SEO Title: Master Option Trading Strategies: Your Guide to Success

Image: optionstrategiesinsider.com

Headline: Unleash the Power of Options: Strategies for Surging Returns

Introduction:

Imagine having the ability to profit from market fluctuations, regardless of the direction stocks move. This is the allure of option trading, a savvy investment strategy that empowers you to navigate market complexities and emerge as a financial victor. Whether you’re a budding trader or a seasoned pro, this comprehensive guide will arm you with the success strategies you need to triumph in the thrilling world of options.

Option trading involves buying or selling contracts that bestow the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price and time. This flexibility grants traders a wide array of profit-generating opportunities, allowing them to tailor strategies to their individual goals and risk tolerance.

Main Body:

1. Fundamental Concepts of Option Trading:

- Calls: Options that grant the buyer the right to purchase an asset.

- Puts: Options that grant the buyer the right to sell an asset.

- Premiums: Fees paid to option sellers for granting these rights.

- Strike Prices: The predetermined price at which assets can be bought or sold.

- Expiration Dates: The date on which the option contract expires and becomes worthless.

2. Market Analysis for Option Trading:

- Technical Analysis: Examining historical price charts for patterns and trends.

- Fundamental Analysis: Evaluating company financials, economic indicators, and industry news.

- Sentiment Analysis: Monitoring market sentiment and investor psychology.

3. Option Strategies for Success:

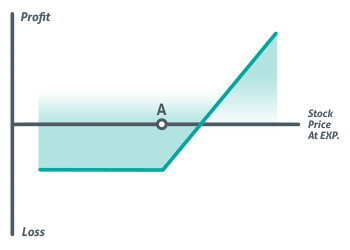

- Covered Calls: Selling calls against stocks you own, receiving a premium while limiting upside potential.

- Protective Puts: Buying puts to shield portfolios from downside risks.

- Bull Calls: Buying calls when you expect stock prices to rise, potentially generating significant returns.

- Bear Puts: Buying puts when you anticipate stock prices to decline, profiting from downturns.

4. Risk Management in Option Trading:

- Delta: Measures the sensitivity of an option’s price to changes in the underlying asset’s price.

- Theta: Represents the time decay of an option’s value as it approaches expiration.

- Vega: Measures the option’s sensitivity to implied volatility.

- Margin Accounts: Use caution when using margin, as it can amplify both gains and losses.

5. Advanced Option Trading Strategies:

- Straddles and Strangles: Buying both calls and puts at different strike prices, profiting from large price swings.

- Iron Condors: Selling calls and puts at various strike prices above and below the current stock price.

- Butterfly Spreads: Combining calls and puts with different strike prices to reduce risk and enhance potential rewards.

Conclusion:

Option trading offers a plethora of opportunities to generate wealth, but it also carries inherent risks. By mastering the success strategies outlined in this guide, you can arm yourself with the knowledge and confidence you need to navigate the complexities of the options market. Remember to conduct thorough research, employ risk management measures, and adapt your strategies to changing market conditions. Embrace the power of options and seize the potential for financial growth!

Image: tujogim.web.fc2.com

Option Trading Success Strategies

Image: www.pinterest.com