As an avid options trader, I’ve witnessed firsthand the exhilarating and dynamic nature of daily options trading activity. It’s a fast-paced environment where the market’s heartbeat can change in a matter of seconds. Whether you’re a seasoned professional or just starting out, understanding the nuances of daily options trading is crucial for success.

Image: booksdrive.org

Deciphering Daily Options Trading Activity

Options trading involves the buying and selling of options contracts, which provide the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Daily options trading activity refers to the volume and price movements of these contracts throughout the trading day.

Tracking daily options trading activity can provide valuable insights into market sentiment, upcoming events, and potential trading opportunities. By analyzing the volume, open interest, and implied volatility of options contracts, traders can gauge market expectations and make informed decisions.

Understanding Implied Volatility

Implied volatility (IV) is a key indicator in options trading. It represents the market’s perception of the future volatility of the underlying asset. Higher IV suggests that investors expect significant price fluctuations, while lower IV indicates a belief in price stability.

Traders should consider IV when determining options strategies. Selling options with higher IV can generate higher premiums, but also carries greater risk. Conversely, buying options with lower IV may yield lower returns, but offers a more conservative approach.

Maximizing Trading Potential

To maximize trading potential in daily options trading, consider the following tips and expert advice:

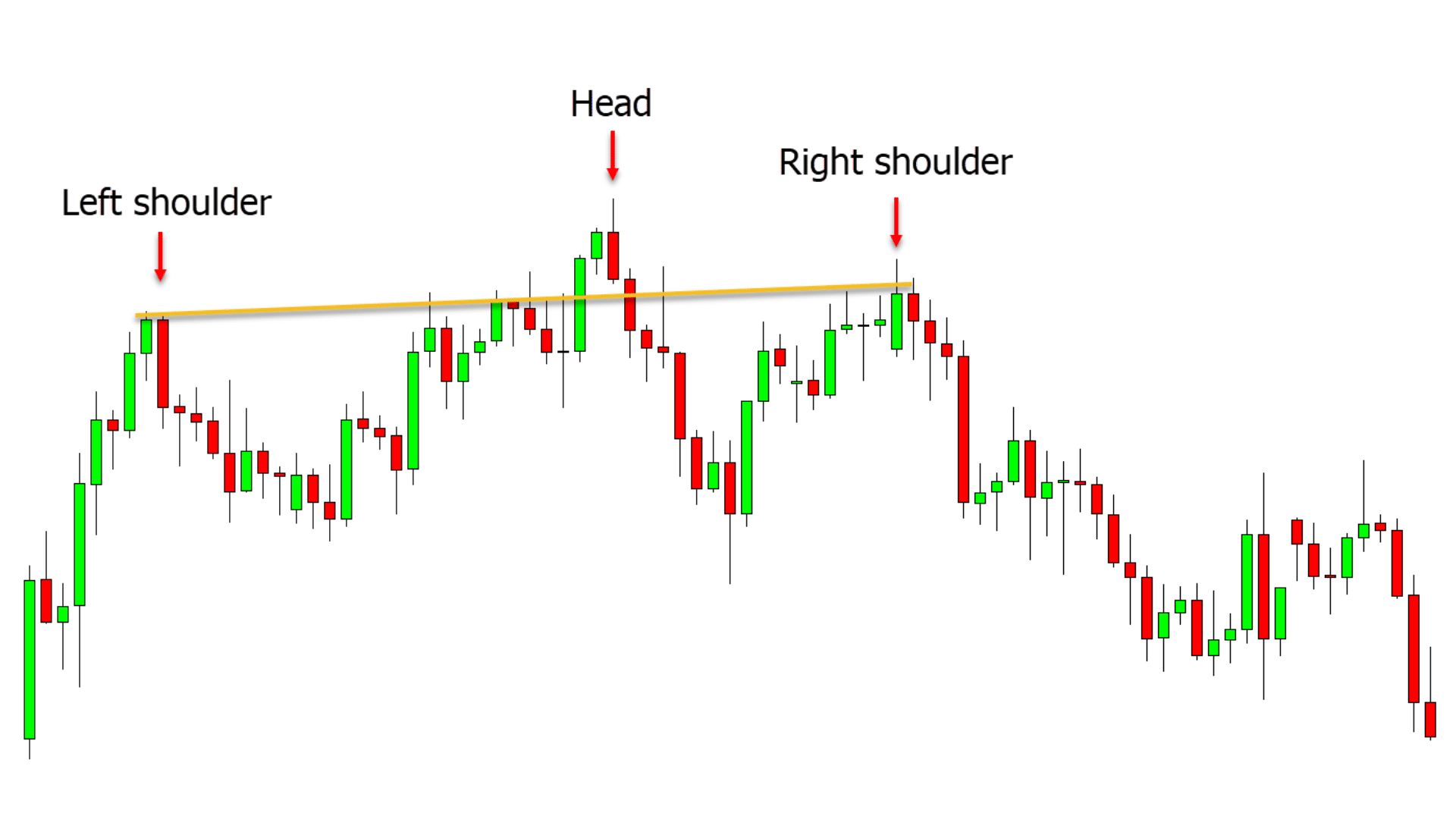

* Master fundamental and technical analysis: Understanding the underlying asset’s industry, earnings, and economic factors can provide a solid foundation for informed trading decisions. Additionally, using technical analysis to identify chart patterns and indicators can pinpoint potential trading opportunities.

* Monitor market news and events: Stay updated on relevant news and economic events that could impact the underlying asset and options market. This includes geopolitical events, earnings reports, and economic indicators.

Image: stockmarketsguides.com

FAQ on Daily Options Trading

- Q: What are the key factors to consider when trading options?

- A: Implied volatility, option premium, strike price, and expiration date.

- Q: How do I mitigate risk in options trading?

- A: Diversify your portfolio, manage your risk-reward ratio, and consider hedging strategies.

- Q: What are some common options trading strategies?

- A: Covered calls, cash-secured puts, bull/bear spreads, and iron condors.

Daily Options Trading Activity

Image: meta-formula.com

Conclusion

Daily options trading activity is an intricate and rewarding aspect of the financial markets. By understanding the fundamentals, monitoring market trends, and utilizing expert advice, traders can navigate the dynamic landscape and potentially generate profitable returns. Are you ready to dive into the thrilling world of daily options trading?