Introduction

Image: www.chegg.com

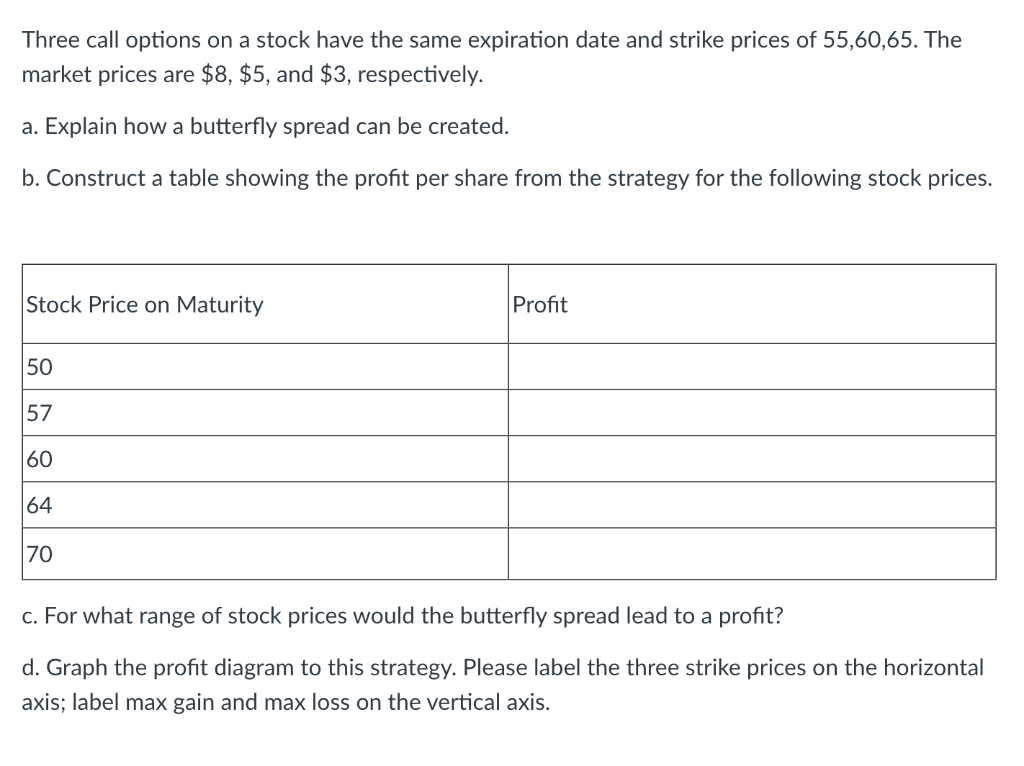

In the fast-paced world of investing, day trading stands as a popular strategy, offering the potential for quick profits but also carrying inherent risks. With the advent of options trading, a new question arises: does buying call options fall under the umbrella of day trading? Delving into the intricacies of this topic, this comprehensive guide will elucidate the nuances and provide clarity for seasoned investors and aspiring traders alike.

Defining Day Trading: A Temporal Perspective

The defining characteristic of day trading lies in its time frame. Day traders, unlike long-term investors, execute their transactions within the same trading day, opening and closing their positions before the market closes. They harness short-term price fluctuations to capitalize on fleeting market opportunities.

