Introduction

Venturing into the world of options trading can yield lucrative rewards or daunting losses, depending on your strategy. Delta neutral option trading offers a unique approach to managing risk and maximizing profits while minimizing volatility exposure. This article delves into the intricacies of delta neutral strategies, unveiling their benefits, mechanics, and the latest trends in this captivating realm of finance.

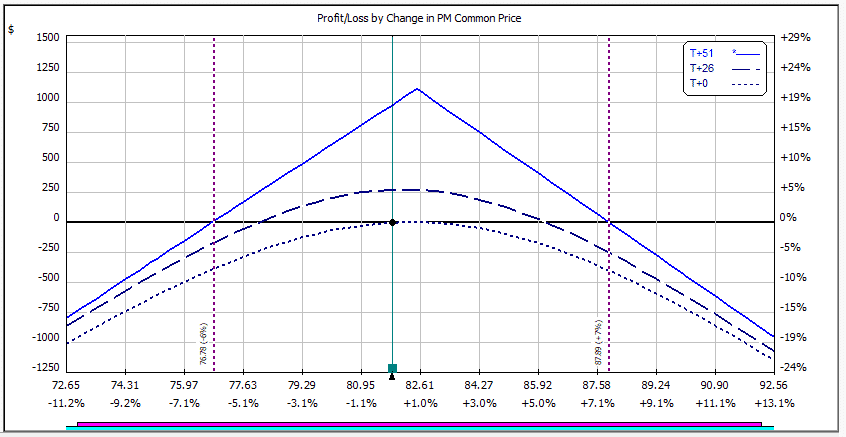

Image: optionstradingiq.com

The Art of Delta Neutrality

Delta neutrality is a technique used in option trading where the trader holds positions that have a combined delta of close to zero. This means that the trader’s portfolio exhibits minimal sensitivity to changes in the underlying asset’s price and is therefore less susceptible to directional market movements. The delta of an option measures its sensitivity to the price of the underlying asset.

Benefits of Delta Neutral Trading

Employing delta neutral strategies offers several advantages:

- **Reduced risk:** By maintaining a delta-neutral portfolio, traders can hedge their bets and minimize the impact of market fluctuations on their overall position.

- **Income generation:** Delta neutral strategies can generate income through premiums collected on the options sold, providing a steady stream of cash flow.

- **Volatility capture:** Traders can capitalize on implied volatility by selling options with a higher delta, potentially profiting from the decay in volatility.

Mechanics of Delta Neutral Trading

Creating a delta-neutral portfolio involves identifying pairs of options with different deltas but the same underlying asset and expiration date. For example, a trader might sell one call option with a delta of 0.6 and buy one put option with a delta of -0.6 for the same underlying stock.

The goal is to maintain the overall delta of the portfolio as close to zero as possible. As the price of the underlying asset changes, the delta of the long and short options will adjust in opposite directions, keeping the combined delta of the portfolio in a neutral range.

Image: www.talkdelta.com

Latest Trends and Insights

The world of delta neutral trading is constantly evolving. Here are some of the latest trends:

- **Increased popularity of synthetic delta neutrality:** This technique involves creating a delta-neutral position by combining different types of options, including synthetic shares.

- **Growing use of advanced option analytics:** Traders are leveraging technology to develop sophisticated algorithms and models for identifying delta-neutral opportunities.

- **Rise of index options:** Delta neutral strategies are increasingly being used with index options, providing broader market exposure.

Tips and Expert Advice

For successful delta neutral trading, consider these tips from experienced traders:

- **Choose liquid options:** Trade options with high liquidity to ensure you can adjust your position quickly as needed.

- **Understand the underlying asset:** Thoroughly research and understand the underlying asset and its price drivers.

- **Manage risk prudently:** Use stop-loss orders and position sizing to limit potential losses.

- **Monitor your portfolio closely:** Regularly track your portfolio’s delta to ensure it remains within the desired range.

Additionally, consider the following expert advice:

“Delta neutral trading is not without risk, and it’s important to understand the potential pitfalls before jumping in.” – John Carter, Author of Mastering the Trade

“Maintaining a clear and concise trading plan is crucial for successful delta neutral trading.” – Mark Douglas, Trading Psychologist

Frequently Asked Questions (FAQ)

- What are the main types of delta neutral strategies?

- Is delta neutral trading suitable for all investors?

- How do I calculate the delta of an option?

Common delta neutral strategies include covered calls, synthetic short stock, and collar spreads.

Delta neutral strategies can be complex and are generally recommended for experienced options traders with a good understanding of risk management.

The delta of an option measures its price sensitivity to a $1 change in the underlying asset’s price. It can be calculated using option Greeks calculators or derived from option pricing models.

Delta Neutral Option Trading Strategies Profiting

Image: bitcointradingpractice.com

Conclusion

Delta neutral option trading strategies offer a sophisticated approach to managing risk and generating income in the options markets. By understanding the basics, staying abreast of the latest trends, and applying expert advice, traders can leverage the power of delta neutrality to enhance their trading outcomes.

Are you ready to explore the world of delta neutral options trading and unlock its profit potential?