Introduction

In the world of options trading, a butterfly spread is a neutral strategy that involves buying one option at a middle strike price and selling two options at lower and higher strike prices with the same expiration date. This strategy is often used by traders who expect the underlying asset’s price to remain within a certain range during the life of the option. In this article, we will explore the basics of butterfly spreads and provide guidance on when it is most advantageous to buy them.

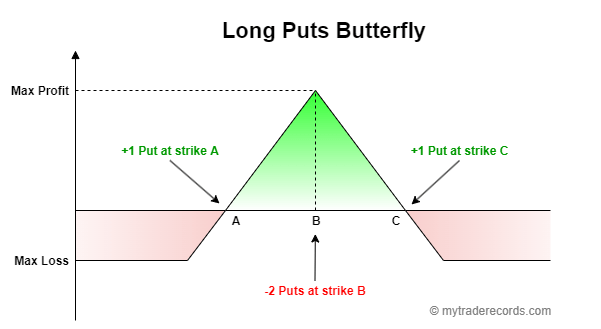

Image: www.mytraderecords.com

The butterfly spread takes its name from the shape of the payoff profile, which resembles a butterfly with its wings spread out. The maximum profit for a butterfly spread occurs when the underlying asset’s price is equal to the middle strike price at expiration.

Understanding Butterfly Spreads

To understand when to buy a butterfly spread, it is essential to have a clear understanding of how the strategy works:

- Step 1: Buy one option at the middle strike price (K1).

- Step 2: Sell two options at a lower strike price (K2) and a higher strike price (K3), equidistant from K1.

- Step 3: All options should have the same expiration date.

The breakeven points for a butterfly spread occur when the underlying asset’s price is equal to K1 ± (K3 – K2). If the price remains within this range, the trader will make a profit. The maximum profit occurs when the underlying asset’s price is equal to K1 at expiration.

When to Buy a Butterfly Spread

The ideal time to buy a butterfly spread is when the trader expects the underlying asset’s price to fluctuate within a relatively narrow range during the life of the option. This strategy is most suitable in the following market conditions:

- Low Volatility: When the underlying asset’s price is not expected to exhibit significant price swings.

- Defined Range: When the trader has a good estimate of the range within which the underlying asset’s price is likely to trade.

- Short-Term Trade: Butterfly spreads are typically short-term strategies due to the high cost of entering the trade.

Tips and Expert Advice

Here are some additional tips and expert advice for trading butterfly spreads effectively:

- Choose the Right Underlying: Select an underlying asset with low volatility and a clear range estimate.

- Manage Risk: Butterfly spreads can have a high cost of entry, so it’s crucial to manage risk effectively.

- Monitor the Market: Regularly monitor the underlying asset’s price and adjust the trade if necessary.

- Exit Strategy: Have a clear exit strategy in place before entering the trade.

Image: optionalpha.com

FAQ on Butterfly Spreads

What is the profit or loss for a butterfly spread?

The profit or loss for a butterfly spread depends on the underlying asset’s price at expiration, relative to the strike prices. The maximum profit occurs when the underlying asset’s price is equal to the middle strike price at expiration.

What are the risks of trading butterfly spreads?

The risks of trading butterfly spreads include the potential for loss of capital, the high cost of entry, and the potential for rapid losses due to unexpected price movements.

Option Trading Butterfly When To Buy

Image: www.youtube.com

Conclusion

Butterfly spreads are a versatile options strategy that can be used to profit in a variety of market conditions. By carefully considering the market environment, choosing the right underlying asset, and following sound trading principles, traders can improve their chances of success when trading butterfly spreads. Are you interested in learning more about butterfly spreads and other options trading strategies?