Imagine this: you’re scrolling through your favorite financial news app, and a headline catches your eye – a tech company just announced a groundbreaking new product. Your mind races: “Could this be a chance to make big money?” You know the potential is there, but you’re hesitant. You’ve heard stories of people losing everything in the volatile world of options trading. How can you learn the ropes without risking real money? That’s where paper trading apps come in.

Image: front.page

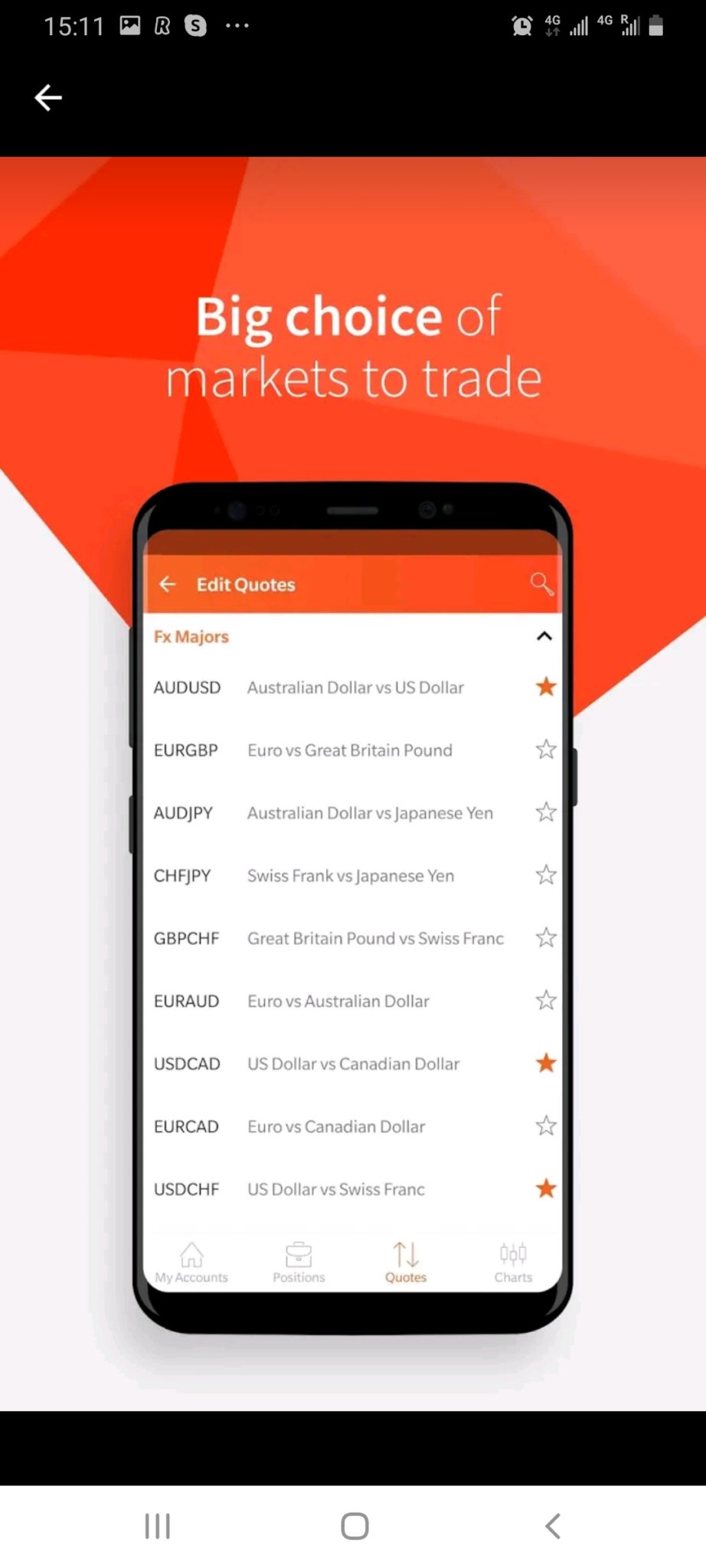

Paper trading apps, also known as “simulated trading” platforms, offer a safe space to practice your option trading skills without the pressure of risking real capital. They provide a realistic trading environment where you can explore various strategies, analyze market trends, and build confidence before committing real funds. But with so many options available, which paper trading app is right for you? Let’s embark on a journey to unveil the best options trading tools and empower you to take control of your financial future.

