Introduction

In the bustling world of finance, the terms “stocks” and “options” often get thrown around, yet their meanings and implications remain enigmatic to many. Whether you’re a seasoned investor or just starting to explore the market, understanding the distinct characteristics of these two investment vehicles is crucial for making informed decisions. This comprehensive guide will delve into the intricacies of stocks and options trading, providing you with a clear understanding of their unique features.

Image: howtotradeonforex.github.io

Stocks: A Piece of the Pie

When you purchase a stock, you essentially become a fractional owner of a company. As the company grows and prospers, so does the value of your investment. Additionally, you may receive regular dividends, which are payments made to shareholders from the company’s profits. Stocks are bought and sold on stock markets, such as the New York Stock Exchange (NYSE) and Nasdaq, where their prices fluctuate based on supply and demand.

Options: Flexible Agreements

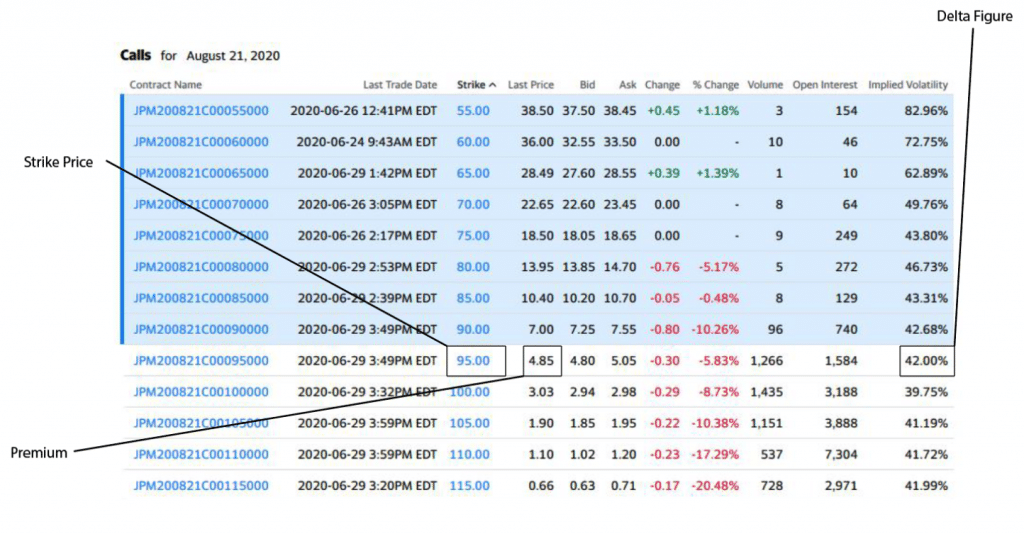

Unlike stocks, options do not confer ownership in a company. Instead, they represent contracts that grant you the right, but not the obligation, to buy or sell an underlying asset (the stock) at a predetermined price on a specific date. There are two main types of options: calls and puts. With a call option, you have the right to buy a stock at a certain price, while with a put option, you have the right to sell a stock at a specified price.

Key Distinctions

Now let’s dive into the key differences between stocks and options trading:

- Ownership: Stocks represent ownership in a company, while options represent contracts that provide the right to buy or sell an underlying asset.

- Returns: Stocks provide potential for appreciation in value and dividends, while options offer the potential for both gains and losses, depending on the outcome of the underlying asset.

- Risk: Stock prices can fluctuate significantly, while options offer more flexibility and the possibility of limiting risk by establishing a predetermined price.

- Expiry: Stocks have no expiry date, while options have a set expiry date, usually ranging from a few weeks to several months.

Image: club.ino.com

Suitability and Considerations

Choosing between stocks and options trading depends on your individual financial goals, risk tolerance, and investment horizons.

- Long-Term Investment: Stocks may be more suitable for long-term investors seeking growth and income.

- Short-Term Trading: Options provide flexibility and can be employed for short-term trading strategies, such as hedging or speculating.

- Risk Tolerance: If you’re not comfortable with the potential for significant losses, options might provide more control over your risk exposure.

- Investment Skill: Options trading requires a higher degree of financial knowledge and experience, making them less suitable for novice investors.

Difference Between Stocks And Options Trading

Image: www.pinterest.com

Conclusion

Navigating the world of stocks and options trading can be daunting, but understanding the fundamental differences between these two investment vehicles is essential for making informed decisions. Stocks offer the allure of ownership and potentially steady growth, while options provide flexibility and the ability to tailor your risk exposure. By carefully evaluating your goals, risk tolerance, and investment horizons, you can determine which option is more suitable for your financial journey. Remember to conduct thorough research, seek professional advice when needed, and always trade responsibly.