Introduction:

Image: stocksonfire.in

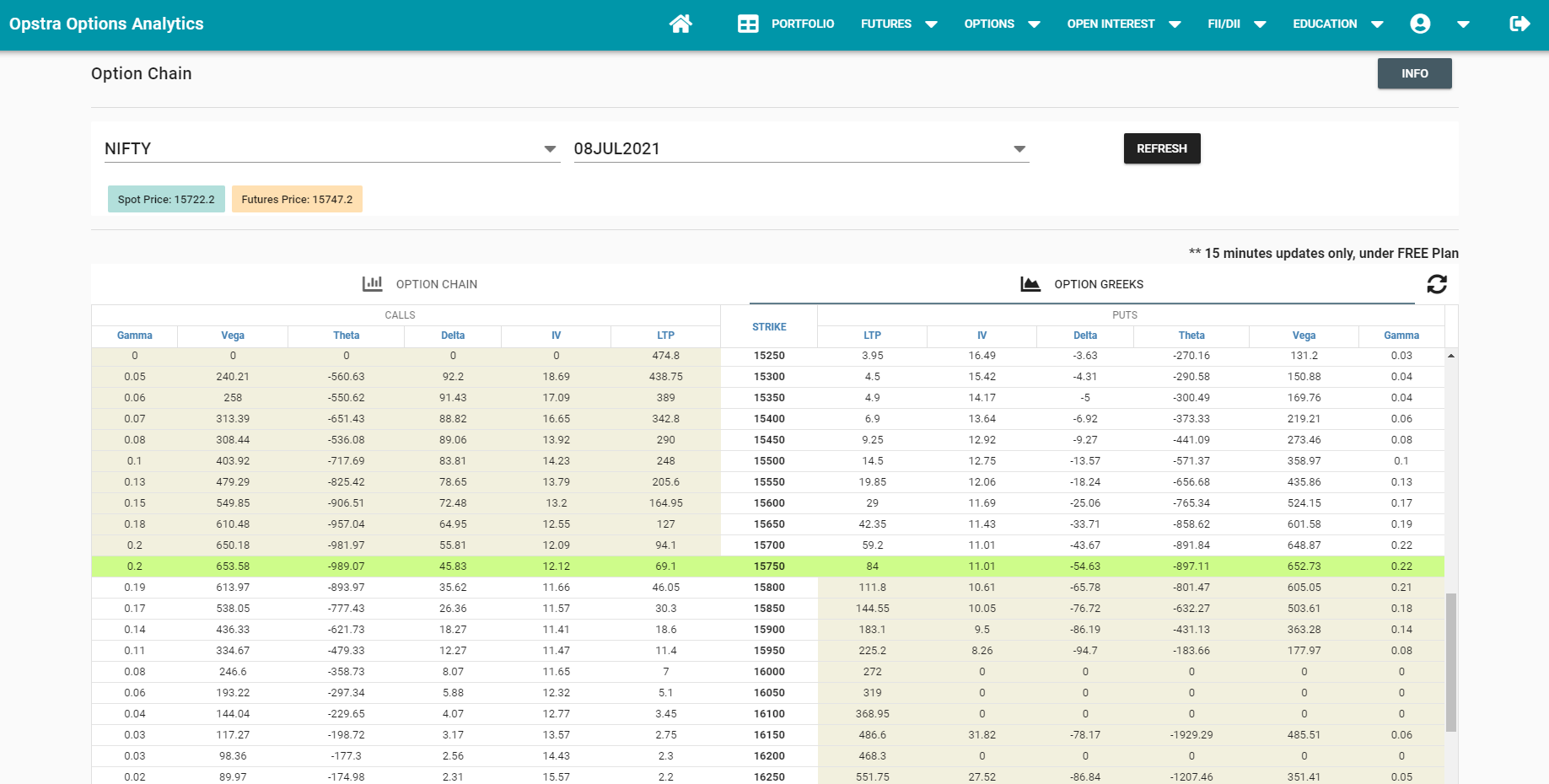

In the intricate world of finance, the realm of options trading offers captivating opportunities and tantalizing risks. Among the diverse array of options trading strategies, OPSTRA (Option-Strategy Adjustment) stands out as a dynamic and potentially lucrative approach. This article delves into the intricacies of OPSTRA options trading, empowering you with the knowledge and insights necessary to navigate this financial terrain.

OPSTRA refers to a multifaceted set of trading strategies that harness options strategies. These strategies involve the utilization of short and long option positions, meticulously calibrated to exploit price movements in underlying assets while effectively managing risk. By skillfully adjusting option positions based on market conditions, OPSTRAs aim to extract consistent returns over time.

Understanding OPSTRA Strategies:

The core principles of OPSTRA strategies lie in exploiting inefficiencies in option pricing and capturing premiums by adjusting option positions in response to market fluctuations. Traders seek to identify opportunities where the perceived value of an option deviates from its theoretical value. By capitalizing on these disparities, they aim to generate profit.

Types of OPSTRA Strategies:

The vast landscape of OPSTRA strategies encompasses a spectrum of techniques, each finely tuned to specific market conditions and risk appetites. Some prominent OPSTRA strategies include:

- Covered Call: Involves selling a call option while simultaneously holding a long position in the underlying asset. The strategy aims to generate premium income while potentially limiting price appreciation.

- Cash-Secured Put: The trader sells a put option while holding cash to cover the potential obligation to buy the underlying asset at the strike price. This strategy seeks to generate premium income while offering partial downside protection.

- Collar: This strategy combines a covered call with a protective put option. It aims to cap potential gains while providing downside protection at the cost of reduced premium income.

- Straddle: The trader simultaneously buys both a call option and a put option at the same strike price and expiration date. This strategy capitalizes on significant price fluctuations in either direction.

- Strangle: Similar to a straddle, a strangle involves buying an out-of-the-money call option and out-of-the-money put option. It offers a broader range of strike prices, allowing for greater flexibility but also potentially higher risk.

Benefits and Risks of OPSTRA Trading:

OPSTRA trading offers several advantages, including the potential for consistent income generation, enhanced risk management, and the ability to capitalize on market inefficiencies. However, like any trading strategy, it also carries inherent risks, and traders must exercise diligent risk management strategies to mitigate potential losses.

Key Considerations for OPSTRA Traders:

Success in OPSTRA options trading demands a comprehensive understanding of market dynamics, disciplined risk management practices, and the ability to adapt quickly to changing market conditions. Traders should consider the following:

- Market Volatility: OPSTRA strategies are highly sensitive to market volatility. Elevated volatility can enhance profit potential but also amplify risks.

- Time Decay: The value of an option erodes over time. OPSTRA traders must carefully consider option expiration dates to optimize returns.

- Option Premiums: Option premiums reflect market sentiment and expectations. Understanding the factors influencing premiums is crucial for successful OPSTRA trading.

Conclusion:

OPSTRA options trading offers a captivating and potentially rewarding avenue for discerning traders. By skillfully employing OPSTRA strategies, traders can harness the power of options to capture market inefficiencies, generate consistent income, and enhance their risk management capabilities. Embarking on the OPSTRA journey requires a thorough understanding of the strategies, prudent risk management practices, and an unwavering dedication to market analysis. Armed with these insights, traders can confidently navigate the complexities of OPSTRA options trading and unlock the full potential of this dynamic financial instrument.

Image: www.definedgesecurities.com

Opstra Options Trading

Image: www.definedgesecurities.com