Diving Deep into the World of Paper Trading Apps: Your Gateway to Options Mastery

Before we dive into specific apps, let’s understand the fundamentals of paper trading. Think of it as a virtual playground where you can experiment with different options trading strategies, learn how to manage risk, and refine your timing without losing your hard-earned money.

Why Paper Trade?

- Risk-free Learning: The biggest advantage is the ability to learn without risking capital. Paper trading allows you to practice trading strategies without losing money, making it a safe and effective learning tool.

- Build Confidence: As you become comfortable with various strategies and market conditions, your confidence grows. This makes you a more informed and capable trader when you’re ready to trade with real money.

- Master Timing: Options trading thrives on precise timing. Paper trading lets you experiment with entry and exit points, refining your timing skills to gain a competitive edge.

- Develop Discipline: The emotional side of trading can be overwhelming. Paper trading forces you to analyze your decisions rationally, helping you develop the discipline needed for successful trading.

Types of Paper Trading Apps: Navigating the Options Marketplace

- Brokerage-Based Platforms: Most major online brokers like Robinhood, TD Ameritrade, and Interactive Brokers offer paper trading accounts within their trading platforms. This gives you a seamless experience, allowing you to transition from paper trading to live trading on the same platform.

- Standalone Paper Trading Apps: Some apps are specifically designed for paper trading, often with a focus on features tailored towards educational purposes. These apps can be incredibly user-friendly and often offer valuable educational resources alongside their simulated trading features.

Image: stockapps.com

Essential Features: Looking for the Right Fit

- Realistic Market Data: The simulation should use real-time market data, providing you with a true representation of current trading conditions.

- Comprehensive Options Tools: Look for apps that offer various options contract types, including calls, puts, straddles, and spreads, allowing you to explore different strategies.

- Clear Charts and Order Execution: A user-friendly interface with clear charts, insightful indicators, and efficient order execution is vital for a smooth trading experience.

- Historical Backtesting: The capability to backtest your strategies against historical market data is invaluable for refining your trading decisions.

Unlocking Success: Experts Share Their Insights

“Paper trading is not just about learning the technical aspects of options trading; it’s about learning yourself,” advises seasoned options trader, Mark Thompson. “By analyzing your trades and identifying your strengths and weaknesses, you gain valuable self-awareness that translates directly into your real trading experience.”

Tips from the Pros:

- Start with Simple Strategies: Begin with basic call and put options before venturing into more complex strategies.

- Focus on Risk Management: Paper trading is an excellent opportunity to develop effective risk management plans. Experiment with different stop-loss orders and position sizing techniques.

- Track Your Performance: Keep careful records of your paper trades and analyze your performance regularly. Identify areas for improvement and learn from your mistakes.

- Gradually Transition to Live Trading: As you gain confidence and refine your strategies, gradually transition to live trading with small amounts of capital.

Apps For Paper Trading Options

Empowering Your Options Trading Journey: A Call to Action

By embracing paper trading, you’re not just learning about options; you’re taking control of your financial future. It’s a powerful tool that empowers you to learn, refine your skills, and build confidence before stepping into the world of live trading. Choose the right paper trading app, harness the insights from experts, and start your journey towards becoming a confident and successful options trader.

Start paper trading today, and experience the thrill of the markets without the fear of losing your hard-earned money. The journey to financial freedom starts with a single trade, and with paper trading, you can confidently take that first step.