Introduction

As the digital asset landscape continues to evolve, Bitcoin options have emerged as a sophisticated instrument that enables investors to mitigate risk, enhance returns, and participate in the volatile price movements of the world’s most prominent cryptocurrency. However, navigating the vast array of Bitcoin options trading platforms can be a daunting task. In this comprehensive guide, we delve into the intricacies of Bitcoin options trading, exploring the key features, advantages, and considerations to guide you in selecting the platform that best aligns with your investment objectives and trading style.

Image: itsmyownway.com

Understanding Bitcoin Options Trading

An option contract grants the buyer, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a certain amount of Bitcoin at a predetermined price (strike price) on a specified date (expiration date). Options trading provides a versatile tool for investors to speculate on future price movements, hedge against downside risk, and generate income through premium selling strategies.

Key Features to Consider

When evaluating Bitcoin options trading platforms, several key features warrant careful consideration:

- Market Depth and Liquidity: The depth of the market, measured by the number of active buyers and sellers, plays a crucial role in ensuring efficient trade execution and minimizing slippage. Liquidity also affects the bid-ask spread, which represents the difference between the prices at which you can buy or sell an option.

- Supported Contract Types: Different platforms offer varying degrees of option types, including standard contracts (e.g., European, American), as well as more exotic options (e.g., binary, straddle). Choose a platform that provides the flexibility to trade options that align with your specific trading strategies.

- Trading Fees: Transaction costs can significantly impact your trading profitability. Compare the trading fees, including commissions, spreads, and any additional charges, to find a platform that offers competitive pricing and minimizes expenses.

- User Interface and Usability: The user interface and overall platform design significantly affect your trading experience. Look for platforms with intuitive and feature-rich interfaces that cater to beginner and advanced traders alike.

- Security and Regulation: The safety of your funds and the integrity of the trading platform are paramount. Choose platforms that adhere to stringent security protocols, offer robust two-factor authentication, and operate under credible regulatory frameworks.

Advantages of Choosing the Right Platform

Selecting the optimal Bitcoin options trading platform can provide numerous advantages:

- Optimized Trading Performance: A platform with high market depth and liquidity allows for efficient and timely trade execution, reducing the likelihood of missed opportunities or significant slippage.

- Flexible and Diverse Trading Strategies: Platforms that offer a wide range of option types empower traders to implement sophisticated trading strategies, such as hedging, speculation, and income generation.

- Cost Savings: Competitive trading fees directly impact your profitability. Choosing a platform with low commissions and spreads enables you to maximize your trading gains.

- Enhanced User Experience: An intuitive user interface and user-friendly platform design simplify order placement, monitor positions, and track market movements, elevating your trading productivity.

- Peace of Mind: Trading on secure and regulated platforms provides peace of mind by safeguarding your assets and ensuring fair and transparent market practices.

