In the captivating realm of options trading, timing is paramount. Comprehending the intricacies of option trading sessions empowers traders to stay synchronized with market movements and capitalize on fleeting opportunities. With each session unfolding its unique characteristics, deciphering these patterns unlocks the gateway to informed decision-making.

Image: theqa.reviews

The U.S. options market operates within three distinct trading sessions, each possessing its own dynamics and trading hours:

Pre-Market Session: Dawn of Market Activity

The pre-market session provides an early glimpse into the trading day. This window, which runs from 8:00 AM to 9:30 AM EST, presents an opportunity for traders to assess market sentiment and positions ahead of the regular market open. While order execution is possible, it may be prudent to exercise caution due to lower liquidity during these hours.

Strategies for this session:

1. Early Order Placement: Submit orders to gauge market response and potentially secure favorable prices.

2. Limit Orders: Implement limit orders to minimize price slippage, ensuring trades execute at or above a specified price.

Regular Market Session: The Heart of Trading

Commencing at 9:30 AM EST, the regular market session remains the focal point of trading activity. Extending until 4:00 PM EST, this period witnesses robust liquidity, attracting both seasoned traders and retail investors. Options trading during this session offers unparalleled opportunities for implementing complex strategies and executing trades at competitive prices.

Strategies for this session:

1. Scalping: Seize short-term price fluctuations by entering and exiting positions rapidly.

2. Momentum Trading: Identify and capitalize on trends by trading in the direction of market momentum.

After-Hours Session: Extending the Trading Day

The after-hours session, which extends from 4:00 PM to 8:00 PM EST, provides traders with additional time to review market events and adjust their positions. Trading volume during this session tends to be lower, introducing potential price inefficiencies that skilled traders can exploit.

Strategies for this session:

1. News-Driven Trading: Monitor market-moving news events after regular market hours and react accordingly.

2. Overnight Holding: Hold positions overnight to capitalize on potential price gaps between the session’s close and the next day’s open.

Image: fintrakk.com

Recent Developments and Trends

The options trading landscape is constantly evolving, with recent advancements introducing both challenges and opportunities for traders. The proliferation of electronic trading platforms has accelerated order execution, while the rise of options exchanges has increased liquidity and reduced trading costs. Additionally, ongoing regulatory changes are shaping the industry, providing safeguards for investors while ensuring market integrity.

Expert Tips and Advice

- Thoroughly Research: Understand the underlying assets and market dynamics before entering trades.

- Manage Risk: Employ prudent risk management techniques to minimize potential losses and protect your portfolio.

- Control Emotions: Trading can be emotionally charged; maintain a level head to avoid impulsive decision-making.

- Seek Professional Advice: If necessary, consult with a financial advisor for tailored guidance.

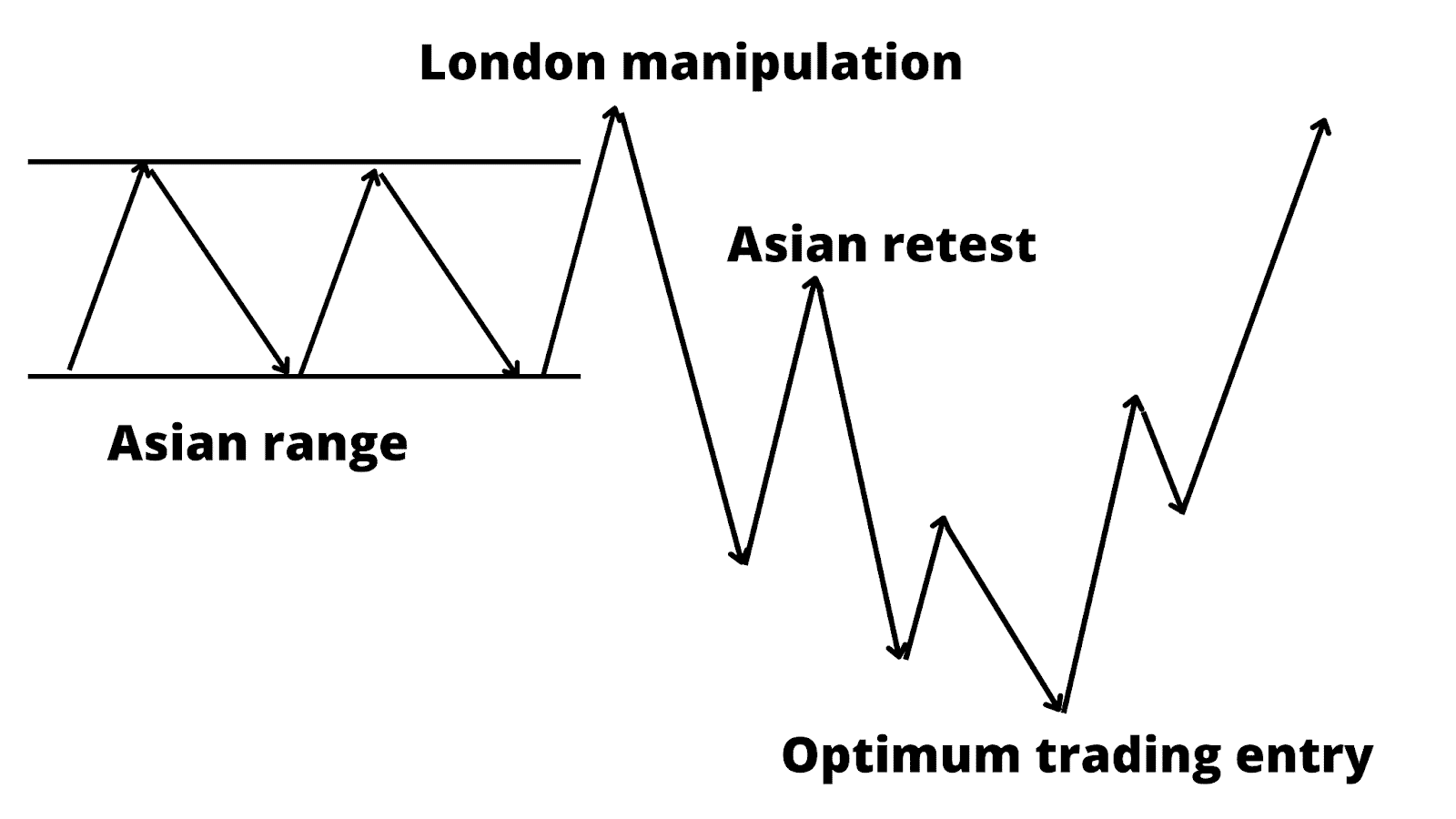

Option Trading Sessions

Image: fxtechlab.com

Frequently Asked Questions

Q: What is the ideal trading session for beginners?

A: The regular market session (9:30 AM – 4:00 PM EST) offers a balance of volume and volatility, making it suitable for beginners.

Q: Is after-hours trading risky?

A: Yes, after-hours trading carries higher risk due to lower liquidity and increased volatility.

Q: How do I choose the best options trading strategy?

A: Consider your risk tolerance, trading style, and market conditions to determine the most appropriate strategy.

Conclusion

Mastering option trading sessions is an indispensable skill for navigating the ever-changing market landscape. By comprehending the distinct characteristics of each session, traders can pinpoint opportune moments, optimize strategy execution, and maximize their trading potential. Remember, ongoing research, prudent risk management, and expert guidance will empower you to thrive in this dynamic realm.

Are you ready to delve deeper into the captivating world of option trading sessions?