Day trading, the practice of buying and selling financial instruments within the same trading day, has gained popularity among investors seeking quick profits. However, understanding if day trading rules extend to options trading is crucial before venturing into this realm.

Image: www.youtube.com

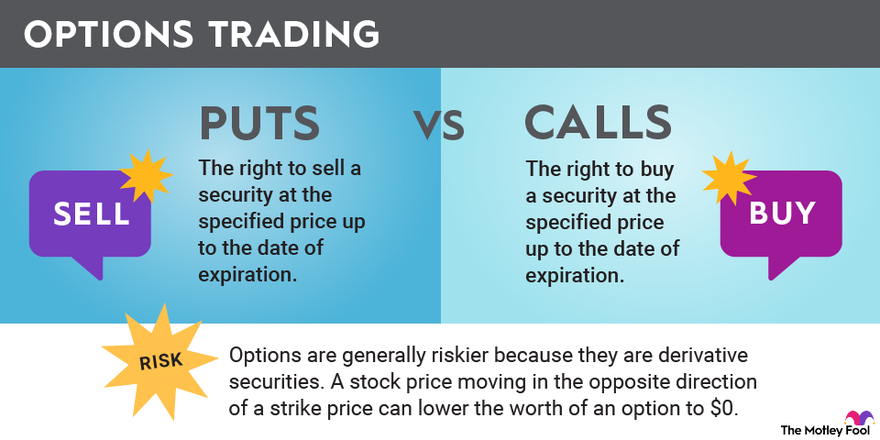

Options, unlike stocks or bonds, represent contracts that grant the buyer (holder) the right, but not the obligation, to buy or sell an underlying asset (stock, index, or commodity) at a specified price (strike price) before a specific date (expiration date). Day trading options involves opening and closing these contracts within the same day, aiming for short-term gains.

Regulation and Margin Requirements

Options trading is regulated by exchanges and the Securities and Exchange Commission (SEC), similar to day trading in stocks. However, certain rules may differ. The Federal Reserve’s Regulation T sets margin requirements for day trading stocks, but these requirements do not directly apply to options trading.

Instead, options traders must meet margin requirements imposed by their respective brokers. Margin accounts allow traders to borrow funds to buy or sell financial instruments. However, option brokers may have varying margin requirements depending on the underlying asset’s volatility and the trader’s risk profile.

Time Decay and Implied Volatility

Day trading options requires careful consideration of time decay and implied volatility. Option contracts lose value over time, known as time decay, which is more pronounced as expiration approaches. As a day trader, you must close your positions before the contract expires to avoid losing all your investment.

Implied volatility represents the market’s expectation of future price fluctuations in the underlying asset. Higher implied volatility leads to higher option prices, which can impact day traders’ returns. Understanding and monitoring implied volatility is crucial for making informed trading decisions.

Risk Management

Risk management is paramount in both day trading stocks and options. However, options trading can introduce additional risks due to factors like leverage and the use of options strategies. Using stop-loss orders, limiting position size, and incorporating risk-averse strategies can help manage risk effectively.

Image: ar.inspiredpencil.com

Psychology and Discipline

Day trading options, like any form of day trading, requires strong emotional control and trading discipline. The rapid pace and potential for significant gains and losses can test even experienced traders. Sticking to a trading plan, controlling impulses, and managing emotions are essential for long-term success.

Does Day Trading Rules Apply To Options

Image: fintrakk.com

Conclusion

While day trading options offers the potential for quick profits, it also comes with significant risks. Understanding the differences between options trading and stock day trading, adhering to regulatory requirements and margin guidelines, and practicing sound risk management is crucial for navigating this dynamic market effectively. However, exploring further resources, such as educational material and consulting professional financial advisors, can greatly enhance your knowledge and trading outcomes.