Unlocking the Secrets of Informed Trading Strategies

In the intricate world of investing, informed trading stands as a beacon of advantage. Equipped with valuable information and insights, informed traders possess the power to navigate volatile markets and maximize their returns. They leverage their knowledge to outsmart the competition and make astute trading decisions. Among the various informed trading strategies, activist trading has emerged as a captivating area of study, providing revelatory evidence about the impact of informed traders on option prices. Get ready to delve into the clandestine realm of activist trading and uncover the compelling evidence that shapes option pricing.

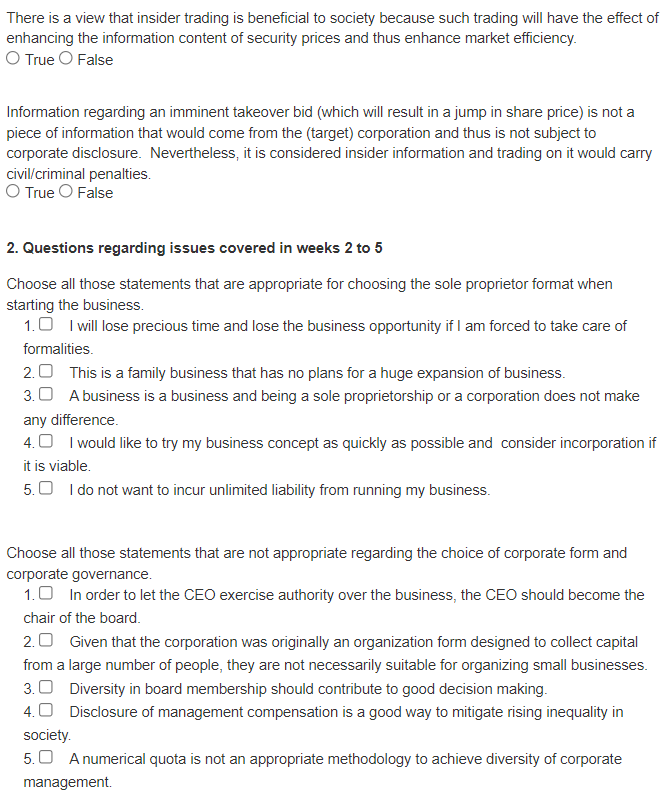

Image: www.chegg.com

Activist Trading: Unmasking the Stealthy Operators

Activist traders, the stealth operatives of the financial markets, are investors who acquire large stakes in companies with the intention of influencing management decisions. Their deep dives into corporate affairs uncover hidden value, enabling them to identify underpriced securities ripe for profit. Through targeted campaigns, they seek to implement changes aimed at unlocking this potential, often triggering significant price movements in both stocks and their associated options.

Lifting the Veil on Option Pricing: Activist Trading’s Unseen Influence

When activist traders make their presence known, option prices tremble in response. The market, perceiving their informed insights, adjusts option premiums accordingly. Put options, instruments that protect against stock declines, experience heightened demand as investors seek refuge from potential volatility. Conversely, call options, which bet on stock appreciation, soar in value due to the anticipated gains predicted by activist campaigns.

Unveiling Empirical Evidence: A Tale Unfolded by Data

A treasure trove of academic studies has meticulously documented the profound impact of activist trading on option prices. Empirical evidence paints a clear picture: activist involvement consistently elevates put option premiums and sends call option premiums skyward. This phenomenon is not transient; the market’s reverence for activist insights endures long after their initial acquisition of stakes.

Image: www.researchgate.net

Discerning Key Determinants: Unraveling the Factors that Sway Option Pricing

The magnitude of activist trading’s influence on option prices is a symphony of multiple factors. Company size, industry sector, and the activist’s reputation all play pivotal roles. Larger companies and those in growth industries tend to witness more pronounced option price reactions. Additionally, activist traders with established track records of successful campaigns command greater market respect, leading to amplified option price adjustments.

Empowering Traders: Unleashing the Potential of Informed Insights

The groundbreaking insights from activist trading research empower investors with an arsenal of informed trading strategies. By closely monitoring activist activity and deciphering their targets, traders can anticipate market reactions and calibrate their own option plays accordingly. Incorporating activist trading data into their decision-making process enhances their ability to navigate market fluctuations and amplify their returns.

Ethical Considerations: Navigating the Murky Waters of Activist Trading

While the allure of substantial gains may tempt some to venture into activist trading, it is imperative to tread carefully. Activist campaigns can be contentious, and their outcomes are never guaranteed. Moreover, the line between legitimate activism and manipulative schemes can be blurry at times. Investors must approach activist trading with a keen understanding of its ethical implications and vigilantly consider the potential risks.

Exploring the Future Landscape: Anticipating the Evolution of Activist Trading

The ever-evolving landscape of investing is likely to witness the continued prominence of activist trading. As markets become increasingly complex and interconnected, the demand for informed trading strategies will only intensify. Activist traders, with their unique blend of financial expertise and strategic insight, are well-positioned to guide investors through the perplexing terrain that lies ahead.

Informed Trading And Option Prices Evidence From Activist Trading

Image: www.chegg.com

Conclusion: Unveiling the Transformative Power of Informed Trading

Informed trading, embodied by the strategic maneuvers of activist traders, has revolutionized the art of option pricing. The body of evidence amassed through rigorous research empowers investors to harness the wisdom of informed traders, amplifying their own success in the financial markets. As markets continue to evolve, embracing informed trading approaches will remain a cornerstone of investment success, allowing investors to navigate the complexities of modern finance with confidence and reaping the rewards of well-informed decision-making.