In the realm of financial markets, there exists a vibrant canvas painted with a myriad of investment instruments, each offering unique avenues to harness market movements. Among these, futures and options stand as two prominent classes, alluring traders with their distinct characteristics and opportunities. Whether you are a seasoned market aficionado or an aspiring investor seeking to expand your horizons, understanding the intricate differences between these instruments is paramount to unlocking their full potential.

Image: www.pinterest.com

Unveiling Futures: Contracts for Future Delivery

Imagine entering into a binding agreement to buy or sell a specific asset at a predetermined price on a specified future date. This, in essence, is the essence of futures trading. In this realm, traders speculate on the future price of commodities, currencies, or other underlying assets.

One of the key advantages of futures trading lies in its ability to hedge against price risk. Suppose you are a farmer anticipating a bountiful harvest in the coming months. To protect yourself from potential price fluctuations, you could enter into a futures contract to sell a portion of your crop at a fixed price. This way, you can safeguard your income regardless of any unfavorable price movements.

Exploring Options: The Power of Choice

In the realm of options trading, the concept of choice takes center stage. An options contract grants the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specified expiration date.

Consider this example: You believe that a certain stock has the potential to rise in value, but you want to limit your risk. An option contract allows you to purchase the right to buy (call option) or sell (put option) the stock at a pre-determined price. If the stock rises as predicted, you have the option to exercise your right to buy the stock and reap the profits. However, if the stock performs contrary to expectations, you can simply let the option contract expire, resulting in a limited loss.

Unveiling the Key Differences

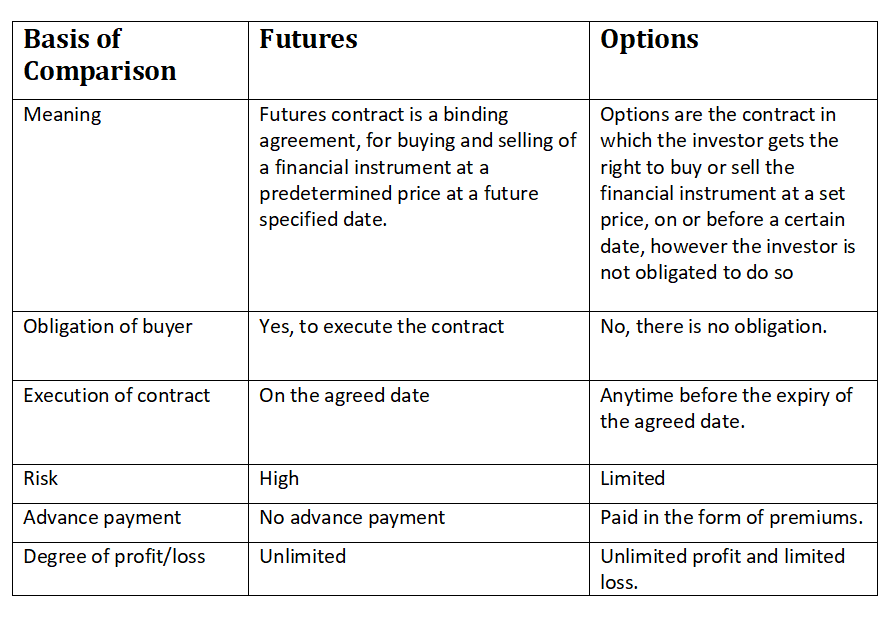

While futures and options share similarities, they also exhibit distinct differences that shape their suitability for various trading strategies:

- Obligation vs. Choice: Futures contracts create a binding obligation to buy or sell the underlying asset, while options grant holders the option to exercise their right to do so.

- Premium vs. Margin: Futures traders are required to post margin, a form of security deposit, while options buyers pay a premium to purchase the option contract.

- Hedging vs. Speculation: Futures are often employed for hedging purposes, managing risk associated with future price fluctuations, whereas options offer a versatile instrument for both hedging and speculative trading.

- Leverage: Futures trading offers inherent leverage, potentially magnifying both profits and losses, while options provide a more defined risk profile.

Image: www.5paisa.com

Navigating the Paths

The choice between futures and options depends on your specific investment goals, risk tolerance, and trading style. If you seek a hedging mechanism to mitigate price risk, futures may be a suitable choice. However, if you prefer a more flexible option with limited risk and the ability to speculate on price movements, options might be a better fit.

Navigating the world of futures and options trading requires a thorough understanding of the mechanics, risks, and potential rewards involved. It is advisable to conduct diligent research and consult with experienced professionals before embarking on your trading journey.

Difference Between Future And Options Trading

Image: www.pinterest.com

Conclusion: Embracing the Potential

Futures and options trading can empower investors with valuable tools to harness market opportunities and manage risks. Understanding the unique characteristics of each instrument allows traders to make informed decisions that align with their investment objectives. Whether you choose the path of futures or options, a well-informed approach is the key to unlocking the full potential of these versatile financial instruments.