Greetings, fellow traders! In this sprawling diary, I embark on an intimate account of my options trading escapades, sharing invaluable insights, personal experiences, and hard-earned wisdom. Join me as we navigate the turbulent waters of the financial markets together.

Image: lisannakainat.blogspot.com

Navigating the Options Market: A Complex but Rewarding Adventure

The realm of options trading enchants with its unbridled potential for wealth accumulation. Yet, it demands a profound understanding of intricate concepts and an unwavering tolerance for risk. Here, I recount my triumphs and tribulations, hoping to illuminate the path for aspiring traders.

Unveiling the Essence of Options Trading

Options contracts confer upon their holders the privilege, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. This dynamic financial instrument unveils a myriad of strategies, ranging from conservative income generation to audacious speculative ventures.

Comprehending the Mechanics of Options Trading

Options contracts are composed of two fundamental components: the strike price and the expiration date. The former denotes the price at which the underlying asset can be bought or sold, while the latter establishes the terminal point of the contract’s validity. Additionally, options are classified into two primary varieties: calls and puts. Call options grant the buyer the right to purchase the asset, while puts bestow the right to sell.

Image: tradersync.com

Identifying Favorable Trading Conditions: Predicting Market Movements

Success in options trading hinges upon the ability to discern advantageous trading conditions. Technical analysis and fundamental analysis serve as indispensable tools in this endeavor. By scrutinizing price charts, economic indicators, and company-specific news, traders strive to anticipate future market movements with greater accuracy.

Embracing a Disciplined Trading Plan: Navigating Market Volatility

Discipline provides the cornerstone of prudent options trading. A well-defined trading plan outlines specific entry and exit points, risk management strategies, and position sizing parameters. By adhering to this plan, traders inject structure and consistency into their decision-making, mitigating the perils of emotional trading.

Expert Tips for Enhancing Trading Proficiency

-

Embrace Patience: Resist the allure of impulsive trades. Exercise patience, allowing market conditions to ripen before executing your strategy.

-

Manage Risk Effectively: Prudent risk management is paramount. Employ stop-loss orders and carefully monitor position sizing to safeguard your capital.

-

Continual Education: Seek knowledge relentlessly. Engage in study, attend workshops, and consult with industry experts to refine your trading acumen.

-

Learn from Both Victories and Losses: Celebrate your successes, but scrutinize your setbacks with equal fervor. Every trade presents an opportunity for growth and improvement.

-

Maintain Emotional Control: Tame the rollercoaster of emotions associated with trading. Develop a sound trading psychology to avoid succumbing to irrational decision-making.

Frequently Asked Questions

- Q: Is options trading right for me?

- A: Options trading involves inherent risks and demands a comprehensive grasp of financial concepts. Assess your risk tolerance and knowledge level before venturing into this arena.

- Q: How much capital is required to start options trading?

- A: The minimum capital required varies depending on the trading strategy employed. However, it is advisable to begin with sufficient capital to accommodate potential losses.

- Q: Can I learn options trading on my own?

- A: While self-study is possible, seeking guidance from experienced traders or educational resources can accelerate your learning curve and enhance your success probability.

- Q: Are options trading profits taxable?

- A: Yes, options trading profits are subject to taxation, varying according to applicable laws and regulations.

- Q: Can I trade options using a demo account?

- A: Many brokers offer demo accounts that allow you to simulate options trading without using real capital. This provides a risk-free environment to hone your skills.

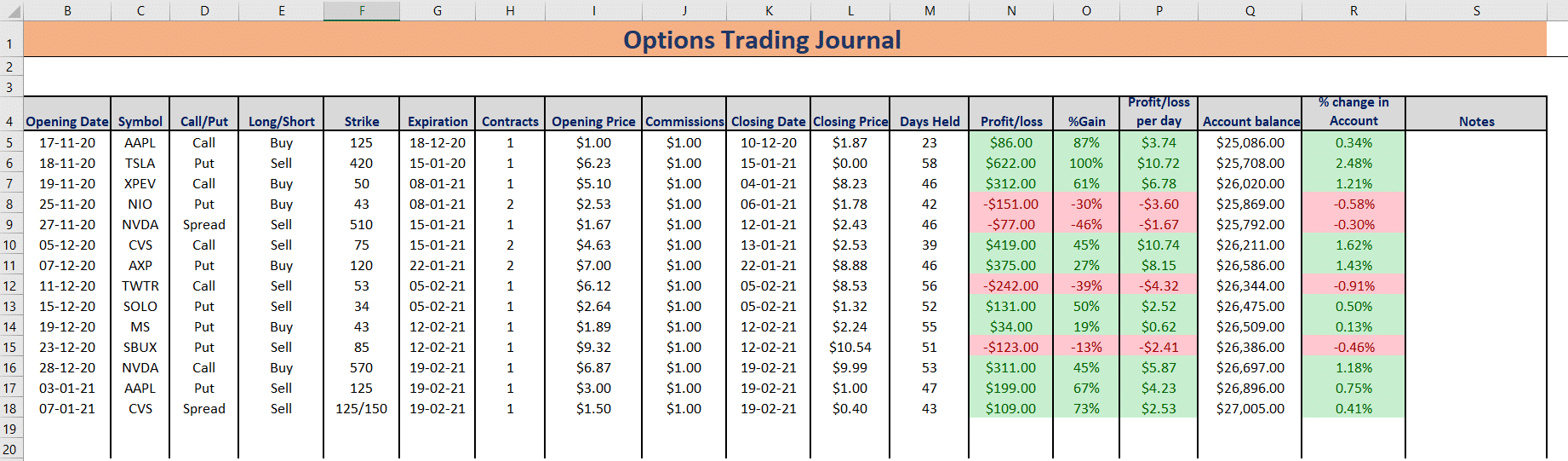

Options Trading Diary

Image: www.pinterest.com

Conclusion

Embarking on an options trading journey requires a harmonious blend of knowledge, discipline, and unwavering determination. Remember, financial markets fluctuate incessantly, demanding a perpetual thirst for learning and adaptation. Embrace this thrilling odyssey, document your experiences, and let your options trading diary become a testament to your financial prowess.

Are you ready to unlock the transformative potential of options trading? Begin your journey today and witness the power of wisely calculated risks.