**

Image: tslnh.com

**

Introduction

In the exhilarating realm of options trading, where fortunes are made and lost, understanding the tax implications is paramount. Navigating this complex landscape can be daunting, but with the right knowledge and guidance, you can confidently navigate the complexities and optimize your financial strategies. This comprehensive guide will delve into the intricacies of tax on options trading, empowering you with a clear understanding of your obligations and maximizing your financial potential.

Options Trading: A Brief Overview

Options are financial instruments that confer the right, but not the obligation, to buy or sell an underlying asset, such as a stock or index, at a predetermined price (strike price) on or before a specified date (expiration date). Call options provide the right to buy, while put options give the right to sell. Traders profit from options trading by correctly speculating on future price movements and exercising or selling their options accordingly.

Tax Treatment of Options Transactions

The tax treatment of options transactions varies depending on the type of options and how they are exercised.

Short-Term Options

Options with an expiration date of 12 months or less are considered short-term options. Their profits or losses are taxed as ordinary income or loss, subject to your marginal tax rate. This applies to both the exercise and sale of short-term options.

Long-Term Options

Options with an expiration date of more than 12 months are considered long-term options. The profits from long-term options held for more than a year qualify for a preferential tax rate, known as the capital gains tax. This tax rate can vary depending on your income level.

Option Premiums

When you buy or sell an option, you pay or receive a premium. Premiums represent the price of the option contract. The premium paid when you buy an option is considered a capital expense and is added to your cost basis for the option. The premium received when you sell an option is taxable as ordinary income.

Tax Basis for Options

Your tax basis for an option is the total amount you have invested in the option, including the premium paid and any commissions. When you exercise or sell an option, your profit or loss is calculated as the difference between the proceeds received and your tax basis.

Calculating Gain or Loss

To calculate your gain or loss, compare the proceeds received from selling or exercising the option to your tax basis. If the proceeds exceed the basis, you have a taxable gain. If the basis exceeds the proceeds, you have a deductible loss.

Reporting Options Transactions

Options transactions are reported on Schedule D of your income tax return. You must report the proceeds, premiums, and tax basis for each option transaction. If you have multiple transactions, consider using tax software or consulting a tax professional to ensure accurate reporting.

Tax-Saving Strategies

- Holding Long-Term: Holding options for more than a year qualifies for the lower capital gains tax rate.

- Exercising Over Buying: Exercising an option instead of selling it can potentially avoid paying ordinary income tax on the profit.

- Consider Tax-Advantaged Accounts: Trading options in an IRA or other tax-advantaged account can defer or eliminate tax payments.

Conclusion

Understanding the tax implications of options trading is crucial for successful and tax-efficient investing. By mastering the concepts discussed in this guide, you can proactively manage your tax obligations, maximize your returns, and confidently navigate the complexities of this dynamic market. Remember, it’s always wise to consult with a tax professional for personalized advice and tailored tax strategies.

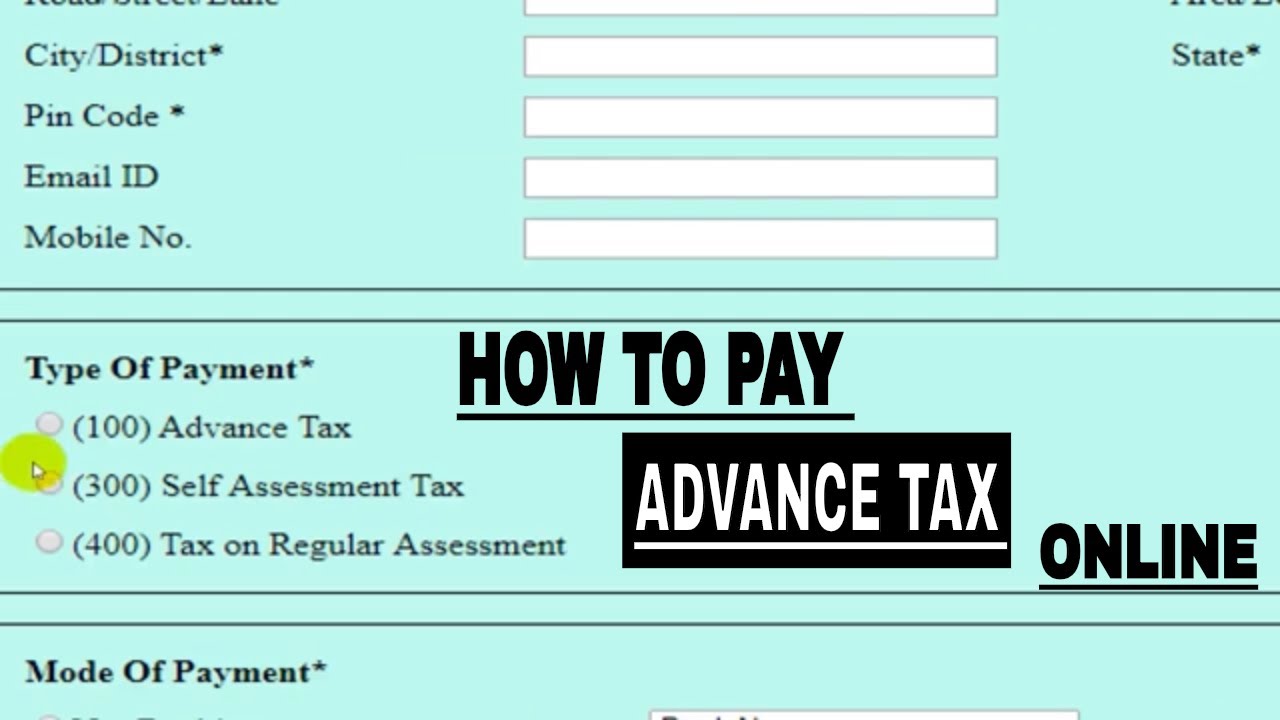

Image: www.daytrading.com

How To Pay Tax On Options Trading

Image: www.youtube.com