Options Trading: A Versatile Instrument

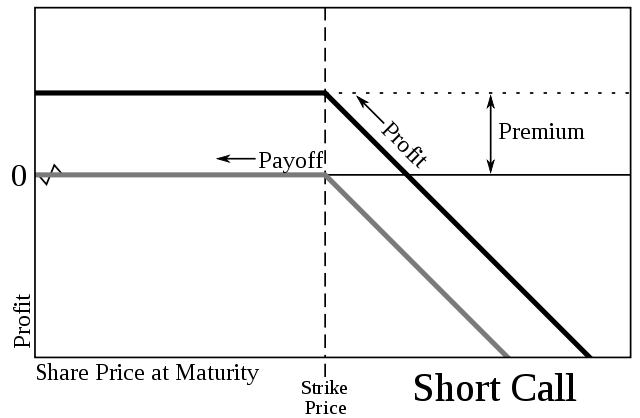

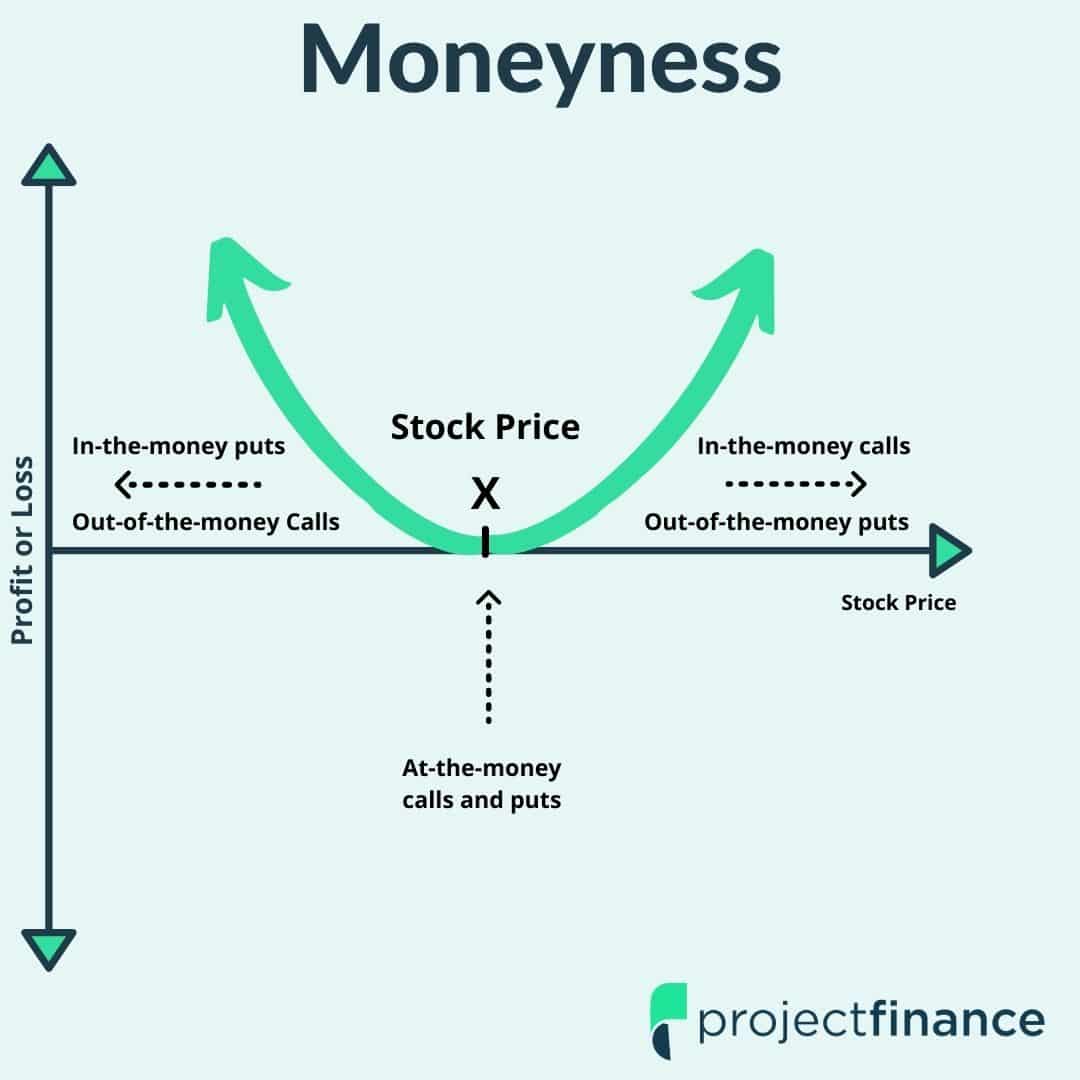

Options, versatile financial instruments, empower investors with the right but not the obligation to buy (call options) or sell (put options) an underlying asset at a predetermined price on or before a specific date. This flexibility offers traders a wide range of strategies, from hedging to speculation.

Understanding the Dynamics of Call Options

Call options confer upon their holders the right to purchase an underlying asset at a set price known as the strike price. For instance, consider a stock trading at $100. Purchasing a call option with a strike price of $110 grants the holder the right to buy that stock for $110 on or before the option’s expiration date.

Does Buying Call Options Constitute Day Trading?

The crux of the matter lies in whether options traders close their positions within the same trading day. If a trader opens and closes a call option position within a single trading day, then by the commonly accepted definition, this transaction qualifies as day trading.

Differentiating Day Trading from Investing

The distinction between day trading and investing hinges on the holding period. Day traders seek to reap profits from intraday price movements, while investors maintain positions for longer durations, often months or years, with the primary objective of capital appreciation or dividend income.

Expert Insights: Navigating Call Options in Day Trading

Seasoned day traders emphasize the importance of meticulous planning, rigorous risk management, and a comprehensive understanding of options mechanics. They advocate for exercising caution, recognizing that call options, like any other investment instrument, carry both potential rewards and risks.

Strategies for Day Trading Call Options

A plethora of call option strategies exist, each tailored to specific market conditions and risk tolerance. Popular approaches include:

- Bull Call Spread: A bullish strategy involving buying a call option with a lower strike price and simultaneously selling a call option with a higher strike price.

- Bear Call Spread: A strategy designed for bearish market scenarios, entailing selling a call option with a lower strike price and buying a call option with a higher strike price.

- Iron Condor: A neutral strategy balancing risk and reward by selling a call option at a higher strike price, buying a call option at an even higher strike price, selling a put option at a lower strike price, and buying a put option at an even lower strike price.

Conclusion

The decision of whether buying call options counts as day trading hinges on the time frame of the transaction. If executed within a single trading day, the activity aligns with the definition of day trading. However, it’s crucial to note that call options offer a broad range of trading strategies, and investors should thoroughly assess their individual risk tolerance and objectives before engaging in any trading activity.

Image: www.newtraderu.com

Does Buying Call Options Count As Day Trading

Image: www.projectfinance.com