In the ever-evolving financial landscape, investors seek innovative avenues to navigate market volatility and augment their portfolios. Among the many tools available, Standard & Poor’s 500 (S&P 500) futures and options have emerged as powerful instruments that empower traders to seize opportunities and mitigate risks. This comprehensive guide delves into the intricate world of S&P 500 derivatives, providing insights and strategies to help you optimize your trading endeavors.

Image: www.youtube.com

Demystifying S&P 500 Futures and Options

S&P 500 futures are standardized contracts that track the value of the underlying S&P 500 index. They allow investors to speculate on the future direction of the market and potentially profit from anticipated price movements. Futures contracts have a set expiration date, and their value is derived from the difference between the current market price and the futures price at the time of expiration.

Options, on the other hand, provide a more versatile approach to market participation. They convey the right, but not the obligation, to buy (call options) or sell (put options) the underlying asset at a predetermined price (strike price) on a specific date (expiration date). Options offer traders various strategies, from hedging against portfolio losses to generating income through premiums.

Unveiling the Benefits of S&P 500 Derivatives

The allure of S&P 500 futures and options lies in their numerous advantages. These instruments enable traders to:

-

Profit from Market Movements: Capitalize on both rising and falling markets, allowing for potential gains regardless of market direction.

-

Manage Risk: Employ futures and options as risk management tools to protect portfolios from adverse price fluctuations.

-

Leverage Market Positions: Gain exposure to the S&P 500 with limited capital investment, offering the potential for significant returns.

-

Generate Income: Utilize options strategies to generate income from premiums or engage in covered calls to enhance portfolio yield.

Navigating the S&P 500 Derivatives Landscape

Navigating the world of S&P 500 derivatives requires a comprehensive understanding of the underlying assets, contract specifications, and trading strategies.

-

Market Research and Analysis: Thoroughly research market trends, economic indicators, and industry reports to inform decision-making.

-

Know Your Risk Tolerance: Carefully assess your financial situation and risk tolerance before venturing into derivatives trading.

-

Understanding Contract Specifications: Grasp the nuances of futures and options contracts, including their expiration dates, contract size, and tick value.

-

Mastering Trading Strategies: Explore and master various trading strategies, ranging from basic trend following to advanced options trading techniques.

Image: twitter.com

Expert Insights and Actionable Tips

To augment your understanding of S&P 500 derivatives, seek guidance from industry experts. Attend conferences, webinars, or consult with experienced traders and financial advisors.

-

Utilize Historical Data: Leverage historical market data to identify trends, patterns, and potential trading opportunities.

-

Manage Positions Effectively: Implement sound risk management practices, including setting stop-loss orders, diversifying portfolios, and continuously monitoring market developments.

-

Stay Updated: Stay abreast of the latest economic news, market events, and regulatory changes that may impact the S&P 500 and its derivatives.

Https Www.Cmegroup.Com Trading Equity-Index Files Sandp-500-Futures-Options.Pdf

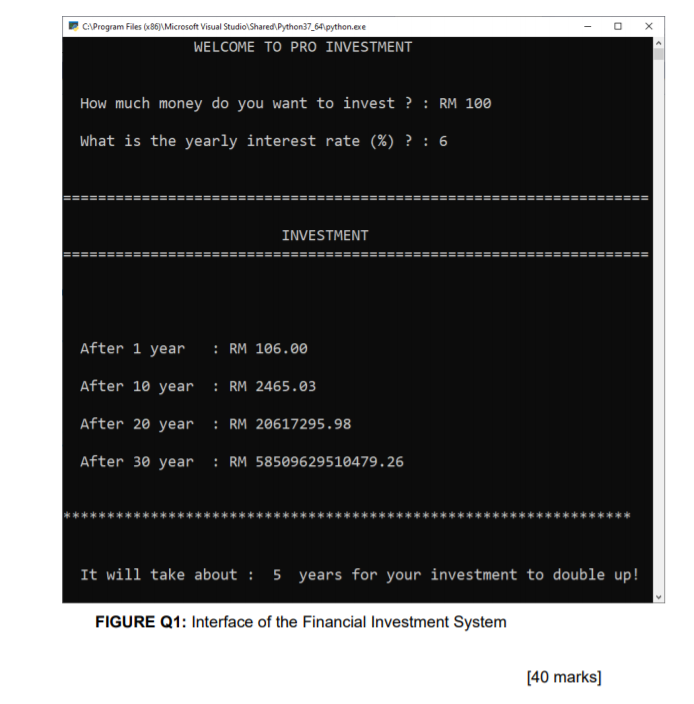

Image: www.chegg.com

Conclusion

The world of S&P 500 futures and options offers immense potential for astute traders and investors seeking to enhance their financial horizons. By harnessing the power of these instruments, leveraging expert insights, and implementing sound trading strategies, you can unlock the opportunities that the financial markets present. Remember, investing in futures and options carries inherent risks, and prudent decision-making is paramount.