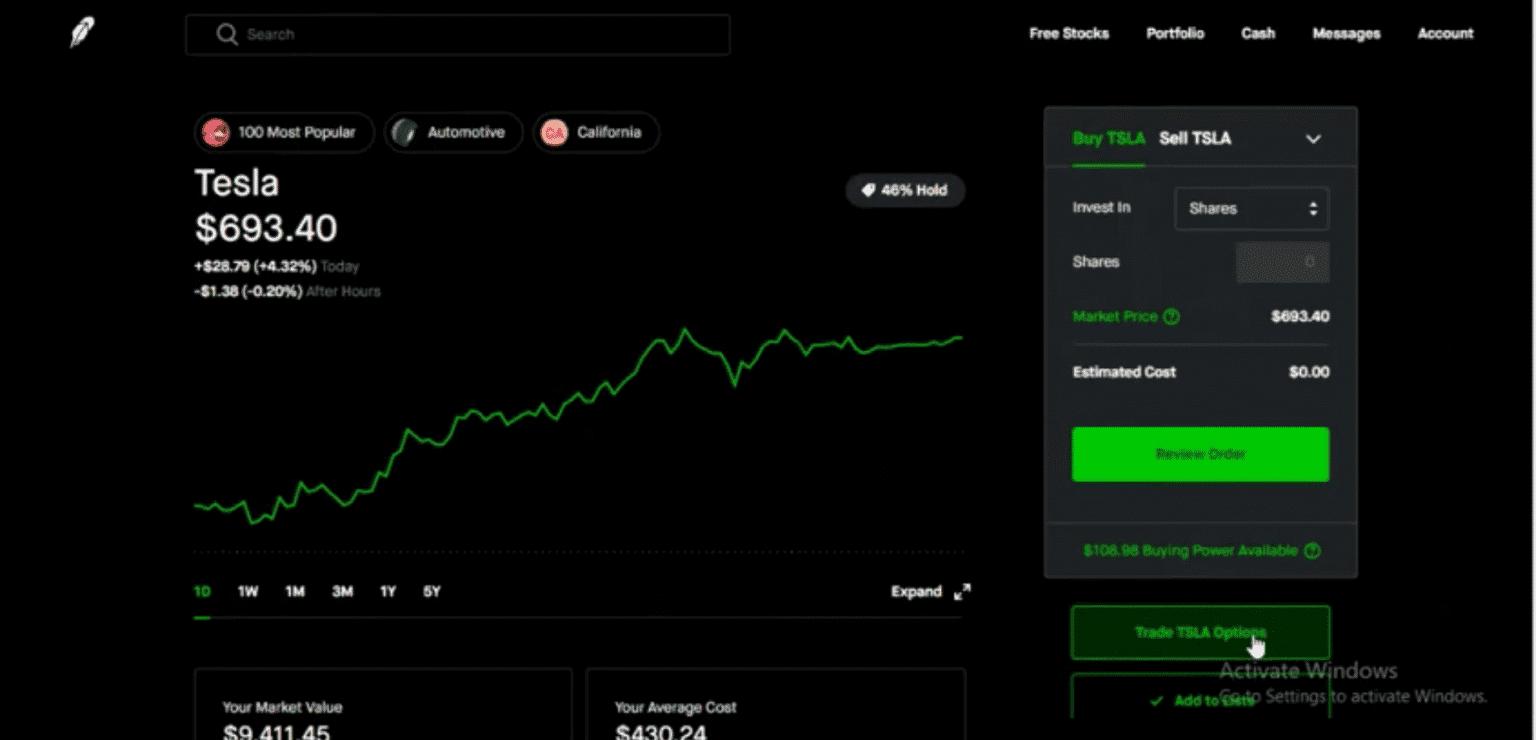

Image: daytradereview.com

The Essence of Options Trading

Options trading grants you the privilege, not the obligation, to buy or sell an underlying asset at a predefined price within a specified timeframe. Think of options as contracts that offer you the flexibility to make strategic decisions based on market conditions. Understanding the two primary types of options – calls and puts – is crucial:

- Call options confer upon you the right to purchase an underlying asset at a set price (strike price) before a specific date (expiration date).

- Put options empower you to sell an underlying asset at a fixed price before expiration.

Embracing the Benefits of Robinhood’s Options Platform

Robinhood’s options trading platform stands out for its ease of use and accessibility. Its intuitive interface guides you through the process seamlessly, from selecting the desired option to monitoring its performance. Furthermore, Robinhood offers educational resources and customer support to empower you as you delve into this intricate domain.

Unveiling the Mechanics of Options Trading on Robinhood

Initiating options trades on Robinhood involves a straightforward process.

- Identify the underlying asset you wish to trade (stocks, ETFs, or indices).

