Introduction

As an avid options trader, I’ve navigated the complex world of capital gains tax firsthand. Options trading can be a rewarding investment strategy, but understanding the tax implications is crucial for maximizing your returns. This article will delve into the intricacies of capital gains tax related to options trading, providing a comprehensive overview and practical tips to optimize your tax strategy.

Image: moneyhandle.in

Options trading involves the buying and selling of options contracts, which are derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. When you trade options, you’re essentially speculating on the future price of the underlying asset. The profit or loss you realize from these trades is subject to capital gains tax, which is levied on the income realized from the sale or exchange of capital assets, including stocks, bonds, and options.

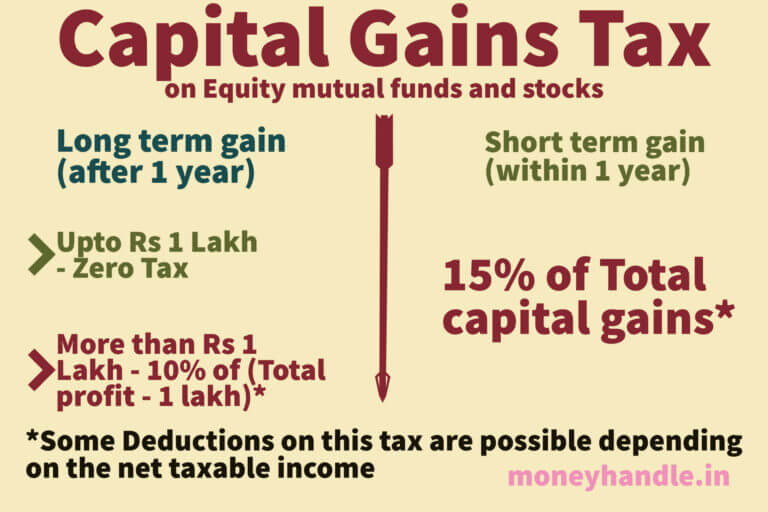

Tax Rates and Holding Period

The tax rate for capital gains depends on the holding period of the option. Options held for less than one year are subject to short-term capital gains tax, which is taxed at your ordinary income tax rate. Options held for more than one year are subject to long-term capital gains tax, which is taxed at a lower rate, depending on your income.

Calculating Capital Gains

To calculate your capital gain, subtract the cost basis of the option (the price you paid for it) from the sale price. If you have a net gain, you’ll owe capital gains tax on the difference. For example, if you buy an option for $100 and sell it for $150, your capital gain is $50. If you held the option for less than a year, the gain is subject to short-term capital gains tax. If you held it for more than a year, the gain is subject to long-term capital gains tax.

Taxation of Option Premiums

When you purchase an option, you pay a premium, which is the price of the option contract. The premium is not deductible for tax purposes, but it is added to your cost basis. This means that if you sell the option for a loss, you can offset the loss against the premium you paid when you purchased it. For example, if you buy an option for $100 and sell it for $50, your loss is $50. However, if you add the $100 premium back into your cost basis, your adjusted cost basis is $150. This means that your loss is actually only $50, which could reduce your capital gains tax liability.

Image: thenewsintel.com

Options Trading Capital Gains Tax

Image: thecollegeinvestor.com

Latest Trends and Tax Strategies

The tax landscape for options trading is constantly evolving. One recent trend is the use of qualified covered calls. A covered call is a type of option strategy where you sell a call option on a stock that you own. If the stock price rises, the buyer of your call option may exercise the option, in which case you will have to sell them the stock at the strike price. However, as long as the stock price remains below the strike price, the call option will expire worthless, and you will be able to keep the premium received from selling the call option. This can be a more tax-advantaged strategy than purchasing and selling