As a seasoned trader, I can still vividly recall the exhilaration of my first successful Eurex options trade. It was a moment of triumph that ignited within me an unyielding passion for unlocking the limitless possibilities offered by these versatile financial instruments. In the world of derivatives, Eurex stands as a beacon of innovation, empowering traders with a diverse array of options trading opportunities tailored to meet their unique strategies.

Image: www.berotak.com

Navigating the intricate landscape of Eurex trading hours options requires a comprehensive understanding of their mechanics and nuances. Our journey begins with exploring the origins and significance of these options, guiding you through their historical evolution and present-day relevance in the financial landscape.

**Eurex: A Pioneer in the Options Arena**

Eurex, a leading derivatives exchange, has played a pivotal role in the development and standardization of options trading in Europe and beyond. Since its inception in 1998, Eurex has continuously expanded its product offerings, establishing itself as a global powerhouse in the options market.

The uniqueness of Eurex options lies in their standardized contracts, ensuring liquidity, transparency, and ease of execution. These standardized contracts streamline trading and enable participants to efficiently manage their risk exposure. Furthermore, Eurex’s rigorous regulatory framework fosters a secure and transparent trading environment, attracting a diverse array of market participants, including institutional investors, asset managers, and individual traders alike.

**Unveiling the Cornerstones of Eurex Options Trading**

At the heart of Eurex options trading lies the concept of exercising an option. An option grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility provides traders with the ability to tailor strategies that align with their risk tolerance and investment goals.

Understanding the interplay between option premiums, strike prices, and expiration dates is crucial for successful Eurex options trading. Option premiums represent the price paid for the right to exercise an option, while strike prices reflect the price at which the underlying asset can be bought or sold. Expiration dates mark the final day on which an option can be exercised, and their proximity influences the premium paid.

**navigating the Eurex Trading Landscape**

Navigating the Eurex trading landscape requires a comprehensive understanding of the various options strategies available. Call options grant the buyer the right to buy an underlying asset, while put options empower the buyer to sell. Depending on their market outlook and risk appetite, traders can employ a diverse range of option strategies, such as buying or selling single options, spreads, or combinations, to maximize profit potential while mitigating risk.

Eurex options also offer distinct advantages for hedging portfolios against market volatility. By utilizing options as a risk management tool, traders can reduce their overall exposure to price fluctuations and enhance portfolio stability during turbulent market conditions.

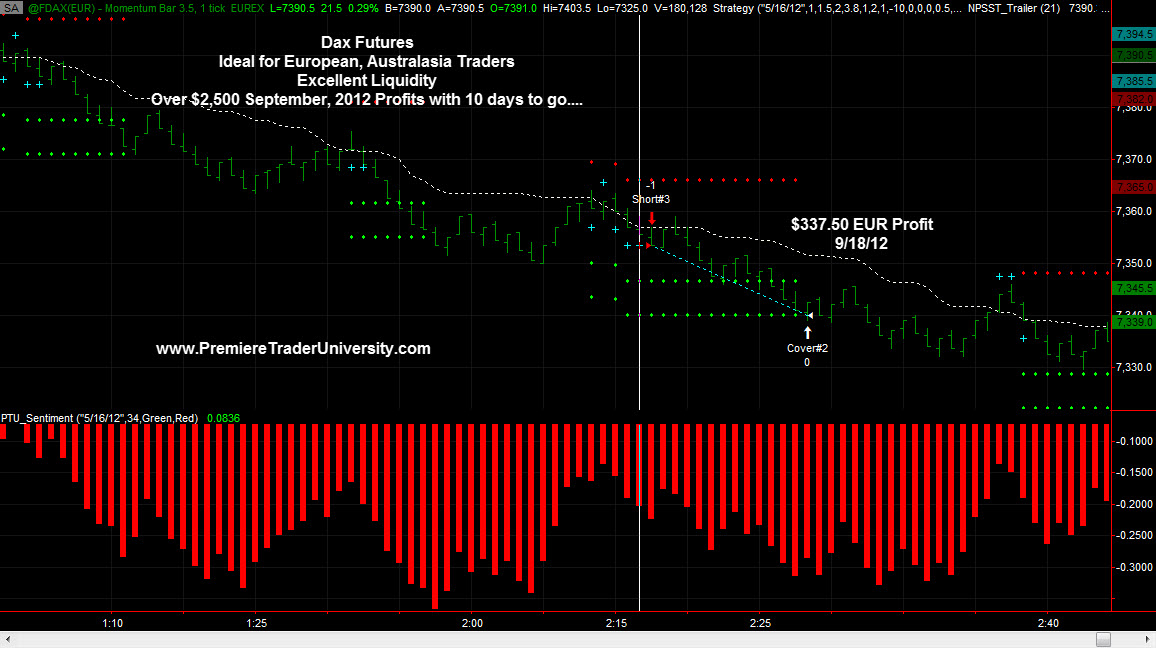

Image: thewaverlyfl.com

**Optimizing Your Eurex Options Strategies**

To maximize the potential of Eurex options trading, it is imperative to harness effective strategies. These strategies encompass meticulous risk management practices, in-depth market analysis, and a keen understanding of option pricing models. By leveraging technical indicators, monitoring market news, and staying abreast of global economic trends, traders can make informed decisions and position themselves for success in the dynamic Eurex options market.

Expert advice and insights from seasoned traders can serve as an invaluable resource for refining one’s options trading strategies. Seeking guidance from experienced mentors, attending industry events, and continuously educating oneself on market dynamics can provide invaluable insights into the complexities of options trading.

**Frequently Asked Questions on Eurex Options Trading**

Q: What are the benefits of trading Eurex options?

A: Eurex options offer standardized contracts, ensuring liquidity, transparency, and ease of execution. They empower traders with tailored strategies, enhance portfolio diversification, and serve as effective hedging tools during market volatility.

Q: How do I determine the right options strategy for my needs?

A: Selecting an appropriate options strategy hinges on understanding your risk tolerance and investment goals. Consider market conditions, the underlying asset’s volatility, and your financial resources to determine the most suitable approach.

Q: What resources are available to enhance my Eurex options trading knowledge?

A: Seek guidance from experienced traders, attend industry events, and continuously educate yourself on market dynamics. Leveraging technical indicators, monitoring market news, and understanding pricing models can refine your strategies and maximize profit potential.

Eurex Trading Hours Options

Image: anajevopule.web.fc2.com

**Embark on Your Eurex Options Journey**

The world of Eurex options trading beckons, offering endless possibilities for both experienced traders and aspiring investors alike. By grasping the underlying principles, honing your strategies, and leveraging the insights shared within this comprehensive guide, you are well-equipped to navigate the dynamic landscape of Eurex options and unlock its transformative power for your financial success.

Are you ready to harness the opportunities presented by Eurex trading hours options? Join the ranks of successful traders and embark on your options trading adventure today.