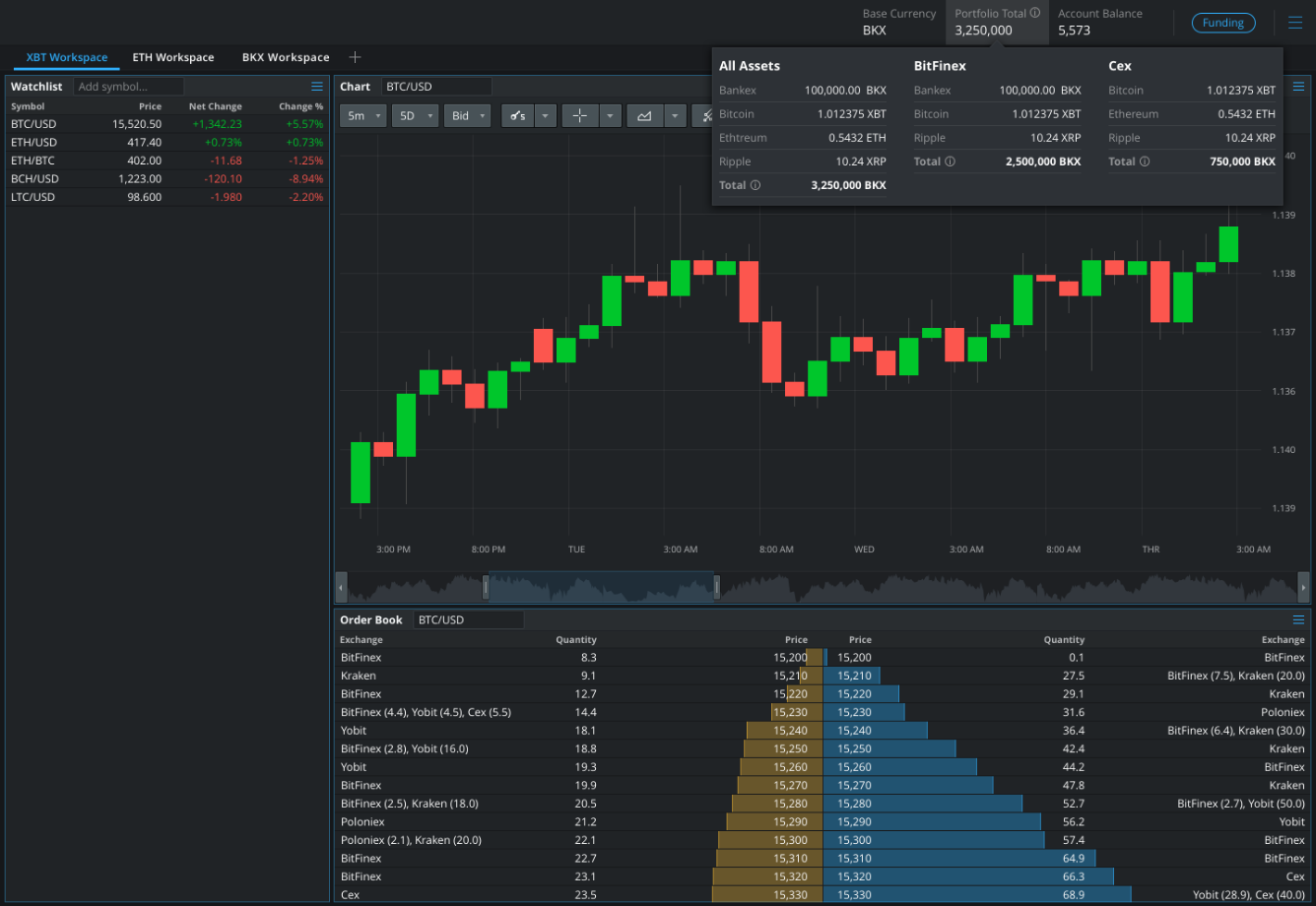

Image: devexperts.com

Considerations for Selection

Beyond the key features, additional considerations can guide your platform selection:

- Trading Experience and Volume: Your trading experience and the frequency of your trades can influence the type of platform that best suits your needs.

- Risk Management Tools: Platforms that offer advanced risk management tools, such as stop-loss orders and limit orders, empower you to better manage your portfolio and protect against potential losses.

- Customer Support and Education: Responsive and knowledgeable customer support is essential for resolving inquiries promptly and accessing valuable educational resources.

- Reputation and Community: Research the platform’s reputation within the trading community and its track record of customer satisfaction.

- Long-Term Goals and Scalability: Consider the platform’s long-term plans and scalability to cater to your evolving trading needs.

Best Bitcoin Option Trading Platform

Conclusion

Choosing the best Bitcoin options trading platform is a crucial step in maximizing your trading success. By carefully considering the key features, advantages, and considerations highlighted in this guide, you can make an informed decision that aligns with your investment objectives, trading style, and risk tolerance. Remember, thorough research and due diligence are essential in navigating the world of Bitcoin options trading and finding a platform that empowers you to execute your strategies with confidence and efficiency.