Harnessing the Perks of No-Cost Options Trading

In the realm of finance, option trading stands as a powerful tool for risk-tolerant investors seeking to amplify returns and manage risk. However, the traditional barrier of brokerage fees could deter many from venturing into this lucrative yet intimidating world. Enter free option trading brokerages, democratizing access to this once-exclusive domain and empowering everyday traders with a cost-effective avenue for financial growth.

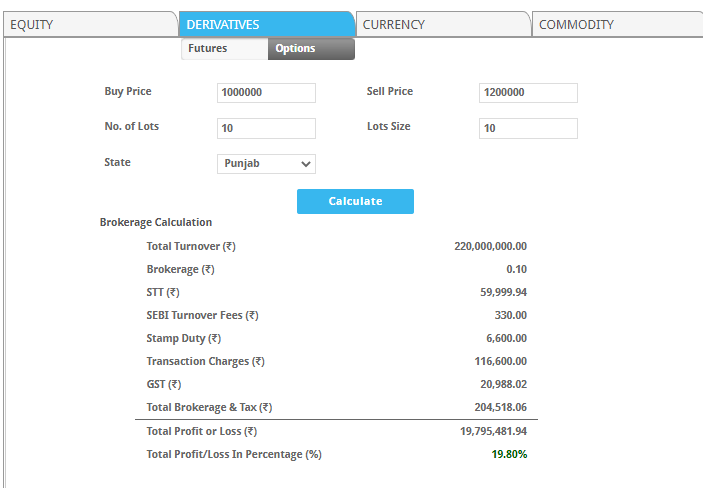

Image: www.adigitalblogger.com

Free option trading brokerages operate on a commission-free model, eliminating the per-contract fees typically associated with executing options trades. This paradigm shift has dramatically lowered the entry barrier for aspiring option traders, making it more feasible for individuals with limited capital or those who execute high-frequency trades to explore this market segment.

Understanding Option Trading

Options, financial instruments derived from underlying assets like stocks, bonds, and commodities, grant traders the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specified date. This flexibility allows traders to speculate on price movements, hedge against risk, or generate income through premium collection. Options trading can be a complex endeavor, requiring a thorough understanding of market dynamics, risk management techniques, and options pricing models.

Evolution of Free Option Trading Brokerages

The advent of online trading platforms and advancements in financial technology have paved the way for the emergence of free option trading brokerages. These innovative platforms leverage economies of scale and operational efficiency to offer commission-free trading, disrupting the traditional brokerage landscape. As a result, traders can now access sophisticated trading tools, real-time market data, and educational resources without incurring exorbitant fees.

The proliferation of free option trading brokerages has fostered increased competition within the industry, compelling established brokerages to adapt or risk losing market share. Consequently, many traditional brokerages have introduced their own commission-free or low-cost trading platforms to cater to the growing demand for affordable options trading.

Free option trading brokerages have revolutionized the options trading landscape, democratizing access to this once-elite market segment. These platforms empower traders of all experience levels to participate in the options market and pursue their financial goals without being burdened by excessive fees.

Tips for Choosing a Free Option Trading Brokerage

While there are numerous free option trading brokerages available, it’s crucial to evaluate their offerings carefully to select the one that aligns with your trading style and needs. Here are some key factors to consider:

- Commission structure: Ensure that the brokerage offers commission-free trading on options contracts.

- Account minimums: Determine if the brokerage imposes any minimum account balance requirements.

- Trading platform: Assess the user-friendliness, functionality, and research capabilities of the brokerage’s trading platform.

- Customer support: Evaluate the brokerage’s customer support channels and response times.

- Educational resources: Consider whether the brokerage provides educational materials, webinars, and other resources to support traders.

By carefully considering these factors, you can identify the free option trading brokerage that best complements your trading approach and enables you to achieve your financial objectives. Don’t hesitate to explore multiple brokerages to compare their offerings and make an informed decision.

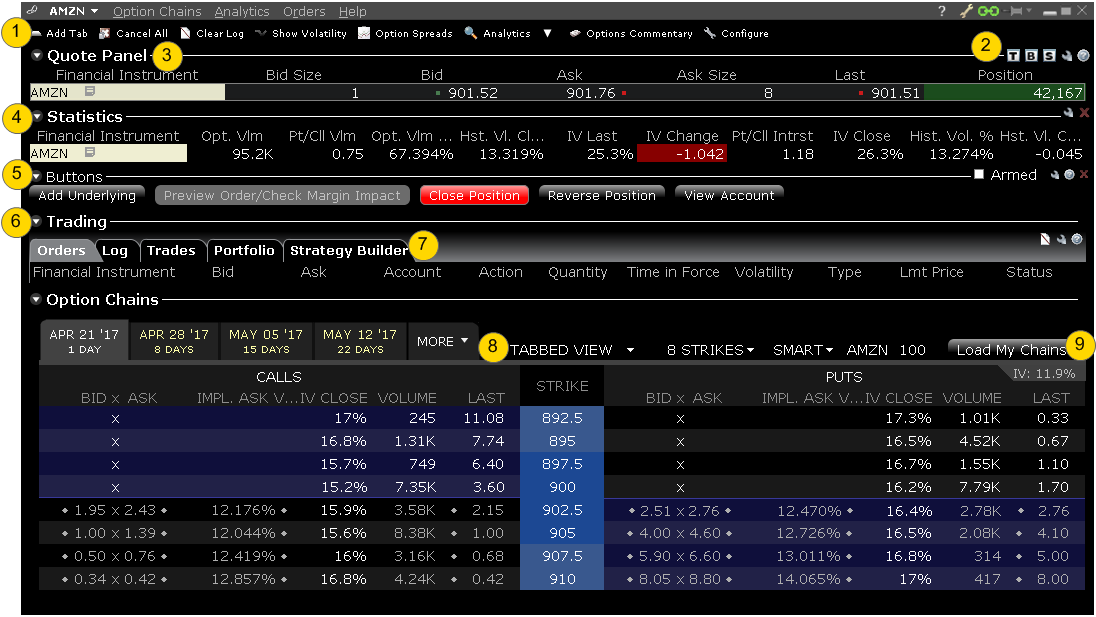

Image: www.ibkrguides.com

Free Option Trading Brokerage

Image: vesect.com

Frequently Asked Questions About Free Option Trading Brokerages

- Q: Are there any catches to free option trading brokerages?

A: Generally, free option trading brokerages do not charge commissions on options trades. However, they may generate revenue through other means, such as margin interest, payment for order flow, or ancillary services.

- Q: What are the risks involved in option trading?

A: Option trading involves significant risk and is not suitable for all investors. Options can lose value quickly, and traders can potentially lose more than their initial investment. It’s crucial to understand the risks associated with options trading and to trade cautiously.

- Q: How can I get started with free option trading?

A: To get started with free option trading, you’ll need to open an account with a free option trading brokerage. Once your account is funded, you can begin placing options trades through the brokerage’s trading platform. It’s advisable to start with small trades and gradually increase your position size as you gain experience and confidence.

- Q: Are free option trading brokerages regulated?

A: Yes, reputable free option trading brokerages are regulated by financial authorities, such