Introduction

In the tumultuous world of option trading, stop orders serve as a valuable tool for traders seeking to safeguard their hard-earned profits. They provide a safety mechanism akin to a neon warning sign, flashing before your eyes when an asset’s trajectory takes an unexpected turn. By automating the process of exiting a position upon specific conditions, traders can minimize losses and maintain peace of mind.

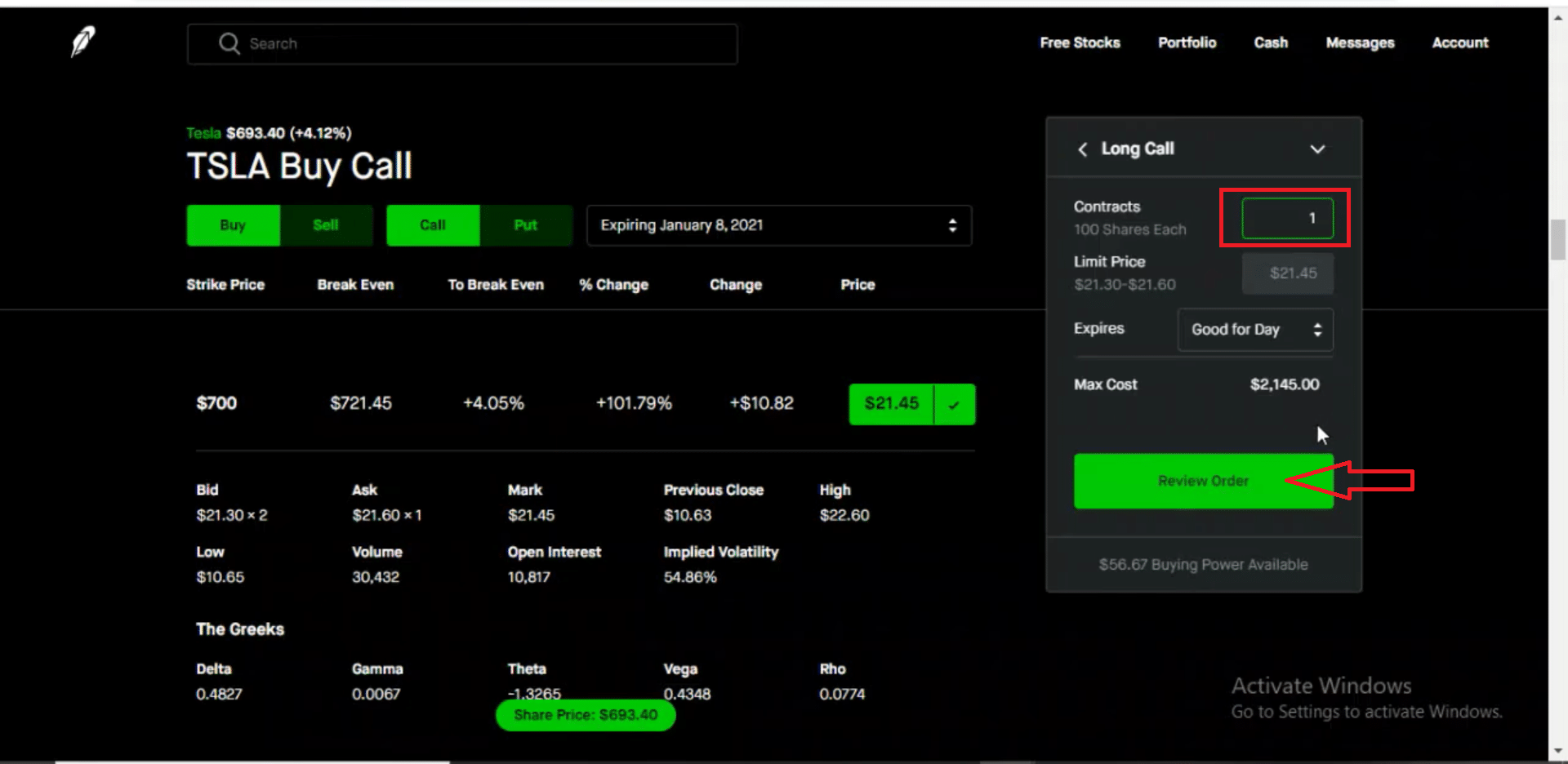

Image: marketxls.com

Imagine the following scenario: You’ve identified an option trade with great potential, a trade that has the makings of a financial masterpiece. However, as the market’s rhythm changes, your optimism is replaced by a sense of unease as the asset’s value begins to plummet. In the absence of a stop order, panic may cloud your judgment, leading to impulsive decisions that could amplify your losses. But armed with this essential risk management tool, you can rest assured that your predetermined exit strategy will be executed without hesitation, safeguarding your capital from devastating setbacks.

Understanding Option Trading Stop Orders

Stop orders, as their name suggests, instruct a broker to execute a sale or purchase once a specific price threshold, known as the stop price, is reached or surpassed. This is in contrast to limit orders, which specify a price at which an option can be bought or sold. Stop orders are predominantly used as a means of limiting risk, but can also be employed to lock in profits.

Types of Option Trading Stop Orders

-

Stop-loss order: The most common type of stop order, a stop-loss order is placed below the current price for long positions (for example, when owning a call option) and above the current price for short positions (for example, when owning a put option). When the stop price is triggered, the order is executed to close the position, preventing further losses.

-

Trailing stop-loss order: A trailing stop-loss order is a dynamic stop-loss order that adjusts the stop price as the asset’s value rises. For example, a trailing stop-loss order with a 5% buffer will automatically move up by 5% if the asset’s price increases. This type of stop order is particularly useful in trending markets, allowing traders to capture gains while mitigating potential losses.

