Introduction

Are you intrigued by the world of options trading, but unsure of how to navigate the eligibility criteria? Charles Schwab, a renowned brokerage firm, offers a comprehensive platform for investors seeking to venture into this exciting financial market. In this article, we’ll delve into the specific requirements you need to meet to become an options trader with Charles Schwab, ensuring you have all the necessary knowledge to embark on your trading journey with confidence.

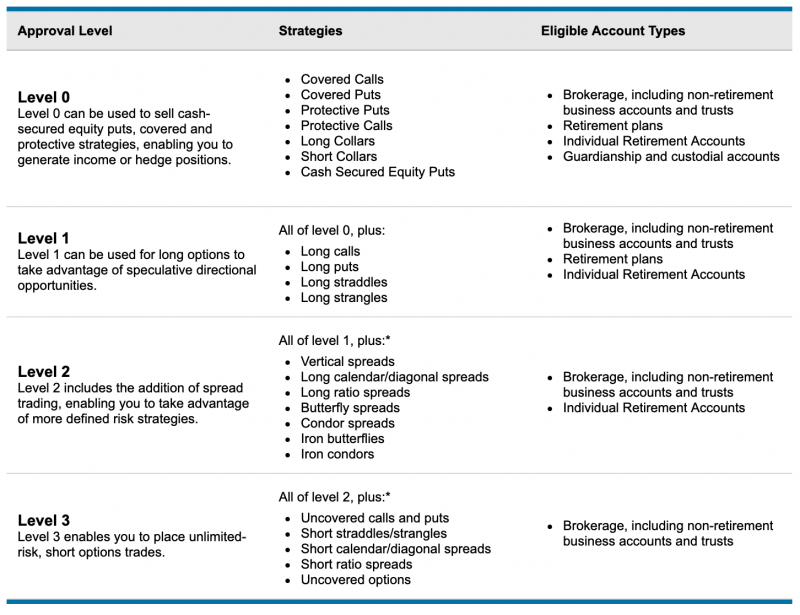

Image: www.schwab.com

Eligibility Criteria

-

Account Type: Trading options requires you to open a brokerage account with Charles Schwab. Two account types are available: individual and joint accounts. Individual accounts are suitable for single investors, while joint accounts are shared by two or more individuals.

-

Age: You must be at least 18 years of age to trade options. However, if you’re a minor, you can open a custodial account jointly with a parent or legal guardian.

-

Investment Objectives and Risk Tolerance: Options trading involves significant risk, so it’s crucial to align your trading strategies with your overall investment objectives and risk tolerance. Schwab will assess your investment goals, financial situation, and risk appetite before approving your options trading application.

-

Options Experience: Schwab requires that you have a working knowledge of options trading principles and strategies. You can demonstrate this proficiency through various means, such as passing the Series 7 exam, completing educational courses offered by Schwab or third-party providers, or showing proof of previous options trading experience with another brokerage firm.

-

Account Funding: To trade options, you need to maintain a minimum account balance. This amount varies depending on the type of options strategies you intend to execute.

Additional Considerations

-

Broker-Assisted Trading: If you’re new to options trading, it’s advisable to consider working with a broker-assisted trading platform. This option allows you to seek guidance from experienced traders who can provide insights and support throughout your trading journey.

-

Margin Trading: Options trading can involve margin trading, which means you can borrow money from Charles Schwab to increase your buying power. However, margin trading comes with additional risks and requirements.

-

Fees: Charles Schwab charges fees for options trading, including commissions, exchange fees, and regulatory fees. It’s essential to factor these costs into your trading strategy.

Image: resivalca.com

Charles Schwab Requirements For Trading Options

Image: www.schwab.com

Conclusion

Trading options with Charles Schwab requires meeting specific eligibility criteria to ensure responsible and informed participation in the financial markets. By fulfilling these requirements, you’ll be equipped to embark on your options trading journey with the necessary knowledge and support. Remember to assess your individual circumstances, seek professional guidance when needed, and continuously educate yourself to navigate the complexities of options trading successfully.