Imagine a world where you could profit from the ups and downs of the stock market without ever risking a single dollar. It sounds enticing, doesn’t it? This is the allure of “no-loss” option trading strategies. The promise of guaranteed returns with zero risk has captured the attention of countless investors, both seasoned and novice. But is it truly possible to achieve such a feat? This article delves into the fascinating world of options trading, dissecting the misconception of “no-loss” strategies and guiding you towards a more realistic and informed approach.

Image: www.youtube.com

While the idea of risk-free gains is alluring, it’s essential to understand that no trading strategy can guarantee profits. The financial markets are inherently unpredictable, and even seasoned traders can fall victim to unexpected market shifts. The term “no-loss option trading strategy,” while often used in online forums and marketing materials, is a misnomer. Remember, even the most meticulous trader cannot control the whims of the market.

Understanding the Fundamentals of Options Trading

To shed light on the complexities of no-loss strategies, let’s first establish a solid foundation in options trading itself. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a specific date (the expiration date). Options are categorized as either “calls” or “puts.” A call option grants the right to buy an asset, while a put option grants the right to sell an asset.

Unveiling the Allure of Options Trading: The Potential for Profit

Options trading often attracts investors due to its inherent leverage. This means that a relatively small investment can potentially yield significant returns. Let’s imagine you buy a call option on a stock that is trading at $100 per share. The option contract gives you the right to buy 100 shares of the stock at $110 per share, with an expiration date of next month. If the stock price rises to $120 per share before the expiration date, you can exercise your option, purchase the stock at $110 per share, sell it immediately in the market for $120 per share, and pocket the $10 difference per share, netting a profit of $1,000 on your initial investment in the option contract.

However, it’s crucial to grasp that the leverage of options trading can also magnify losses. If the stock price falls below the strike price of $110 before the expiration date, your option will expire worthless, and you lose your entire initial investment.

Delving into “No-Loss” Option Trading Strategies

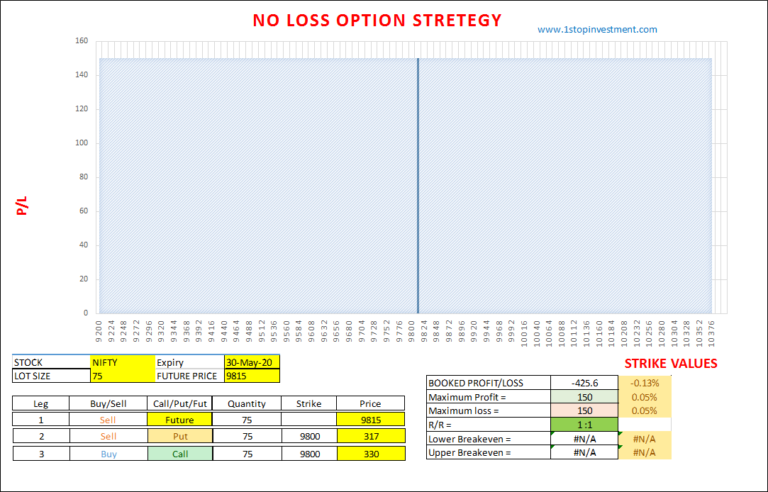

The concept of “no-loss” option trading strategies often revolves around strategies like covered calls and selling options.

Image: www.1stopinvestment.com

Covered Calls: Limiting Risk While Capturing Potential Premiums

A covered call involves selling a call option on a stock that you already own. By selling the call option, you receive a premium upfront. If the stock price stays below the strike price at expiration, you keep the premium and the shares. If the stock price rises above the strike price, the buyer of the call option will exercise it, forcing you to sell your shares at the strike price. Since you already own the shares, you can cover the sale, limiting your potential loss.

Selling Options: Earning Premiums Through Short Selling

Selling options, or more specifically selling put options, involves selling the right to sell an underlying asset to someone else. By selling a put option, you receive a premium upfront. If the stock price stays above the strike price at expiration, the buyer won’t exercise the option, and you keep the premium. If the stock price falls below the strike price, the buyer will exercise the option, forcing you to buy the stock at the strike price.

The Pitfalls of “No-Loss” Strategies: The Reality Behind the Illusion

While covered calls and selling put options can potentially provide a degree of downside protection, they are not risk-free.

-

Unlimited Risk: In covered calls, if the stock price skyrockets beyond the strike price, you are obligated to sell your shares at the strike price, potentially missing out on significant gains. In selling put options, if the stock price plummets far below the strike price, you are forced to buy the stock at the strike price, leading to substantial losses.

-

Market Volatility: The success of these strategies hinges heavily on market volatility. In volatile markets, the premiums you receive from selling options may not compensate for potential losses, leaving you susceptible to significant losses.

-

Time Decay: The time value of an option decays as it approaches its expiration date. This means that you will lose a portion of the premium every day.

A More Realistic Approach: Managing Risk, Not Eliminating It

Instead of chasing the elusive “no-loss” strategies, focus on managing risk through a comprehensive understanding of options trading, coupled with a disciplined approach to risk management.

-

Set Realistic Expectations: Recognize that no trading strategy can guarantee profits. Embrace the inherent uncertainty of the markets and focus on building a long-term investment strategy based on risk management and consistent returns.

-

Diversify Your Portfolio: Don’t rely solely on options trading. Diversify your investment portfolio across different asset classes like stocks, bonds, and real estate to mitigate risk.

-

Practice Proper Risk Management: Establish clear stop-loss orders to limit potential losses. This will help you exit a trade automatically when a predetermined price level is reached, preventing further losses.

-

Thorough Due Diligence: Before engaging in any option trading, conduct rigorous research on the underlying asset and the market conditions.

-

Continuous Learning & Adapting: The financial markets are constantly evolving. Invest in your knowledge by reading books, attending seminars, and keeping abreast of market trends through reliable sources, continuously refining your understanding of options trading.

No Loss Option Trading Strategy

The Bottom Line: Navigating the World of Options with Wisdom

While the promise of “no-loss” option trading strategies might seem alluring, it’s essential to approach the subject with a healthy dose of skepticism. There are no foolproof strategies to guarantee profits in the unpredictable world of finance. Instead of chasing unrealistic expectations, embrace a more pragmatic approach to risk management. Learn the fundamentals of options trading, diversify your portfolio, and prioritize continuous learning to develop a sustainable investment strategy for achieving your financial goals. Remember, success in trading requires a blend of knowledge, discipline, and resilience.