Day trading involves buying and selling financial instruments within the same trading day, typically with the goal of profiting from short-term price fluctuations. Options contracts are a popular choice for day traders, as they offer the potential for high returns. However, it’s crucial to understand the legal framework surrounding day trading options to avoid costly mistakes and ensure compliance with regulatory requirements.

Image: scallywagandvagabond.com

Understanding the Basics: Defining Option Contracts

An option contract is an agreement between two parties that gives the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific underlying asset, such as a stock, at a specified price (the strike price) on or before a certain date (the expiration date). The seller of the option, known as the option writer, has the corresponding obligation to fulfill the contract if the buyer exercises their right.

Day trading options involves buying and selling these contracts within the same trading day, taking advantage of short-term price movements in the underlying asset. This strategy can be highly lucrative but also carries significant risks.

Legal Framework: Regulatory Oversight and Compliance

Day trading options is subject to various legal regulations and requirements imposed by government agencies such as the Securities and Exchange Commission (SEC) in the United States. These regulations aim to protect investors and ensure the integrity of the financial markets.

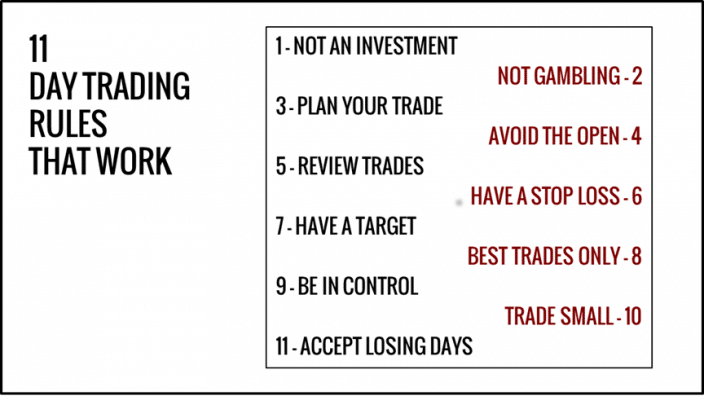

Pattern Day Trading Rule: Restricting Excessive Trading

The Pattern Day Trading (PDT) Rule, implemented by the SEC, aims to prevent excessive day trading of options and other financial instruments. Under this rule, individuals who engage in four or more day trades (purchases and sales within the same day) of the same underlying security within a rolling five-business-day period are designated as pattern day traders.

This designation imposes additional requirements on traders, such as maintaining a minimum account balance of $25,000. Traders must also receive approval from their brokerage firm to engage in pattern day trading and provide a signed agreement acknowledging the risks involved.

