Introduction

In a pulsating realm where fortune and wisdom dance hand in hand, welcome to the electrifying world of live option trading in India. Whether you’re a seasoned investor or a budding trader seeking to conquer this dynamic market, let this immersive guide be your beacon of knowledge and empowerment. With every turn of the page, we’ll delve into the intricacies of live option trading, unveiling its transformative potential for financial growth.

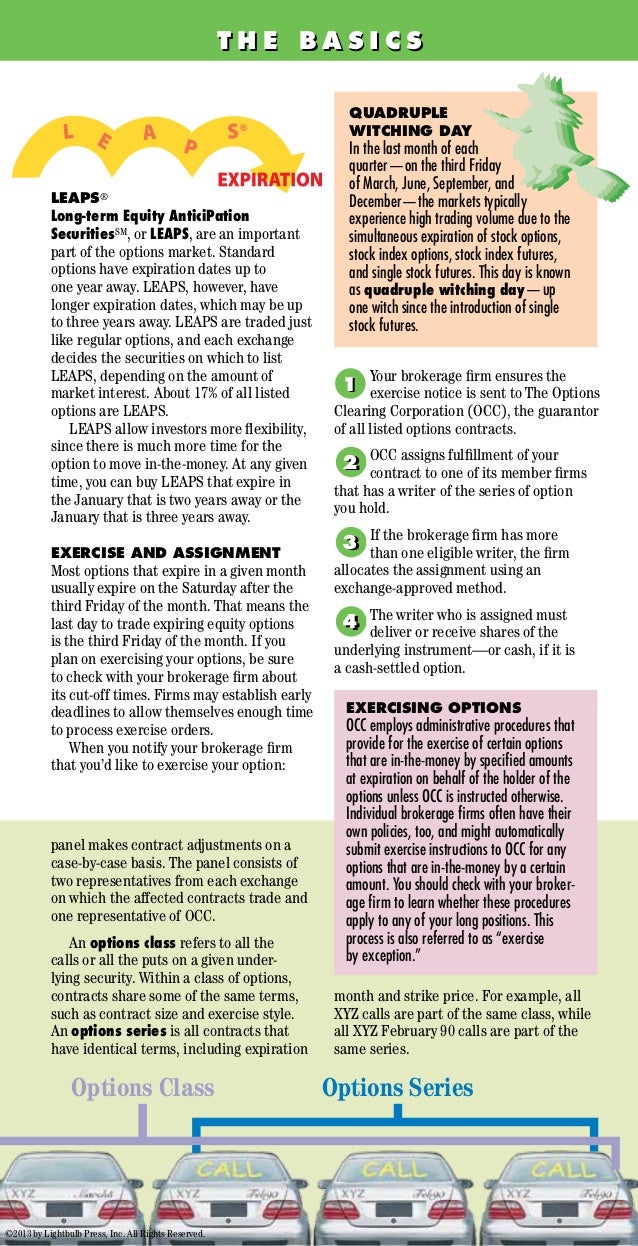

Image: fx.caribes.net

Unveiling the Essence of Live Option Trading

Live option trading stands as a potent financial instrument, empowering traders to capitalize on the ever-fluctuating tides of the financial markets. Unlike traditional stock trading, options offer a unique blend of leverage and flexibility, enabling traders to amplify their gains while managing potential risks.

Imagine maneuvering through a labyrinthine maze, where each decision can lead to untold riches or treacherous pitfalls. Live option trading presents a similar landscape, demanding a keen eye for opportunity and the composure to navigate its complexities. Understanding its fundamental principles and strategies becomes paramount in this high-stakes arena.

Embarking on Your Option Trading Journey

As you embark on this invigorating expedition into live option trading, a solid foundation of knowledge becomes your most valuable asset. Let’s decipher some key terms that will guide you along this path.

-

Options: A contract that grants you the right, but not the obligation, to buy or sell an underlying asset (such as a stock or index) at a predetermined price (strike price) on or before a specific date (expiration date).

-

Call Option: Gives you the right to buy the underlying asset at the strike price.

-

Put Option: Gives you the right to sell the underlying asset at the strike price.

-

Option Premium: The price you pay to acquire an option contract.

With these basic concepts firmly grasped, you’re now equipped to delve into the strategic nuances of live option trading.

Deciphering Option Trading Strategies

The world of option trading encompasses a diverse array of strategies, each tailored to specific market conditions and objectives. By mastering these strategies, you gain the agility to adapt to the ever-changing market dynamics and seize profitable opportunities. Here are some of the most popular approaches:

-

Covered Call: Selling a call option against an underlying asset that you own. This strategy generates income through the premium received while capping potential upside gains.

-

Short Put: Selling a put option on an underlying asset that you do not own. This strategy can provide income but carries the obligation to buy the underlying asset if the option is exercised.

-

Long Straddle: Buying both a call and a put option with the same strike price and expiration date. This strategy benefits from high volatility in the underlying asset.

-

Iron Condor: A neutral strategy involving selling an out-of-the-money call option, buying an out-of-the-money put option, and selling two at-the-money put options.

-

Bull Call Spread: Buying a call option and selling a call option with a higher strike price. This strategy positions you to profit from a limited upside move in the underlying asset.

Unleashing the Power of Live Option Trading Platforms

In today’s digital age, a plethora of live option trading platforms stands at your disposal. These platforms provide real-time market data, charting tools, and advanced order execution capabilities, empowering you to make informed decisions and seamlessly execute your trading strategies.

When selecting a platform, consider factors such as user interface, reliability, trading fees, and customer support. Reputable platforms like Zerodha, Upstox, and Angel Broking have earned the trust of traders in India, offering a comprehensive suite of features and exceptional trading experiences.

Image: ujejocykixova.web.fc2.com

Navigating the Risks of Live Option Trading

While the allure of substantial returns is undeniable, it’s crucial to acknowledge the inherent risks associated with live option trading. These risks are magnified by the use of leverage, which can amplify both your profits and your losses.

Understanding your risk tolerance and managing your trades prudently are essential for long-term success. Employ sound risk management strategies such as stop-loss orders and position sizing to mitigate potential losses and preserve your capital.

Seek Knowledge and Sharpen Your Skills

Embracing continuous learning is essential in the ever-evolving landscape of live option trading. Immerse yourself in books, articles, and webinars to deepen your understanding of market dynamics, trading strategies, and risk management techniques.

Connect with experienced traders through online forums or professional organizations to learn from their insights and strategies. Attend industry events and webinars to stay abreast of the latest market trends and innovations.

By investing in your knowledge and skills, you empower yourself to navigate the complexities of live option trading with greater confidence and competence.

Embracing a Disciplined Trading Mindset

Emotional control is paramount in the high-stakes world of live option trading. Allow logic and reason to guide your decisions, rather than succumbing to the allure of fear or greed.

Develop a disciplined trading plan and stick to it resolutely. Define your trading goals, risk parameters, and exit strategies in advance. This structured approach will help you stay focused and avoid impulsive decisions that could jeopardize your profits.

Live Option Trading India

Image: www.pasitechnologies.com

Harnessing live Option Trading for Financial Empowerment

Live option trading offers a transformative opportunity for financial empowerment. When executed with the right mix of knowledge, skill, and discipline, it can pave the way for substantial wealth creation.

By leveraging the power of options, you gain the flexibility to tailor your trading strategies to varying market conditions and maximize your profit potential. Embrace the thrill of live option trading, and with dedication and perseverance, you can unlock a world of financial opportunities that were previously beyond your grasp.