Introduction

In the realm of financial markets, options emerge as a powerful tool for investors to navigate the uncertain waters of stock price fluctuations. Free option paper trading presents an invaluable opportunity to hone one’s trading skills without the risks associated with real capital, making it an indispensable resource for aspiring traders.

Image: www.chartguys.com

Paper trading simulates the real-time trading environment by providing virtual funds and market data, allowing traders to test their strategies and develop market acumen without incurring financial losses. Embracing free option paper trading empowers traders to navigate complex market dynamics, gain confidence, and cultivate a solid foundation for successful investing.

The Fundamentals of Option Paper Trading

Options, a type of financial derivative instrument, grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. The option’s value is influenced by factors such as the price of the underlying asset, time to expiration, volatility, and interest rates.

Free option paper trading platforms mirror the functionality of real-time trading systems, providing traders with access to live market data, option quotes, and trading capabilities. By actively simulating realistic market conditions, these platforms offer a safe and immersive learning environment, empowering traders to fine-tune their strategies and develop a deep understanding of option trading.

Benefits of Free Option Paper Trading

The allure of free option paper trading stems from its multifaceted benefits, catering to traders of diverse experience levels.

-

Risk-free Learning: Unlike real-time trading, paper trading eliminates financial risks associated with market volatility, allowing traders to experiment boldly and explore different strategies without fear of financial repercussions.

-

Practical Experience: Paper trading offers an invaluable hands-on training ground, enabling traders to experience the dynamics of real-world markets in real-time, honing their reflexes and developing an intuitive grasp of market behavior.

-

Strategy Testing: Paper trading serves as an ideal platform for testing and fine-tuning trading strategies, allowing traders to evaluate their performance in various market conditions without the pressure of actual losses.

-

Boosting Confidence: Successful experiences in paper trading can significantly boost a trader’s confidence, empowering them to transition to real-world markets with a heightened level of assurance.

Image: seekingalpha.com

Free Option Paper Trading

Image: www.youtube.com

Getting Started with Free Option Paper Trading

Embarking on the journey of free option paper trading is a straightforward process, comprising the following steps:

-

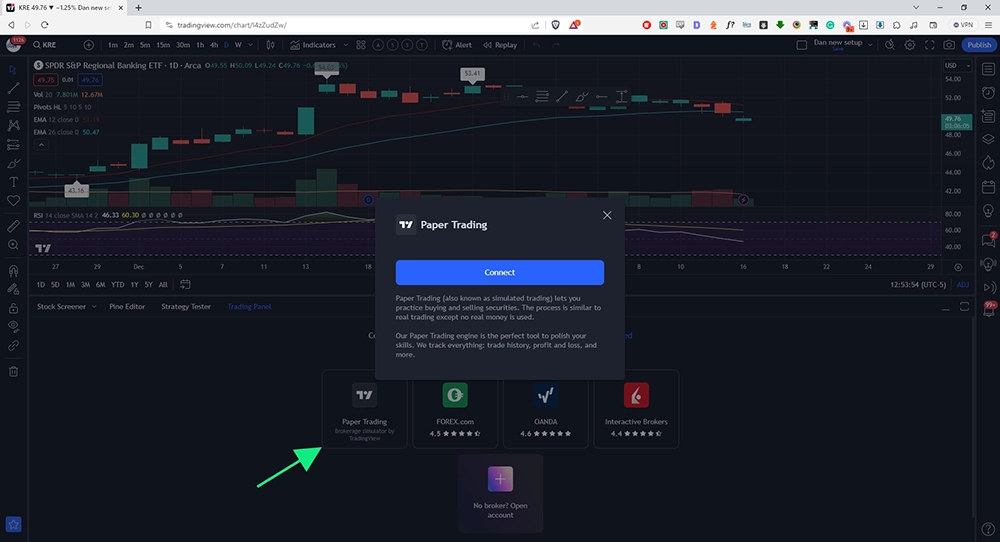

Selecting a Platform: Numerous reputable platforms offer free option paper trading services, such as Thinkorswim, TradingView, and Interactive Brokers. These platforms provide robust trading capabilities, real-time data, and educational resources to facilitate a seamless trading experience.

-

Setting Up an Account: Registering an account on your chosen platform is generally quick and hassle-free, often requiring only basic personal and financial information. Most platforms offer demo accounts credited with virtual funds, enabling traders to begin practicing immediately.

-

Exploring the Platform: Take time to familiarize yourself with the interface and functionalities of your chosen platform. Understanding the trading tools, order types, and market data visualizations will empower you to navigate the platform confidently and efficiently.

-

Developing a Strategy: Before initiating trades, develop a systematic trading plan outlining your entry and exit points, profit targets, and risk management strategies. Paper trading provides the freedom to experiment and refine your strategy until you achieve optimal performance.

-

Evaluating Performance: After executing trades, meticulously evaluate your