A Guide to Options Trading on the Robinhood Platform

Options trading is a complex and potentially risky financial strategy that allows investors to speculate on the future price of an asset, such as a stock or commodity. In recent years, options trading has become increasingly popular, thanks in part to the rise of online brokerages like Robinhood that make it easy for individual investors to access the options market.

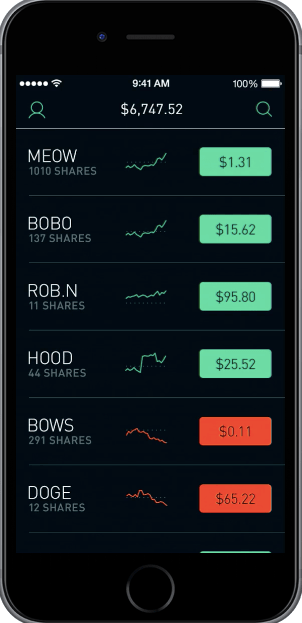

Image: www.daytrading.com

However, it’s important to note that options trading is not suitable for all investors. Before you start trading options, it’s important to understand the risks involved and to make sure that you have the necessary knowledge and experience. If you’re not sure whether options trading is right for you, it’s a good idea to speak with a financial advisor.

What are options?

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. There are two main types of options: calls and puts.

A call option gives the buyer the right to buy an underlying asset at a specified price on or before a certain date. A put option gives the buyer the right to sell an underlying asset at a specified price on or before a certain date.

How does options trading work?

When you buy an option, you are essentially buying the right to buy or sell an underlying asset at a specified price on or before a certain date. You do not have to exercise this right, but you have the option to do so if you believe that the price of the underlying asset will move in your favor.

The price of an option is determined by a number of factors, including the price of the underlying asset, the time until expiration, and the volatility of the underlying asset. The more volatile the underlying asset, the more expensive the option will be.

Can you do options trading on Robinhood?

Yes, you can do options trading on Robinhood. Robinhood offers a variety of options trading products, including:

- Single-leg options

- Multi-leg options

- Covered calls

- Cash-secured puts

To start options trading on Robinhood, you will need to open an account and be approved for options trading. Once you have been approved, you will be able to trade options on any of the stocks or ETFs that are available on the Robinhood platform.

Image: soialindo.blogspot.com

Tips for options trading on Robinhood

Here are a few tips for options trading on Robinhood:

- Understand the risks involved. Options trading is a complex and potentially risky financial strategy. Before you start trading options, it’s important to understand the risks involved and to make sure that you have the necessary knowledge and experience.

- Start small. When you first start trading options, it’s a good idea to start small. This will help you to get a feel for the market and to learn how to manage your risk.

- Use limit orders. When you place an order to buy or sell an option, you can use a limit order to specify the maximum price that you are willing to pay or the minimum price that you are willing to accept. This will help you to avoid getting filled at a price that you are not comfortable with.

- Have a plan. Before you execute an options trade, it’s a good idea to have a plan. This plan should include your entry and exit points, as well as your risk management strategy.

FAQs about options trading on Robinhood

Here are some frequently asked questions about options trading on Robinhood:

- What are the requirements for options trading on Robinhood?

- Be at least 18 years old

- Have a valid Social Security number

- Have a U.S. bank account

- Pass the options trading knowledge test

- How much does it cost to trade options on Robinhood?

- What are the risks of options trading on Robinhood?

- The possibility of losing your entire investment

- The risk of being assigned an options contract

- The risk of margin calls

- How can I learn more about options trading on Robinhood?

- The Robinhood Learning Center

- The Robinhood Options Playbook

- Robinhood webinars and live events

To be approved for options trading on Robinhood, you must meet the following requirements:

Robinhood charges a $0.65 per-contract fee for options trades. This fee is the same for all options trades, regardless of the size of the trade.

Options trading is a complex and potentially risky financial strategy. The risks of options trading include:

Robinhood offers a variety of resources to help you learn more about options trading. These resources include:

Can You Do Options Trading Robinhood Website

Image: www.youtube.com

Conclusion

Options trading can be a complex and potentially risky financial strategy. However, it can also be a powerful tool for investors who are looking to generate income or speculate on the future price of an asset.

If you are interested in learning more about options trading, Robinhood offers a variety of resources to help you get started.

Are you interested in learning more about options trading on Robinhood?