The Thrilling World of Options Trading

Options trading offers an exciting avenue to leverage market movements and amplify potential gains. However, traditional options trading usually entails substantial commissions, diminishing returns and limiting accessibility for many investors. The emergence of commission-free options trading platforms has revolutionized the landscape, allowing both experienced traders and novices to partake in this rewarding endeavor without financial burdens.

Image: projectopenletter.com

Understanding Commission-Free Options Trading

Commission-free options trading involves platforms that do not charge any fees for executing options trades. This eliminates the intermediary costs typically associated with such transactions, providing traders with more flexibility and control. However, it’s essential to note that while the trading platforms may waive commission fees, other costs like exchange fees, regulatory fees, and clearinghouse fees may still come into play.

- Benefits of Commission-Free Options Trading: Enhanced profitability due to reduced fees, increased flexibility for active traders, expanded trading opportunities for smaller accounts.

- Considerations: Examination of other fees associated with options trading, evaluation of platform capabilities and offerings, and comparison of different platforms to find the best fit for individual needs.

Navigating the Commission-Free Options Trading Landscape

In choosing a commission-free options trading platform, it’s crucial to assess the following factors:

- Regulatory Compliance: Ensuring the platform is registered and regulated by relevant authorities and adhering to industry best practices.

- Trading Platform and Features: Evaluating the platform’s user interface, tools, resources, and educational materials for alignment with trading style and needs.

- Market Access and Product Offerings: Confirming the platform’s range of options markets available for trading and the variety of options contracts offered.

- Additional Fees: Determining whether the platform charges additional fees beyond the commission-free trading, such as spreads or margin rates.

Expert Tips for Commission-Free Options Trading Success

To optimize success in commission-free options trading, consider these insider tips:

- Trade Strategically: Applying thoughtful trading strategies, managing risk, and utilizing hedging techniques are key to long-term success.

- Education and Research: Continuous learning about options strategies, market trends, and economic indicators is essential for making informed trading decisions.

- Start Small: Practicing responsible risk management by initiating trading with smaller positions and gradually increasing as experience grows.

- Monitor the Markets: Regularly monitoring market movements, news, and economic data is vital to capturing trading opportunities and adapting to market dynamics.

