Options trading can be a thrilling and rewarding adventure, offering the potential for substantial profits. However, for beginners, navigating the complex world of options can seem daunting. The right platform can make all the difference in your success. From accessing real-time market data to executing trades efficiently, choosing the best platform is crucial.

Image: www.tradestation.com

A while back, I was feeling overwhelmed trying to manage my trades across multiple platforms, constantly switching between websites and apps. I knew there had to be a better way, and finally, I stumbled upon a platform that made all the difference. It streamlined my trading process, provided valuable insights, and helped me stay on top of my options positions. Today, I want to share my findings and guide you through the process of finding the perfect platform for your trading journey.

Understanding the Options Trading Landscape

What are Options and Why Trade Them?

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a specific price (the strike price) on or before a certain date (the expiration date). Options offer a unique combination of leverage and risk management. Unlike buying or selling the underlying asset directly, options allow you to control a larger position with a smaller amount of capital. This leverage can potentially amplify profits, but it can also magnify losses.

Options are valuable tools for traders seeking to generate profits from a variety of market conditions. For example, you can use options to:

- Profit from Price Volatility: If you believe an asset’s price is likely to move significantly, buying options can provide significant leverage to enhance potential gains.

- Hedge Existing Positions: Options can act as insurance, mitigating risk by protecting against adverse price movements in your portfolio.

- Generate Income: Selling options can generate income through premiums, but it requires careful risk management.

Key Features to Look for in an Options Trading Platform

With numerous options trading platforms available, it’s essential to understand the key features that distinguish the best platforms from the rest. Consider these factors when selecting a platform for your trading needs:

Image: www.youtube.com

1. Intuitive User Interface and Mobile Accessibility

A user-friendly platform is paramount for a smooth and enjoyable trading experience. Look for a platform with a clean and intuitive interface that makes it easy to navigate. Key information should be readily accessible, including real-time quotes, order execution screens, and account management sections. If you plan to trade on the go, ensure that the platform offers a robust mobile app with all the features and functionality of the desktop version.

2. Comprehensive Options Trading Tools and Analytics

The best platforms offer a wide range of tools and analytics to help you make informed trading decisions. These tools can include:

- Real-Time Market Data: Access to accurate and up-to-the-minute market data is crucial for staying ahead of the curve, including price quotes, order books, and trading volume.

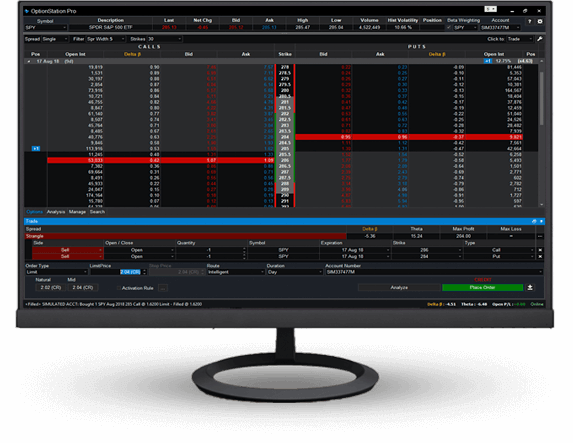

- Options Chain Analysis: The ability to analyze options chains, which display different strike prices and expirations, allows you to compare and contrast pricing options.

- Technical Indicators: Various technical indicators help you identify trends, support and resistance levels, and potential breakout points, enhancing your decision-making process.

- Trading Strategies: Some platforms offer pre-built trading strategies or allow you to create your custom strategies, leveraging conditional orders, alerts, and risk management tools.

3. Order Types and Execution Speed

To successfully execute your options trades, you’ll need a platform with a wide array of order types and fast execution speeds. Look for platforms that support market, limit, stop-loss, and trailing stop orders, providing flexibility in your trades. Fast order execution ensures that you can capitalize on market opportunities and minimize slippage, which occurs when the price of an asset changes between the time you place your order and when it’s executed.

4. Robust Security Measures and Account Protection

Since you’ll be entrusting your funds to the platform, prioritize security features. Look for platforms that offer industry-standard encryption, two-factor authentication, and other robust measures to protect your account and personal information from unauthorized access.

5. Educational Resources and Customer Support

Whether you’re a seasoned trader or just starting out, access to educational resources and reliable customer support can make a significant difference. Look for platforms that provide beginner-friendly tutorials, webinars, and expert insights. In addition, ensure that the platform offers prompt and effective customer support through various channels, including live chat, email, and phone.

Top Platforms for Options Trading

A plethora of platforms cater to options traders, each with its unique strengths and weaknesses. Here’s a rundown of some of the leading platforms for options trading:

1. Interactive Brokers

For experienced traders seeking a wide range of options, low commissions, and advanced charting tools, Interactive Brokers stands out. With access to global markets and a comprehensive array of options strategies, this platform caters to sophisticated traders. However, its interface can be overwhelming for beginners.

2. TD Ameritrade

TD Ameritrade strikes a balance between advanced features and user-friendliness. Its Thinkorswim platform offers powerful charting tools, options analytics, and an intuitive interface that appeals to both beginners and experienced traders. It also boasts strong educational resources and exceptional customer support.

3. Fidelity

Fidelity provides a beginner-friendly platform with competitive pricing and a user-friendly interface. It offers a wide range of options strategies, charting tools, and research resources. Its focus on educational content and customer service makes it a popular choice for new traders.

4. Robinhood

Robinhood gained popularity for its commission-free stock and options trading, making it attractive to entry-level investors. However, it lacks the advanced features and research tools found in more sophisticated platforms. With limited order types and analytics, it’s best suited for simple options trading strategies.

Tips for Choosing the Best Platform

After considering the key features and popular platforms, here are some tips to help you narrow down your choices:

- Identify your trading style: Are you a day trader seeking rapid execution speeds or a long-term investor focused on research and analysis? Knowing your trading style helps determine the features you prioritize.

- Consider your experience level: Beginners might prefer platforms with beginner-friendly tutorials, while experienced traders value advanced tools and analytics.

- Review pricing and fees: Compare commission structures, account minimums, and other fees associated with each platform.

- Test the platform: Most platforms offer demo accounts, allowing you to experiment with their interface, tools, and features before committing real money.

- Read reviews and compare platforms: Look for reviews from other traders and compare platforms based on their features, pricing, and user experience.

FAQs about Options Trading Platforms

Q: What is the difference between a brokerage account and an options trading platform?

A brokerage account is a financial account where you deposit funds and hold investments. An options trading platform is software that allows you to trade options within your brokerage account. Many brokers now offer platforms specifically designed for options trading.

Q: Is it safe to trade options online?

Yes, trading options online can be safe if you choose a reputable platform with robust security measures. Look for platforms with encryption, two-factor authentication, and other security protocols to protect your funds and personal information.

Q: Do I need special software to trade options?

Most brokers offer web-based platforms that can be accessed through your browser. However, you may need to download additional software for advanced features, such as charting tools or real-time data feeds.

Q: How do I choose the right options trading platform for me?

The best platform for you depends on your trading style, experience level, and budget. Consider the features, pricing, and user experience of different platforms before making a decision.

Best Platform For Options Trading

Conclusion

Finding the best platform for options trading is crucial for a successful and rewarding experience. By carefully considering the key features, popular platforms, and expert tips outlined in this article, you can find a platform that aligns with your trading needs and goals. Remember, your trading journey is unique, so choose the platform that best supports your individual style and helps you navigate the exciting world of options trading.

Are you interested in learning more about options trading platforms and how to choose the best one for your needs?