Introduction

The realm of options trading presents a compelling opportunity for investors seeking to harness the potential of underlying assets like Amazon’s stock (AMZN). By delving into the intricate world of AMZN options, astute traders can craft lucrative strategies that exploit price fluctuations and generate substantial returns. This comprehensive guide will illuminate the fundamentals of AMZN options trading, equipping you with the knowledge and strategies to navigate this dynamic financial landscape.

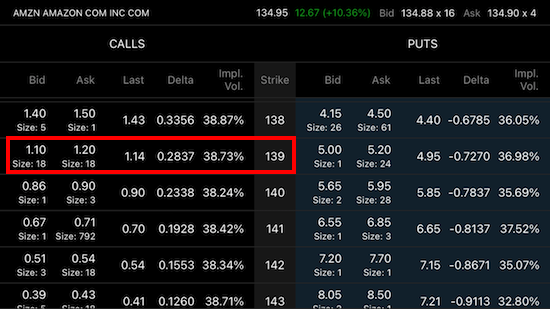

Image: tightfistfinance.com

Understanding AMZN Options

AMZN options are contractual agreements granting the holder the right, but not the obligation, to buy (call option) or sell (put option) a predetermined number of AMZN shares at a specified price (strike price) on or before a specific date (expiration date). These options provide investors with the flexibility to speculate on AMZN’s future price movements without incurring the full cost of purchasing or selling the underlying shares.

Key Concepts in AMZN Options Trading

- Call Options: Provide the right to buy AMZN shares at a set strike price. When the AMZN stock price exceeds the strike price, the call option holder can exercise the option to purchase the shares at a profit.

- Put Options: Grant the right to sell AMZN shares at a specific strike price. If the AMZN stock price falls below the strike price, the put option holder can execute the option to sell their shares for a profit.

- Settlement: On the expiration date, options contracts that remain in-the-money (i.e., profitable) can be exercised, allowing the holder to complete the purchase or sale of AMZN shares at the agreed-upon strike price.

- Premium: A fee paid upfront by the option buyer to the option seller. The premium represents the cost of acquiring the contractual rights granted by the option contract.

Crafting Profitable AMZN Options Strategies

Navigating the AMZN options market requires a thoughtful approach. Here are some proven strategies to enhance your profitability:

1. Buy Call Options When AMZN Stock Is Rising:

- Acquire call options with a strike price slightly above the current AMZN stock price.

- Target stocks with strong bullish momentum and positive market sentiment.

- Monitor price action and exercise the option when the stock price surges beyond the breakeven point (strike price + premium).

2. Sell Put Options When AMZN Stock Is Expected to Hold or Rise:

- Identify stocks that are likely to maintain or appreciate in value.

- Sell put options with a strike price below the current stock price.

- Collect premium from the buyer who pays to protect their portfolio from a potential decline in the stock’s price.

3. Combine Calls and Puts for Hedge Positioning:

- Purchase a call option and sell a put option with the same strike price and expiration date.

- This strategy creates a more conservative position, limiting potential losses while maintaining upside profit potential.

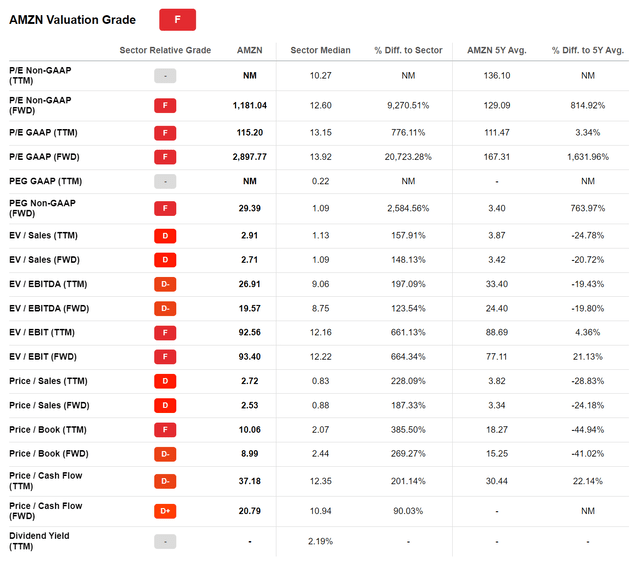

Image: seekingalpha.com

Maximizing Returns with Options Trading

- Monitor Market Trends: Stay abreast of financial news, economic indicators, and analyst reports to gauge market sentiment and AMZN’s stock performance.

- Employ Technical Analysis: Utilize technical indicators, such as moving averages and support/resistance levels, to identify price patterns and predict future price movements.

- Establish Risk Parameters: Determine your risk tolerance and set clear exit strategies for both profitable and unfavorable outcomes.

- Seek Professional Guidance: Consider consulting with an experienced financial advisor for personalized guidance on AMZN options trading.

Make Money Trading Amzn Options

Image: www.youtube.com

Conclusion

Mastering the art of trading AMZN options requires a combination of knowledge, strategic planning, and risk management. By understanding the fundamental concepts, deploying effective strategies, and embracing best practices, investors can harness the potential of this dynamic and rewarding financial market. Remember, consistent research, careful analysis, and disciplined execution are the keys to navigating the ever-evolving landscape of AMZN options trading.