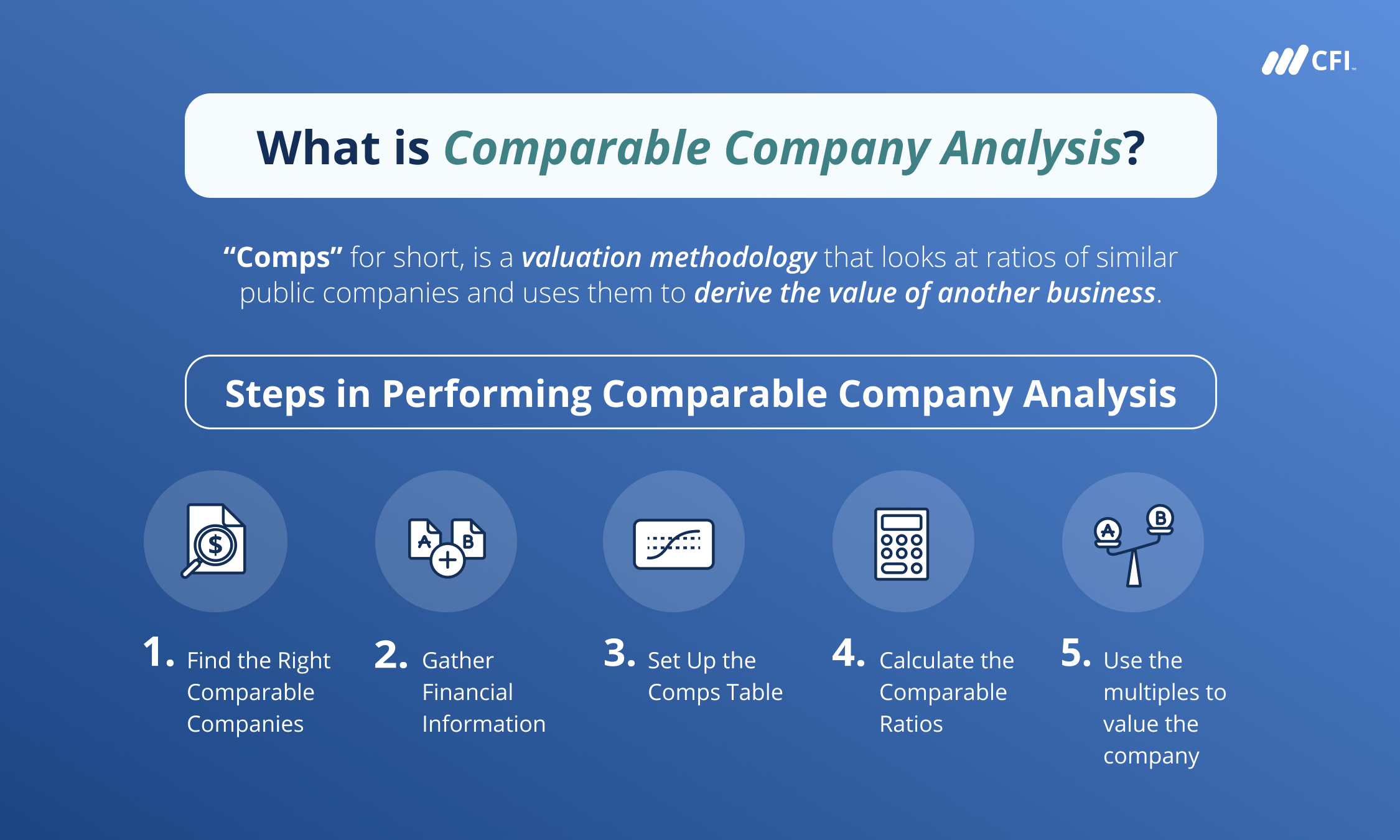

Image: corporatefinanceinstitute.com

Comission Free Options Trading

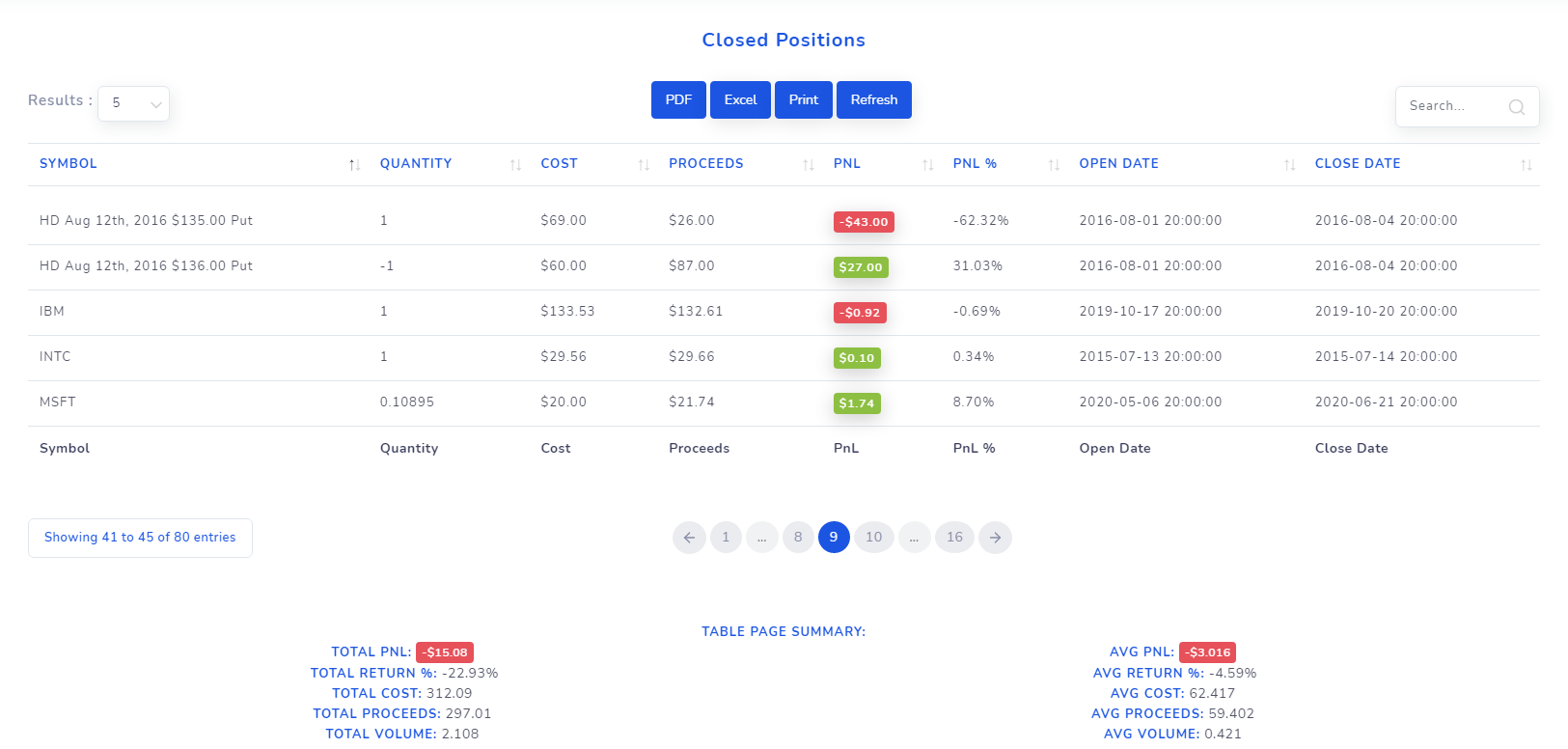

Image: www.tradesviz.com

Frequently Asked Questions on Commission-Free Options Trading

Q: Is commission-free options trading available to all traders?

A: Yes, commission-free options trading platforms accessible to both experienced traders and those new to the options market.

Q: Are there any hidden fees to consider in commission-free options trading?

A: While platforms may not charge commissions, other fees like exchange fees, regulatory fees, and clearinghouse fees may apply.

Q: How do I choose the best commission-free options trading platform?

A: Assess factors like regulation, reputation, trading features, market access, and additional fees to determine the platform most suited to your needs.

Interested in exploring the world of Commission-Free Options Trading? Engage with the thriving online communities, forums, and social media platforms where traders connect, share insights, and stay up-to-date with market trends and opportunities.