Image: www.tradingwithrayner.com

Suitability Standards: Ensuring Trading Appropriateness

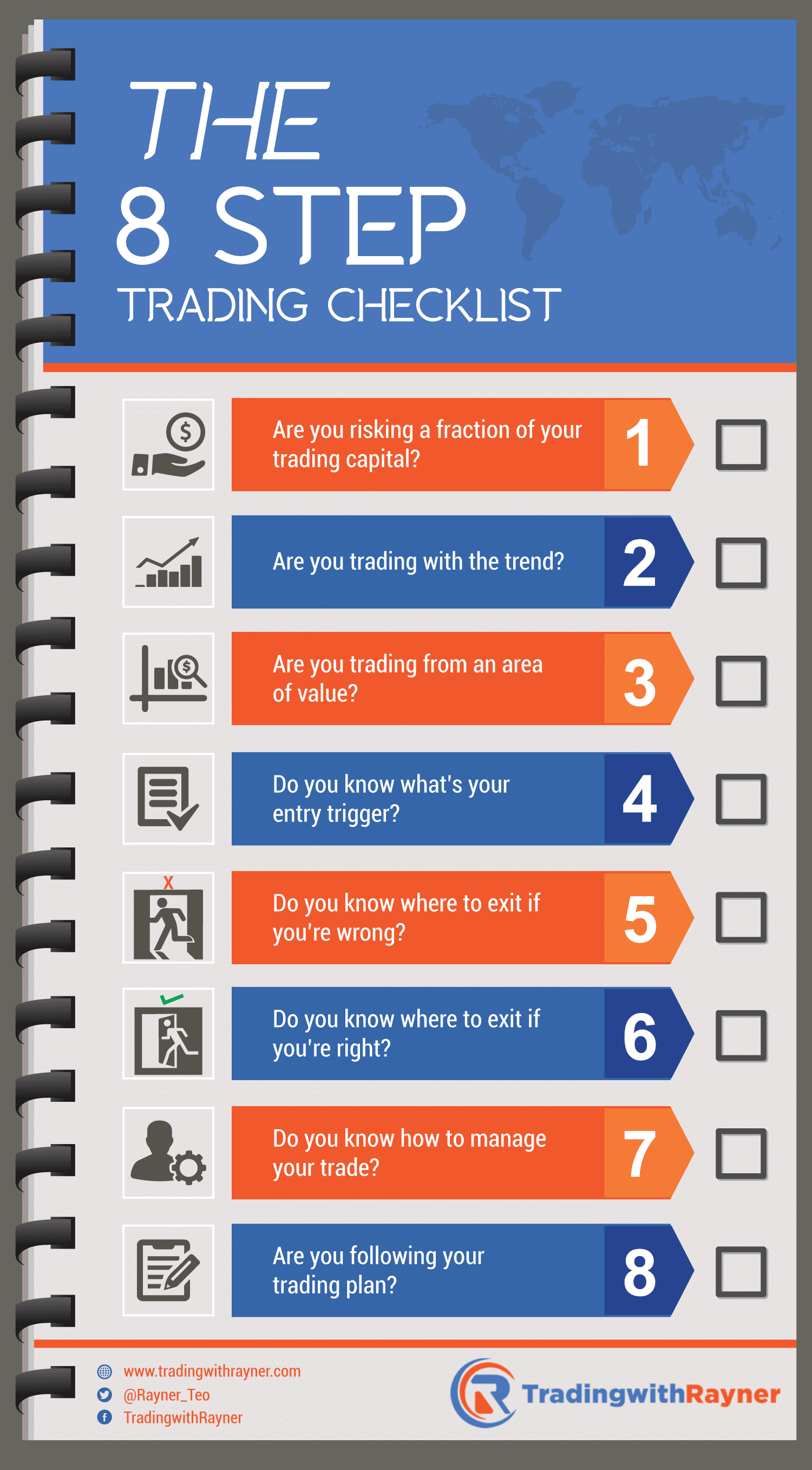

Brokerage firms are obligated to assess the suitability of options trading for their clients before allowing them to trade. This involves determining whether the client has adequate knowledge, experience, and financial resources to engage in such trading activities.

Brokers must consider factors such as the client’s trading history, investment objectives, and risk tolerance. They may also require clients to complete a questionnaire or take training courses to demonstrate their understanding of options trading.

Margin Trading Restrictions: Leveraging Caution

Many traders use margin accounts to access borrowed funds and increase their potential profits. However, margin trading carries inherent risks and is subject to specific regulations.

For example, the SEC imposes a maximum leverage ratio of 1:4 for options day trading. This means that traders cannot borrow more than four times their equity balance. Brokers are also required to monitor margin accounts closely and may liquidate positions if losses reach certain levels.

Recordkeeping Requirements: Preserving Transparency

Day traders are required to maintain accurate records of their trading activities. These records should include details such as the date, time, and prices of trades, as well as the names and underlying assets of the options contracts involved.

Failure to maintain proper records can result in legal penalties and hinder traders’ ability to track their performance and identify potential areas for improvement.

Additional Considerations for Day Trading Options

Beyond compliance with legal regulations, day trading options involves several additional considerations to maximize success:

Understanding the Underlying Market: Gauging the Bigger Picture

Successful day trading requires a deep understanding of the underlying market for the assets being traded. This includes factors such as economic conditions, company news, and industry trends.

Analyzing charts, researching fundamental data, and following financial news can provide traders with valuable insights into potential price movements.

Managing Risk and Setting Stop-Loss Orders: Protecting Profits and Mitigating Losses

Day trading options can be highly volatile, and managing risk is paramount. Setting stop-loss orders can help traders limit potential losses by automatically selling an option contract if it falls below a specified price.

Proper risk management techniques help preserve capital and prevent trading decisions from being clouded by emotions.

Seeking Professional Guidance: Enhancing Decision-Making

While many traders choose to navigate the day trading landscape independently, seeking professional guidance from a financial advisor or experienced trader can be invaluable.

These professionals can provide personalized advice, help interpret market trends, and offer valuable insights that can improve trading performance over time.

Day Trading Laws For Option Contracts

Image: unitedstatestroopers.blogspot.com

Conclusion

Day trading options requires a thorough understanding of legal regulations and careful