In the realm of finance, traders navigate a constantly evolving landscape, seeking opportunities to maximize returns and minimize risks. One notable figure in the world of option trading stands out as both a legend and a cautionary tale: Michael Milken. Dubbed “the man who sold the bonds,” Milken’s rise and fall hold valuable lessons for traders of all levels, offering insights into the intricacies and potential pitfalls of option trading.

Image: swing-trading-strategies.com

Understanding Option Trading

Option trading involves contracts that give buyers (holders) the right, but not the obligation, to buy or sell an underlying asset (e.g., a stock, commodity, or bond) at a specific price on or before a certain date. Options trading allows investors to speculate on market movements without owning the underlying asset and offers the potential for high leverage.

Milken’s Enigma

Michael Milken rose to prominence in the 1980s as a pioneer in the development and trading of high-yield bonds, known as junk bonds. These bonds, considered risky due to their low credit ratings, offered investors the potential for high returns. Milken’s ability to package and sell these bonds made him a Wall Street superstar, amassing both wealth and influence.

Trading Techniques and Risks

Milken’s trading techniques were complex and often involved substantial leverage. He would typically purchase large quantities of junk bonds at low prices and hold them until their value increased, often with the assistance of his vast network of market connections. However, Milken’s aggressive approach carried inherent risks, and his downfall ultimately stemmed from unethical business practices that caught the attention of regulators.

Image: en.rattibha.com

Ethical Considerations in Trading

Milken’s trading activities were not limited to pure market speculation. He used his influence and insider knowledge to engage in activities such as insider trading and stock manipulation. These actions violated ethical standards and undermined investor confidence, ultimately leading to his prosecution and imprisonment.

Lessons Learned from Milken’s Story

Traders can derive valuable lessons from Milken’s triumphs and tribulations:

- Importance of Risk Management: Leverage, while offering potential gains, can also amplify losses. Traders should carefully manage their exposure to risk and avoid excessive leveraging.

- Ethical Behavior: Maintaining integrity is paramount in the financial industry. Unethical practices, such as insider trading, not only erode trust but also often result in legal consequences.

- Understanding Market Dynamics: Successful traders have a deep understanding of the markets they trade in. Thoroughly researching underlying assets, market conditions, and historical trends can enhance decision-making.

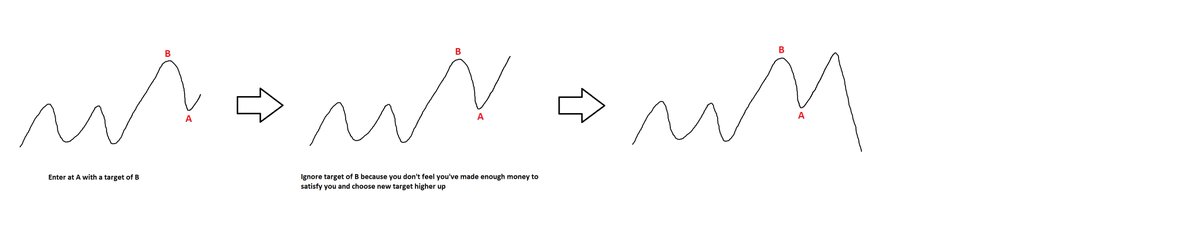

- Importance of Patience: While options trading offers the potential for quick gains, sustained success often requires patience. Identifying the right opportunities and waiting for favorable market conditions can pay off in the long run.

- Learning from Mistakes: Mistakes are inevitable in trading. Instead of dwelling on losses, traders should analyze their mistakes, learn from them, and adapt their strategies accordingly.

Option Trading Lessons From The Man Who Sold

Image: issuu.com

Conclusion

The rise and fall of Michael Milken stand as a cautionary tale in the annals of option trading. While his groundbreaking techniques revolutionized the bond market, his unethical practices ultimately led to his downfall. By embracing Milken’s lessons, traders can navigate market complexities with both skill and integrity, maximizing their chances of long-term success while avoiding the pitfalls that befell the “man who sold the bonds.”