Understanding the Last Trading Date:

The last trading date for stock options marks the final day when traders can buy or sell specific option contracts. After this date, trading for the options in that series ceases, and the contracts become known as “expired options.” This date typically occurs two business days before the third Friday of each month, except for certain holiday adjustments.

Image: www.youtube.com

comprender the significance of the last trading date is crucial for successful options trading. This knowledge enables traders to effectively manage their options positions, avoiding potential losses due to missed expirations. By understanding when an option expires, traders can plan their trading strategies accordingly, ensuring they meet their investment objectives.

Navigating Last Trading Date Complexities:

The last trading date for stock options can vary depending on the specific exchange or platform on which the options are traded. To determine the last trading date for a particular option contract, traders should refer to the option chain provided by their broker or the exchange itself.

Options that are not exercised or assigned on or before the last trading date may become worthless, resulting in the complete loss of the premium paid for the contracts. It’s important for traders to monitor their option positions and take action to liquidate or roll over their contracts before expiration to avoid such losses.

Strategic Considerations for Last Trading Date:

Traders should consider several key factors when navigating the last trading date for stock options:

1. Market Volatility: Options with shorter time to expiration are more susceptible to market volatility, as their value can fluctuate significantly in a short period. Traders should exercise caution when holding options with short time to expiration, especially during periods of high market volatility.

2. Time Value Decay: The value of options decays over time, especially in the final days leading up to expiration. Time value decay accelerates as the option approaches its expiration date, making it crucial for traders to consider the potential impact on their option positions.

3. Liquidity: Liquidity can decrease significantly in the final days before expiration, making it difficult to buy or sell options at favorable prices. Traders should be prepared for reduced liquidity and adjust their trading strategies accordingly.

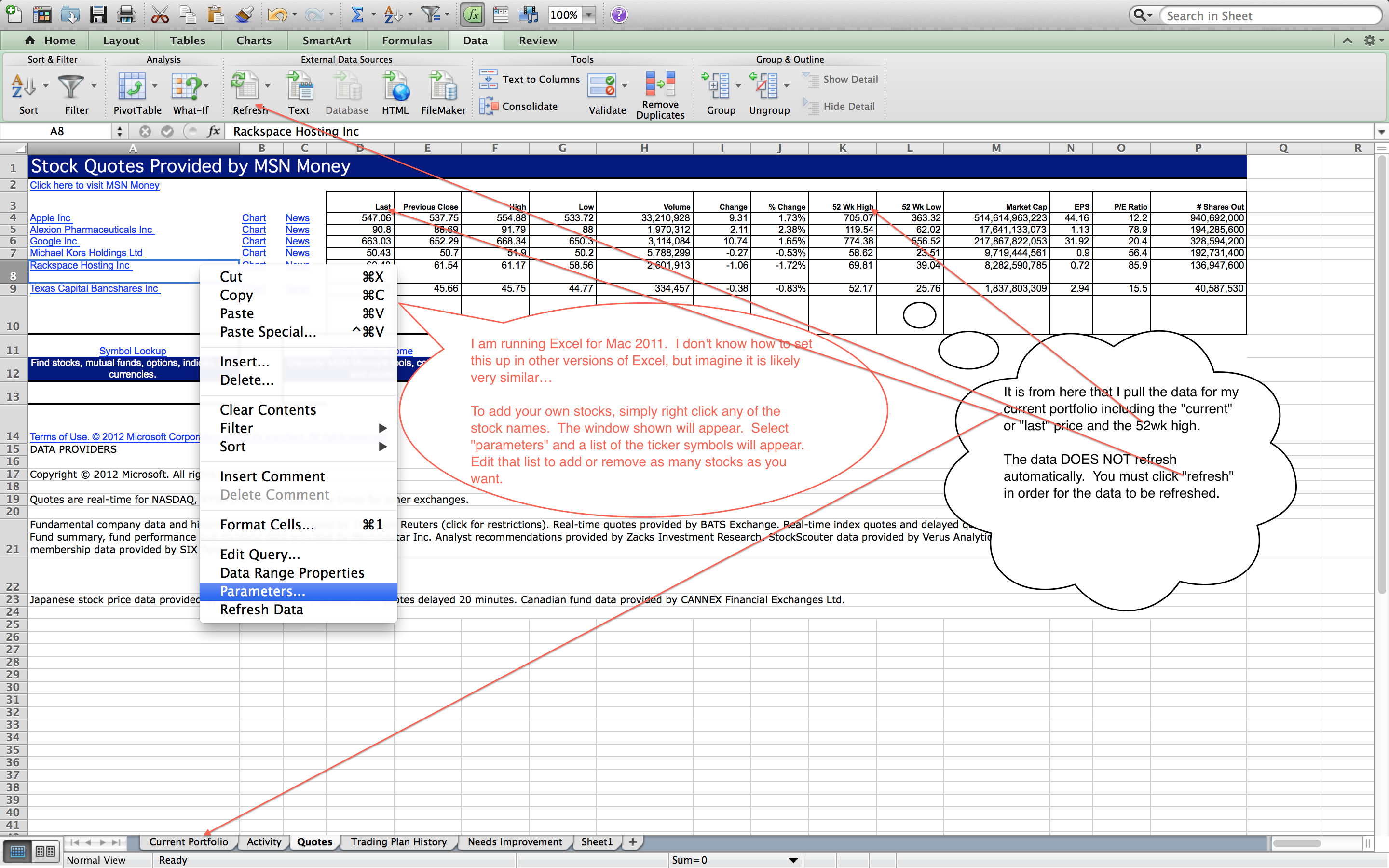

Image: db-excel.com

Last Trading Date Stock Options

Image: www.pinterest.com

Maximizing Option Trading Strategies Using Last Trading Date:

1. Active Management: Traders can actively manage their option positions by closely monitoring the last trading date. By taking calculated actions before expiration, traders can increase their chances of a successful trading outcome.

2. Expiration Date Awareness: Recognizing the interplay between time value decay and market volatility, traders can adjust their trading strategies accordingly. This includes the possibility of closing out positions prematurely or executing option strategies with longer time frames.

3. Avoiding Late Trading Errors: Traders should be cautious about late trading on the last trading date. Due to the liquidity constraints and potential for unexpected price movements, it’s advisable to initiate trades well in advance of the expiration date.

In conclusion, understanding and utilizing the last trading date for stock options is a crucial aspect of successful options trading. Through careful planning, strategic considerations, and active management, traders can enhance their ability to navigate the complexities associated with option expirations and maximize their trading outcomes. Remember to remain informed about your positions, monitor market conditions, and seek professional guidance when necessary to make informed trading decisions.