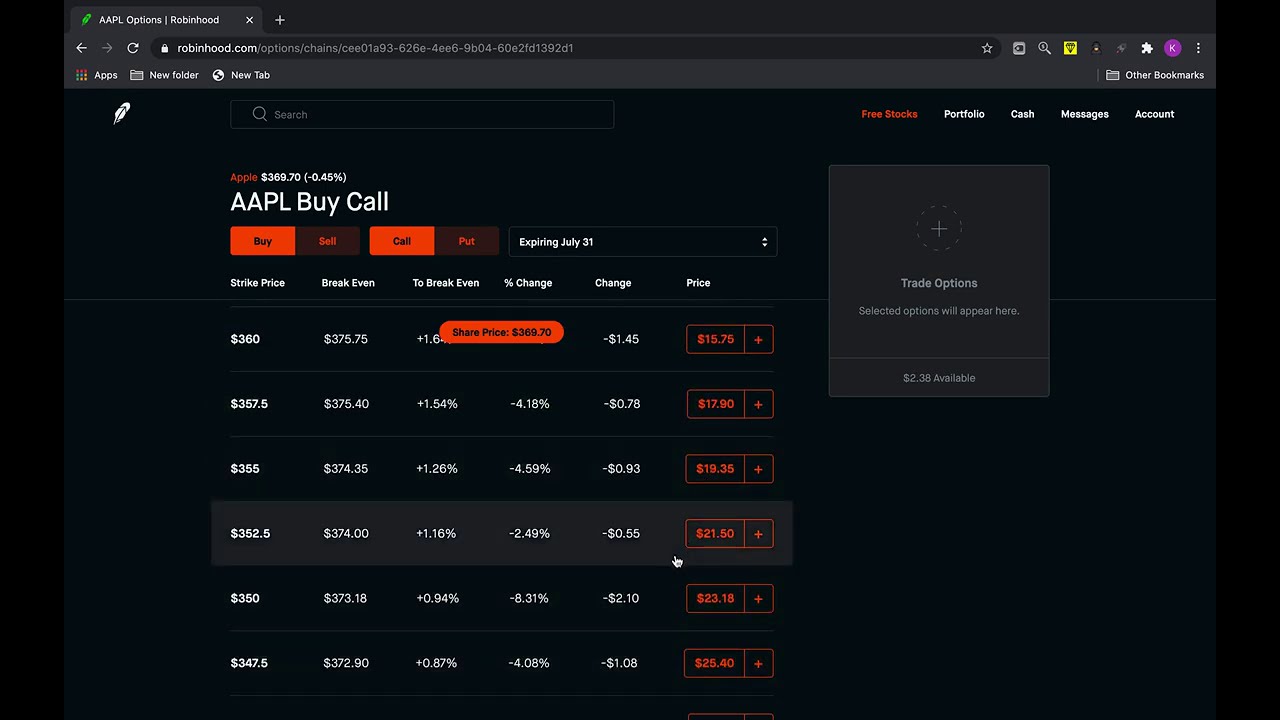

- Determine whether you intend to purchase a call or put option.

- Select the strike price and expiration date that align with your trading strategy.

- Set an order type (market order, limit order, or stop order) to define how you enter the trade.

- Execute the trade and monitor its performance as the market fluctuates.

Image: marketxls.com

Understanding Key Concepts in Options Trading

Grasping fundamental concepts in options trading is vital for succeeding in this arena.

- Premium: The price you pay to acquire an options contract.

- Intrinsic value: The profit you would realize by exercising the option at the current market price.

- Time decay: The gradual loss in value of an option as it nears its expiration date.

Navigating Market Trends and Expert Insights

Staying abreast of market trends and expert perspectives can empower your options trading strategies.

- Monitor economic indicators like inflation, unemployment rate, and interest rates for insights into market direction.

- Leverage technical analysis to identify potential trading opportunities based on historical price movements and patterns.

- Attend webinars and seek guidance from financial advisors to gain valuable insights and stay updated on industry best practices.

Tips for Successful Options Trading on Robinhood

To elevate your options trading success, consider incorporating these practical tips:

- Start with small positions to manage risk and gain confidence.

- Diversify your portfolio by trading options on multiple underlying assets.

- Practice patience and discipline to avoid impulsive trades.

Frequently Asked Questions (FAQs)

Here are answers to commonly asked questions regarding options trading on Robinhood:

- Who is eligible to trade options on Robinhood?: You must meet Robinhood’s eligibility requirements and pass an options trading quiz.

- What is the minimum balance required to trade options on Robinhood?: Robinhood does not impose a minimum balance requirement for options trading.

- Can I trade penny stocks as options on Robinhood?: Penny stocks are not available for options trading on Robinhood.

Options Trading For Robinhood

Image: www.youtube.com

Seizing the Opportunity

Options trading on Robinhood empowers you to enhance your investment strategies with precision and flexibility. Leverage the user-friendly platform, educational resources, and insights provided to unlock your trading potential. As you delve deeper into this dynamic arena, remember to manage risk prudently, embrace informed decision-making, and continuously refine your approach. Share your thoughts and experiences in the comments section below. Are you ready to embark on this transformative trading journey?