When it comes to investing in the stock market, there are a myriad of different strategies that one can employ to potentially generate profits. One such strategy that combines elements of both investing and speculating is options earnings trading. Options, with their unique characteristics and versatile nature, offer traders and investors alike the opportunity to capitalize on anticipated stock price movements surrounding earnings events. In this comprehensive guide, we will delve into the intricacies of options earnings trading, providing valuable insights and practical information to help you navigate this exciting arena.

Image: en.healthd-sports.com

The Essence of Options Earnings Trading

Options, in the context of the financial markets, represent financial instruments that convey to the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying security, such as a stock, at a specified price (strike price) within a predetermined time frame. Options earnings trading revolves around utilizing options to capitalize on the potential price fluctuations of a stock around its earnings announcement. Traders often anticipate significant market movement following an earnings release, as company performance updates can impact the intrinsic value of the underlying stock.

Understanding Call and Put Options

As mentioned earlier, call options grant the holder the right to buy the underlying stock at the strike price, while put options confer the right to sell. In the realm of options earnings trading, both calls and puts can be employed strategically. Call options are typically used when one expects the stock price to rise post-earnings, providing the potential to profit from the increase in stock value. Conversely, put options are utilized when one anticipates a decline in the stock price following the earnings release, allowing for potential gains from the stock’s depreciation.

Trading Options During Earnings Season

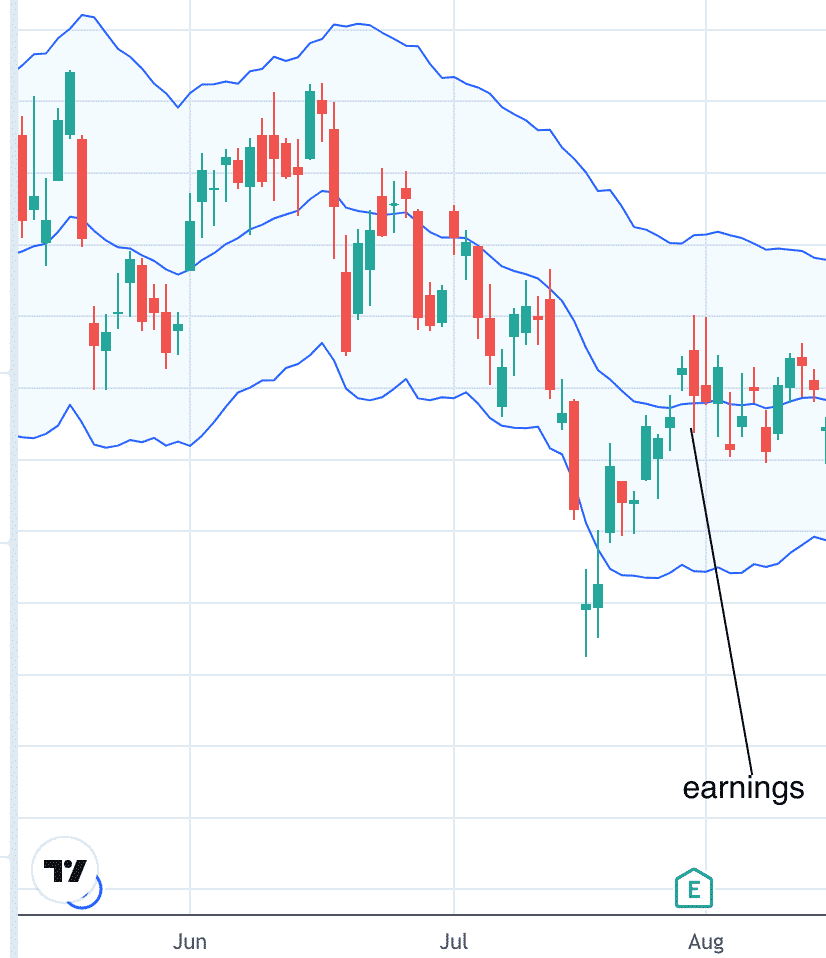

Traditionally, earnings season refers to the period when publicly traded companies release their financial results for a specific quarter. Typically, this season spans several weeks and can generate heightened market activity due to the influx of earnings-related information. Options traders closely monitor this period as it presents opportunities to capitalize on potential stock price volatility.

Image: www.fidelity.com

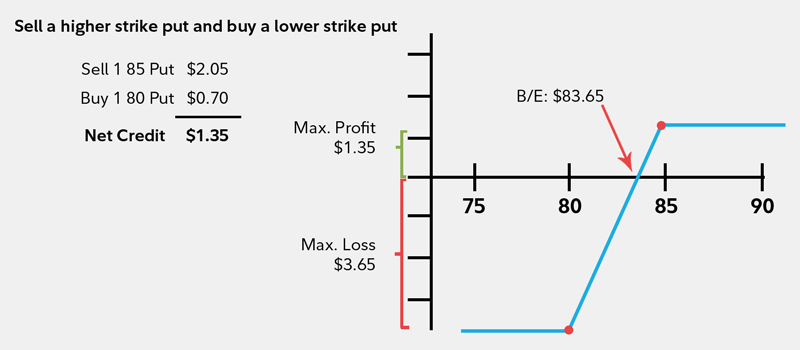

Strategies for Options Earnings Trading

There are various strategies that can be employed in options earnings trading. One popular approach is to purchase at-the-money (ATM) options, which have strike prices close to the current trading price of the underlying stock. This strategy aims to capture significant price movements without overpaying for the options premium. Alternatively, traders may consider purchasing out-of-the-money (OTM) options, which have a strike price significantly different from the stock’s current price. While OTM options offer the potential for higher returns, they also carry a higher risk of expiration with no value.

Another strategy is to trade weekly options, which offer shorter durations compared to traditional monthly options expiring approximately 45 days later. These are suitable for traders seeking to profit from short-term price movements around earnings announcements. It’s important to note that options premiums tend to spike closer to expiration, so traders should be mindful of the time decay factor.

Managing Risk in Options Earnings Trading

While options earnings trading can present opportunities for profit, it’s crucial to acknowledge the inherent risks involved. One effective risk management technique is position sizing, which entails determining the appropriate number of options contracts to trade relative to one’s capital. Traders should also consider using stop-loss orders to mitigate potential losses. Furthermore, it is advisable to thoroughly research the underlying stock, its historical performance, and expected earnings results to make informed trading decisions.

Options Earnings Trading

Image: optionstradingiq.com

Conclusion

Options earnings trading offers a unique blend of stock investing and speculation, allowing individuals to potentially profit from anticipated stock price movements surrounding earnings events. By understanding the concepts of call and put options, adopting appropriate trading strategies, and employing risk management techniques, traders can navigate this exciting domain. Remember to conduct thorough research, trade within your risk tolerance, and constantly refine your strategies based on market experience. Options earnings trading can be a rewarding endeavor for those who possess a solid understanding of the market dynamics and a willingness to embrace calculated risk.