As an avid investor, I’ve always been intrigued by the potential of options trading. Particularly, Robinhood’s user-friendly platform piqued my interest. Determined to harness its power, I embarked on a journey to unravel the eligibility requirements.

Image: www.youtube.com

Understanding Options and Their Role

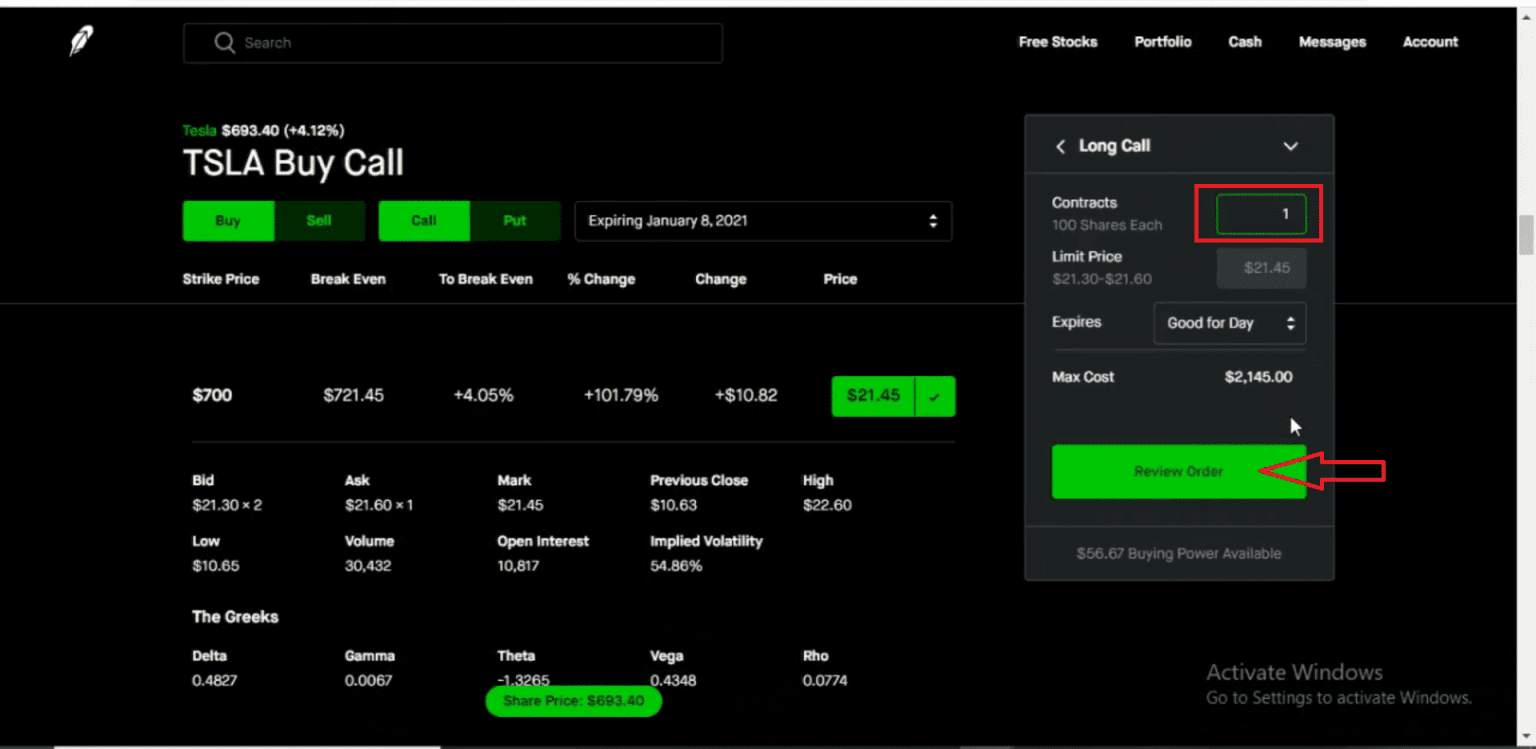

Options provide a flexible financial instrument that allows investors to speculate on the future price movements of an underlying asset, such as stocks or indices, without outright ownership. By purchasing call or put options, you gain the right but not the obligation to buy or sell the underlying asset at a predetermined price (strike price) on or before a set date (expiration date).

Understanding these concepts is crucial for navigating the options trading landscape. Once armed with this knowledge, let’s explore the eligibility criteria set by Robinhood.

Robinhood’s Eligibility Requirements

To qualify for options trading on Robinhood, you need to meet certain criteria. These include:

- Account Status: Your account must be approved and funded with at least $2,000.

- Options Level: You must obtain options trading permission by completing Robinhood’s educational modules and passing an options quiz.

- Investment Experience: Robinhood evaluates your trading activity and experience before granting options privileges. Factors considered include account size, trading frequency, and investment goals.

- Risk Tolerance: Options trading carries significant risk. Robinhood assesses your tolerance for risk based on your investment goals and previous trading behavior.

Navigating Robinhood’s Options Quiz

Robinhood’s options quiz is designed to test your understanding of options concepts and trading strategies. It consists of a series of multiple-choice questions that cover key areas such as:

- Call and Put Options

- Option Premiums

- Options Pricing

- Risk Management

Carefully studying Robinhood’s educational materials and demonstrating a thorough grasp of options will increase your chances of passing the quiz.

Image: www.youtube.com

Tips for Optimizing Eligibility

To maximize your chances of becoming eligible for options trading on Robinhood, consider these expert tips:

- Consistent Investment Activity: Regularly executing trades and maintaining a sufficient balance will demonstrate your active participation in the market.

- Investment Research: Engage in research and demonstrate your understanding of market trends and investment strategies.

- Options Knowledge: Study various options concepts, strategies, and risk management techniques to enhance your quiz performance.

- Patience: The eligibility process can take time. Be patient and continue to build experience and knowledge.

Frequently Asked Questions

Q: Can I opt-out of options trading?

A: Yes, you can contact Robinhood to disable your options trading permission.

Q: What’s the minimum balance required for options trading?

A: Robinhood requires an account balance of at least $2,000.

Q: Can I purchase options without owning the underlying asset?

A: Yes, with options trading, you only need to purchase the right to buy or sell the underlying asset.

Q: Are options suitable for all investors?

A: Options trading involves significant risk and is not suitable for all investors. It’s crucial to understand the risks before engaging in this activity.

How To Become Eligible For Options Trading Robinhood

Image: marketxls.com

Conclusion

Becoming eligible for options trading on Robinhood unlocks a powerful financial tool that can enhance your investment strategy. By comprehending eligibility requirements, passing the options quiz, and actively applying expert advice, you can maximize your chances of success.

Now, I invite you to share your thoughts. Are you interested in exploring options trading or seeking further information on the topic?