Navigating the World of Options Trading

Embarking on the exhilarating journey of options trading can be both exciting and daunting. Choosing the right platform is a crucial step to maximize your potential returns while mitigating risks. To empower you with knowledge, this comprehensive guide delves into the intricacies of options trading, showcases the top sites for this dynamic market, and unveils invaluable insights to elevate your trading game.

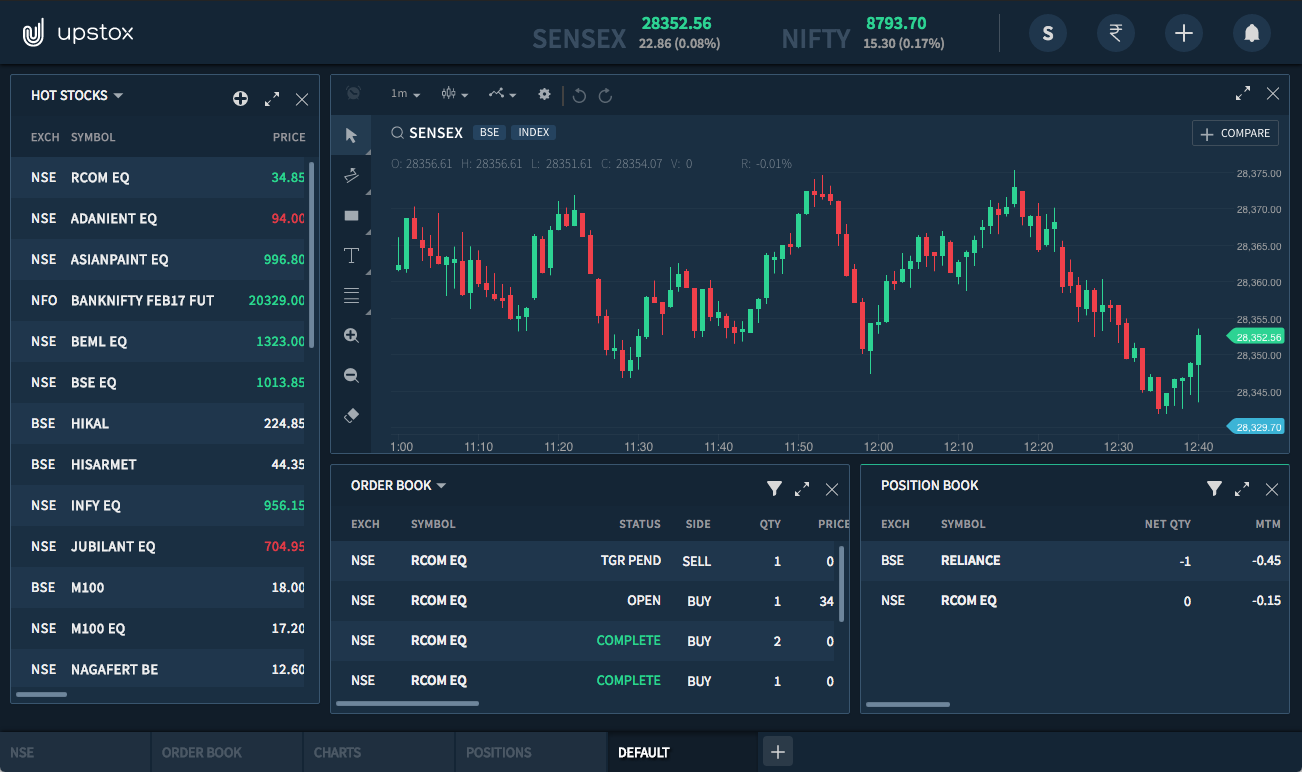

Image: equityblues.com

From defining options and tracing their history to exploring the latest trends and developments, this article equips you with the foundation to navigate the options market with confidence. Glean expert advice, unravel tips for successful trading, and engage in a thought-provoking FAQ section to quench your thirst for knowledge.

The Essence of Options Trading

Understanding the Fundamentals

Options, essentially, bestow the right, not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. These versatile financial instruments offer traders the flexibility to profit from market fluctuations, hedge against risks, or generate income through premiums.

Delving into the history of options unveils their roots in the 17th century, where traders sought to mitigate risks associated with agricultural commodities. Over time, options evolved into a sophisticated instrument used in various markets, including stocks, bonds, currencies, and indices.

Navigating the Latest Trends and Developments

The options market is constantly evolving, fueled by technological advancements and changing market dynamics. Keeping abreast of the latest trends and developments is pivotal for traders seeking to stay ahead of the curve.

- Exchange-Traded Options (ETOs): ETOs are standardized options contracts traded on exchanges, offering greater liquidity and transparency.

- Over-the-Counter (OTC) Options: OTC options, also known as customized options, cater to specific investor needs and are not traded on exchanges.

- Artificial Intelligence (AI): AI is revolutionizing options trading by offering sophisticated analytical tools and automated trading algorithms.

- Regulatory Changes: Regulatory changes can significantly impact the options market, so staying informed about these shifts is essential.

Image: www.pinterest.com.mx

Expert Tips for Successful Options Trading

Embarking on options trading requires a blend of knowledge, skill, and a proven strategy. Seasoned traders have invaluable insights to share, guiding you towards successful outcomes.

- Know Your Options: Before venturing into the market, arm yourself with a thorough understanding of options and their complexities.

- Define Your Goals: Clearly define your trading goals, whether it’s income generation, risk management, or speculation.

- Manage Your Risk: Options trading carries inherent risks, so implement robust risk management strategies to safeguard your capital.

- Stay Informed: Diligent research and continuous learning are indispensable for staying abreast of market trends and adjusting your strategies accordingly.

- Seek Professional Advice: If uncertain about a particular trade or strategy, don’t hesitate to seek guidance from experienced professionals.

Embracing these expert tips will empower you to navigate the options market with a well-informed and proactive approach, amplifying your chances of successful trading endeavors.

Frequently Asked Questions

To illuminate the intricacies of options trading, we present a comprehensive FAQ section.

- Q: What is an option premium?

A: It’s the price paid to the options seller for the right to buy or sell an underlying asset. - Q: How do I choose the right options strategy?

A: Tailoring your strategy to your goals, risk tolerance, and market conditions is crucial for success. - Q: Can I trade options with a small account?

A: Yes, micro-options and fractional shares make options trading accessible to investors with limited capital. - Q: How do I minimize losses in options trading?

A: Effective risk management, including position sizing, stop-loss orders, and diversification, can mitigate potential losses. - Q: How do I stay updated on options trading news and events?

A: Following reputable financial news sources, industry blogs, and expert commentary will keep you informed.

Best Sites For Trading Options

Image: liveinsure.in

Conclusion

Mastering the art of options trading requires a holistic approach that encompasses knowledge, strategy, and expert guidance. By selecting the right platform, embracing our tips, and engaging with the provided FAQ, you equip yourself with the tools and insights to navigate this dynamic market with confidence.

Are you ready to unlock the potential of options trading and embark on a rewarding financial journey? If this comprehensive guide has piqued your interest, delve deeper into the world of options by visiting our website for additional resources, tutorials, and expert insights to elevate your trading prowess.