Embarking on the world of options trading often sparks a fundamental question: how much capital do I need to get started? Unlike stocks, options trading presents a unique landscape where the capital required can vary significantly depending on several factors. Join us as we delve into this crucial aspect, exploring the nuances of options trading and providing insights to help you navigate the financial markets effectively.

Image: optionclue.com

Understanding Options Trading

Options trading involves contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). This flexibility offers investors opportunities to speculate on price movements and potentially generate profits.

Factors Influencing Capital Requirements

The amount of capital needed for options trading is determined by a combination of factors:

1. Option Type:

Call options typically require less capital upfront compared to put options, as you only need to cover the potential difference between the strike price and the underlying asset’s price at expiration. Put options, on the other hand, require more capital since you are essentially betting on the asset’s value declining.

Image: www.angelone.in

2. Option Strike Price:

The strike price plays a significant role in determining capital requirements. Out-of-the-money (OTM) options, which have a strike price that is significantly different from the underlying asset’s current price, require less capital than at-the-money (ATM) options, with the strike price close to the current price.

3. Option Expiration Date:

Longer-term options have higher capital requirements than short-term options. This is because longer-term options have more time for the price of the underlying asset to fluctuate, potentially leading to larger potential losses.

4. Underlying Asset’s Volatility:

Options trading involves understanding the volatility of the underlying asset. Assets with high volatility experience significant price fluctuations, requiring more capital to cover potential losses.

5. Trading Strategy:

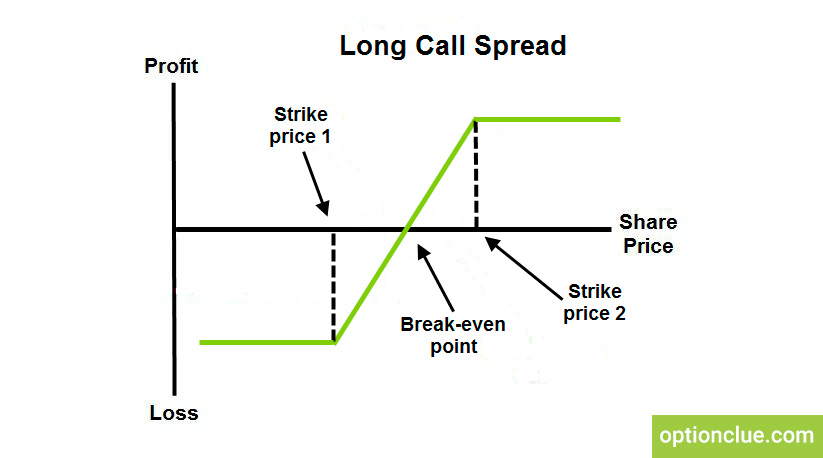

Different trading strategies, such as covered calls or option spreads, can impact the amount of capital required. Covered calls involve selling call options while owning the underlying shares, while option spreads involve combining multiple options contracts with different strike prices and expiration dates.

General Guidelines for Capital Requirements

While capital requirements can vary, it is generally recommended that aspiring options traders allocate a portion of their overall investment portfolio specifically for options trading. This ensures they have sufficient capital to cover potential losses while also maintaining a diversified portfolio.

For beginners, it is advisable to start with a small amount of capital and gradually increase it as they gain experience and become more comfortable with options trading.

How Much Calital Is Needed For Options Trading

Image: purepowerpicks.com

Conclusion

Determining the amount of capital needed for options trading requires careful consideration of the aforementioned factors. Options traders should assess their trading goals, risk tolerance, and financial situation to establish appropriate capital levels. By understanding the intricacies of options trading and allocating capital prudently, investors can navigate the markets with a more informed approach, maximizing their potential for success.