-

Stop-limit order: A stop-limit order is a hybrid of a stop order and a limit order. It becomes active once the stop price is reached, but the execution of the order is only permitted within a specific price range determined by the limit price. This type of stop order provides more control over the execution price, but it also carries the risk of the order not being executed if the market moves rapidly beyond the limit price.

Expert Insights and Actionable Tips

“Stop orders are not a guarantee against losses, but they are an essential risk management tool that can help traders protect their capital,” says renowned options trading expert Michael Carr. “It is crucial to set stop prices at strategic levels that balance risk and reward.”

Here are some practical tips for using option trading stop orders effectively:

- Determine appropriate stop prices: Carefully consider market conditions and technical indicators when determining stop prices. Place stop-loss orders at levels that preserve a reasonable portion of your potential profits while minimizing losses.

- Use stop orders in conjunction with other risk management strategies: Stop orders should be used as part of a comprehensive risk management strategy that includes position sizing, diversification, and proper trade selection.

- Review and adjust stop orders regularly: Market conditions and risk tolerance can change over time. Regularly monitor your stop orders and adjust them as necessary to maintain their effectiveness.

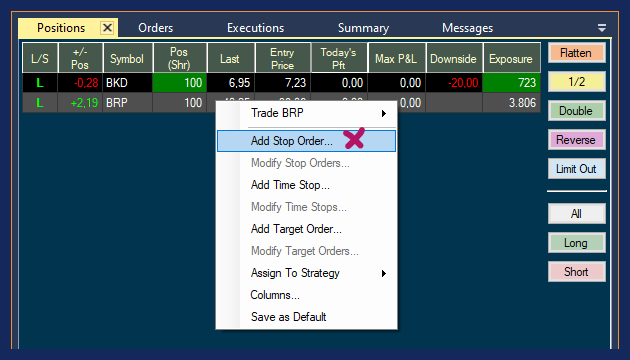

Image: smallinvestmentideas.com

Option Trading Stop Order

Image: www.trade-ideas.com

Conclusion

Option trading stop orders stand as an indispensable risk management tool for traders seeking to navigate the often treacherous waters of the market. They provide traders with the ability to protect profits, minimize losses, and preserve capital. By understanding the different types of stop orders and implementing appropriate strategies, you can increase your chances of success in the high-stakes world of option trading. Remember, while stop orders are not a fail-safe against losses, they are an invaluable tool that can help you sleep easier at night, knowing that your financial well-being is in safe hands.