In the intricate world of financial markets, correlation trading options present a sophisticated strategy that harnesses the interconnectedness of underlying assets. By leveraging the relationships between different stocks, commodities, or indices, traders can potentially enhance their portfolio performance and manage risk with unparalleled precision.

Image: s3.amazonaws.com

Correlation trading centers around the idea that the movements of certain assets tend to exhibit a correlation, either positive or negative. Positive correlation signifies that when one asset rises in value, the other asset tends to follow suit. Conversely, with negative correlation, an upward movement in one asset is often accompanied by a downward movement in the other.

To capitalize on these relationships, traders employ correlation trading options. These specialized options contracts allow investors to bet on the correlation between two assets. For instance, a trader who anticipates a positive correlation between two stocks might purchase a call option on one stock and a put option on the other. If the correlation holds true and both stocks indeed rise, the call option gains value, while the put option loses value, potentially netting the trader a profit.

The intricate calculations involved in correlation trading often require the use of mathematical models and statistical analysis. Traders typically utilize statistical measures like the Pearson correlation coefficient to determine the strength and direction of the correlation between two assets. Sophisticated trading platforms also offer correlation tools that aid in identifying and analyzing potential trading opportunities.

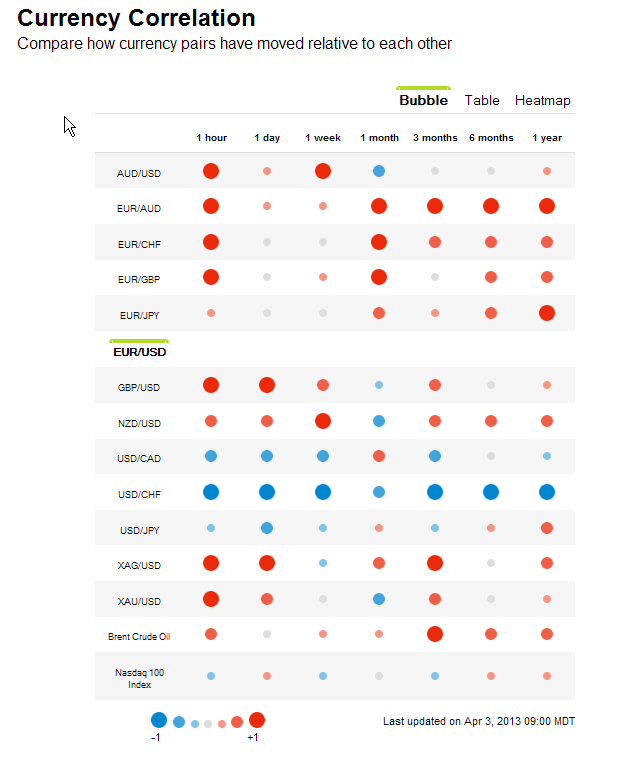

Correlation trading strategies find application across various asset classes. In the equity markets, traders might exploit correlations between stocks within the same sector or industry. In the commodities market, correlations between oil and gas, or gold and precious metals can be leveraged for profit. Additionally, traders can explore correlations between currencies, interest rates, and market indices.

The advent of exchange-traded funds (ETFs) has further amplified the versatility of correlation trading. ETFs that track indices or specific sectors provide convenient vehicles for harnessing correlations. Traders can combine ETF options with stock options to amplify their strategies and achieve more nuanced risk management.

However, correlation trading is not without its complexities. The relationships between assets can be dynamic, influenced by a myriad of factors. Economic conditions, market events, and global news can alter correlations, leading to unexpected outcomes. Therefore, traders must continuously monitor the evolving market environment and adapt their strategies accordingly.

Mastering correlation trading options requires discipline, analytical prowess, and a deep understanding of market dynamics. By unraveling the intricate web of interconnections between assets, traders can unlock new avenues for profit and navigate the markets with greater confidence.

Image: www.pinterest.jp

Correlation Trading Options

Image: www.dailyfx.com