In the exhilarating realm of financial markets, the ability to strategize and harness market opportunities is paramount. Among the myriad trading methodologies that dot the investing landscape, options trading stands out as a powerful tool for prudent risk-taking and amplified gains. This comprehensive guide delves into the intricacies of Dr. Duke options trading, a time-tested approach that empowers traders to navigate market complexities and maximize their earning potential.

Image: www.teepublic.com

Deciphering Dr. Duke Options Trading

Conceptualized by the revered Dr. Richard Duke, a pioneer in market analysis and options trading, the Dr. Duke methodology is an options trading strategy that revolves around identifying price anomalies and leveraging option premiums to generate profits. Its fundamental premise lies in capitalizing on inefficiencies in the options market, where mispriced options present opportunities for astute traders. By exploiting these price disparities, Dr. Duke’s approach aims to capture the lucrative premium decay inherent in options contracts while mitigating downside risk.

Pillars of Dr. Duke’s Strategy

The Dr. Duke options trading strategy rests upon a foundation of meticulous analysis and calculated decision-making. Its pillars include:

1. Technical Analysis Mastery

Dr. Duke’s methodology emphasizes the significance of technical analysis in identifying market trends and price patterns. It involves scrutinizing historical price data, charting techniques, and indicators to discern potential trading opportunities. By employing proven technical analysis techniques, traders can anticipate future market movements with greater precision and confidence.

Image: www.onlinejobs.ph

2. Options Premium Exploitation

Options contracts, with their unique characteristics, offer a means to capture market movements and earn premiums. Dr. Duke’s approach focuses on selecting options with favorable premiums, capitalizing on the time decay inherent in these contracts. Traders can adopt strategies such as selling premium or using covered calls to generate income while managing risk.

3. Risk Management Discipline

Options trading, while offering immense potential, also carries inherent risks. Dr. Duke’s strategy places paramount importance on risk management. It entails strict adherence to predefined trading rules, position sizing, and stop-loss placement to safeguard against unforeseen market volatility and preserve invested capital.

Navigating Market Nuances with Dr. Duke’s Approach

The Dr. Duke options trading strategy proves its mettle in diverse market conditions. Whether in bullish or bearish trends, sideways markets or periods of elevated volatility, traders can adapt the methodology to capitalize on market inefficiencies. Its versatility stems from the ability to employ various options strategies, including long calls, long puts, short calls, and short puts, tailored to the prevailing market dynamics.

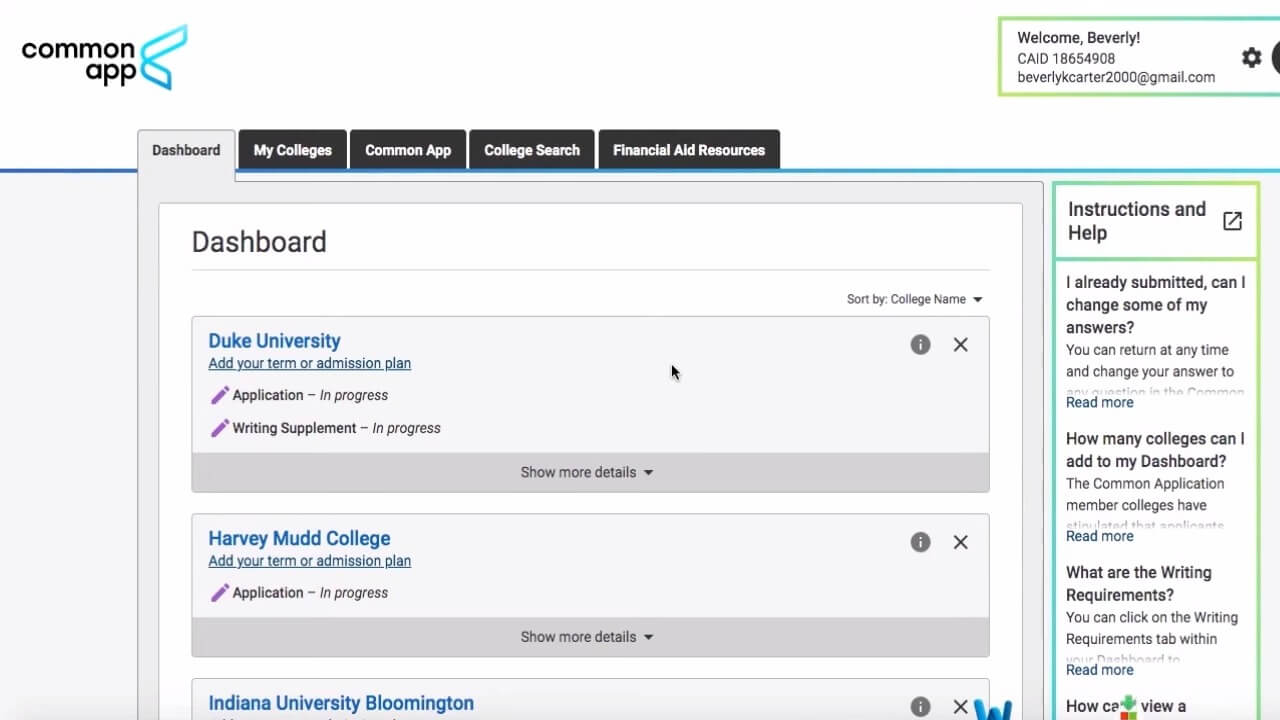

Dr Duke Options Trading

Image: plexuss.com

Unlocking the Edge: Key Takeaways

Embracing Dr. Duke’s options trading strategy can elevate your financial endeavors to new heights. Here are some key takeaways to guide your trading journey:

- Master technical analysis to unravel market trends and pinpoint trading opportunities.

- Harness the power of options premiums to generate income and amplify gains.

- Uphold rigorous risk management practices to safeguard your capital and mitigate market uncertainties.

- Embrace adaptability and adjust your strategy according to evolving market conditions.

- Seek continuous learning and refine your trading acumen to stay abreast of market advancements.