Unlock the Power of Option Trading with Fidelity

In the realm of financial markets, options trading presents a sophisticated avenue for potential gain and strategic portfolio management. Fidelity, a renowned financial behemoth, has emerged as a formidable platform for options traders, offering an array of tools and resources to navigate the intricate world of options. This comprehensive tutorial will delve into the intricacies of Fidelity options trading, empowering you to harness the opportunities and mitigate the risks associated with this dynamic asset class.

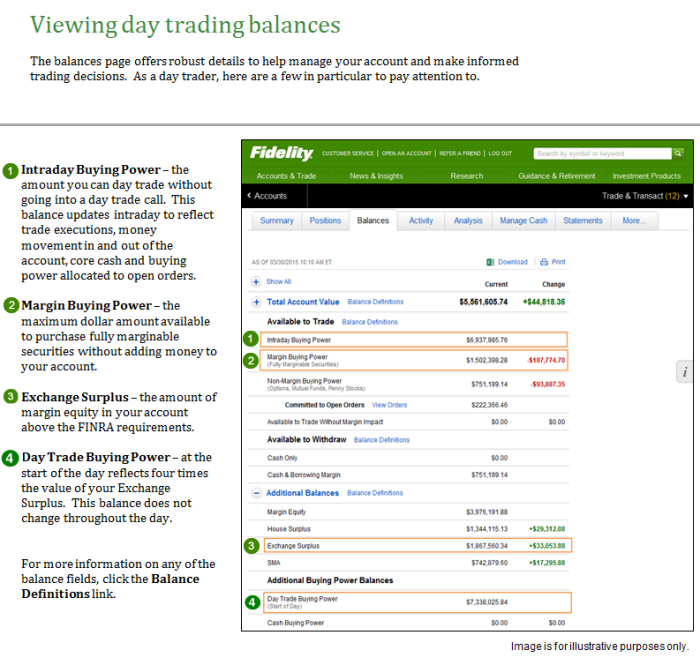

Image: www.youtube.com

Definition and Overview of Options Trading

Options, financial instruments derivative in nature, bestow upon the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date). This flexibility provides traders with a versatile arsenal of strategies, allowing them to speculate on price movements, hedge against potential losses, or generate income through premium collection.

History and Significance

The origins of options trading can be traced back to the 18th century in the Netherlands, where merchants sought to mitigate risks associated with fluctuating tulip prices. Over time, options have evolved into a global financial instrument, facilitating sophisticated trading strategies and enhancing portfolio management capabilities. Today, options are traded on a wide range of underlying assets, including stocks, currencies, commodities, and indices.

Understanding Option Basics

Contract: An options contract represents an agreement between the buyer and seller of an option.

Premium: The price paid by the buyer to the seller for the right to exercise the option.

Expiration Date: The date by which the option must be exercised or expires, rendering it worthless.

Settlement: The process of fulfilling the terms of the options contract, typically involving the delivery of the underlying asset or cash settlement.

Image: ywepubuy.web.fc2.com

Navigating Fidelity’s Options Trading Platform

Fidelity provides a comprehensive online platform that seamlessly integrates trading, analysis, and account management capabilities. Through this user-friendly interface, traders can:

-

Execute options trades effortlessly, with real-time quotes and order customization options.

-

Conduct in-depth technical and fundamental analysis using a suite of charting tools and indicators.

-

Monitor account performance, track trading history, and manage risk exposures in real-time.

Expert Tips for Successful Options Trading

Maximizing your success in options trading requires a strategic approach and sound decision-making. Here are some invaluable tips from seasoned traders:

-

Cultivate a Deep Understanding: Dedicate time to studying market fundamentals, options strategies, and risk management techniques. Knowledge is your most potent weapon.

-

Start Small: Begin with smaller trade sizes to gain experience before venturing into larger positions. Remember, trading involves inherent risks, so prudent risk management is paramount.

-

Implement a Diversified Strategy: Spread your capital across multiple options contracts with varying expiration dates and underlying assets. Diversification reduces portfolio volatility and enhances your chances of profitability.

-

Seek Expert Advice When Needed: Don’t hesitate to seek guidance from experienced traders or financial advisors if market conditions or trading strategies become unclear or complex.

Frequently Asked Questions (FAQs)

Q: What are the potential benefits of options trading?

A: Options trading offers the potential for substantial returns, portfolio diversification, hedging against risk, and income generation through premium collection.

Q: What are the risks involved in options trading?

A: Options trading carries the inherent potential for losses, which can exceed the initial investment. Volatility, liquidity risks, and potential time decay can affect option values and trading outcomes.

Q: How do I determine which options strategy is best for me?

A: Choosing the appropriate options strategy depends on individual financial goals, risk tolerance, and market conditions. Factors such as market volatility, trade duration, and profit potential should be carefully considered.

Fidelity Options Trading Tutorial

https://youtube.com/watch?v=QEAUAJaO0VM

Conclusion

Options trading has emerged as a multifaceted instrument for discerning investors seeking to enhance portfolio performance and exploit market opportunities. Fidelity, with its unparalleled platform and comprehensive educational resources, empowers traders to navigate the complexities of this dynamic asset class. By harnessing the knowledge and strategies outlined in this tutorial, you can unlock the potential of options trading and elevate your financial prowess.

Are you ready to embrace the world of options trading? Let Fidelity guide you on this transformative journey.