Introduction

In the realm of investing, day trading options has emerged as a captivating strategy that offers the potential for significant profits within a single trading day. This fast-paced and dynamic world beckons traders seeking both excitement and financial rewards. However, navigating the complexities of options trading requires a deep understanding of its intricacies and techniques. This article delves into the fundamentals and advanced strategies of day trading options, empowering you with the knowledge and skills to increase your chances of success.

Image: todaynewsspot.com

Understanding Options Trading

Options are financial contracts that provide traders with the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price within a specified period. This flexibility gives options traders unique advantages over traditional stock traders. For instance, options traders can profit not only from price increases but also from price declines, depending on the type of option they possess.

Types of Options

There are two primary types of options: calls and puts. Call options confer the right to buy an asset, while put options provide the right to sell an asset. Each type of option can be tailored to the trader’s specific trading strategy, whether they anticipate an increase or decline in the asset’s price.

Day Trading Strategies

Day trading options differs from longer-term options trading in that day traders aim to close out their positions before the end of the trading day. Successful day trading requires a combination of technical and fundamental analysis to identify potential trading opportunities. Popular day trading strategies include scalping, which involves small and frequent trades, and breakout trading, which capitalizes on large price movements.

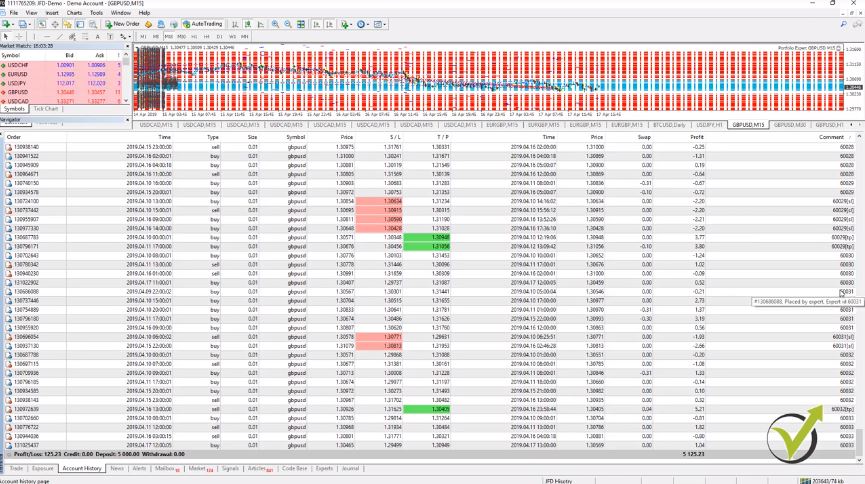

Image: eatradingacademy.com

Risk Management

Risk management is paramount in day trading options, as high leverage can lead to substantial losses. Establishing clear risk tolerance parameters and using stop-loss orders are essential to protect capital. Diversification and proper position sizing are also crucial, ensuring that a single trade does not jeopardizing the entire portfolio.

Make Money Day Trading Options

Image: www.pinterest.com

Conclusion

Day trading options presents both lucrative opportunities and inherent risks. To succeed in this fast-paced environment, traders require a comprehensive understanding of options trading, a disciplined approach to risk management, and the ability to adapt to ever-changing market conditions. By embracing the principles outlined in this guide and continually refining their skills, day traders can increase their odds of profitability while pursuing the thrill of trading options.