Introduction

Investing in shares has become an increasingly popular way for individuals to grow their wealth and achieve financial independence. With a wide range of investment options available, choosing the right options can be daunting, especially for beginners. In this article, we will delve into the world of ANZ share investing options trading, providing a comprehensive guide to help investors make informed decisions.

Image: www.sharesight.com

ANZ Bank offers a diverse range of share investing options, catering to investors with varying risk appetites and financial goals. From online share trading platforms to managed funds and structured products, ANZ offers solutions for both passive and active investors. By understanding the various options available, investors can customize their investment strategies to align with their individual needs and objectives.

ANZ Share Trading Platform

ANZ’s online share trading platform provides investors with direct access to the Australian Securities Exchange (ASX). The platform offers a user-friendly interface, allowing investors to buy and sell shares in real time. Investors can research stocks, place orders, and monitor their investments all from the convenience of their own devices.

One of the key benefits of the ANZ share trading platform is its low brokerage fees, which make it an attractive option for frequent traders and investors looking to minimize transaction costs. The platform also offers a range of tools and resources to assist investors in making informed decisions, including:

- Market data and analysis tools

- Comprehensive stock research

- Real-time news and updates

- Watchlists and price alerts

Managed Funds

For investors seeking a more hands-off approach, managed funds offer a way to diversify their portfolios and potentially enhance returns. ANZ offers a range of managed funds managed by experienced fund managers who invest in a diversified mix of shares, bonds, and other assets.

The advantage of managed funds is that investors can access the expertise of professional fund managers without having to research and make investment decisions themselves. However, it’s important to note that managed funds come with higher fees compared to direct share investing.

Structured Products

Structured products provide investors with a tailored investment solution combining features of both shares and fixed income. ANZ offers a range of structured products, such as warrants, options, and contracts for difference (CFDs), which allow investors to leverage their positions and potentially enhance returns.

Structured products are often more complex and higher-risk investments compared to direct share investing. Investors should thoroughly understand the risks involved before investing in structured products.

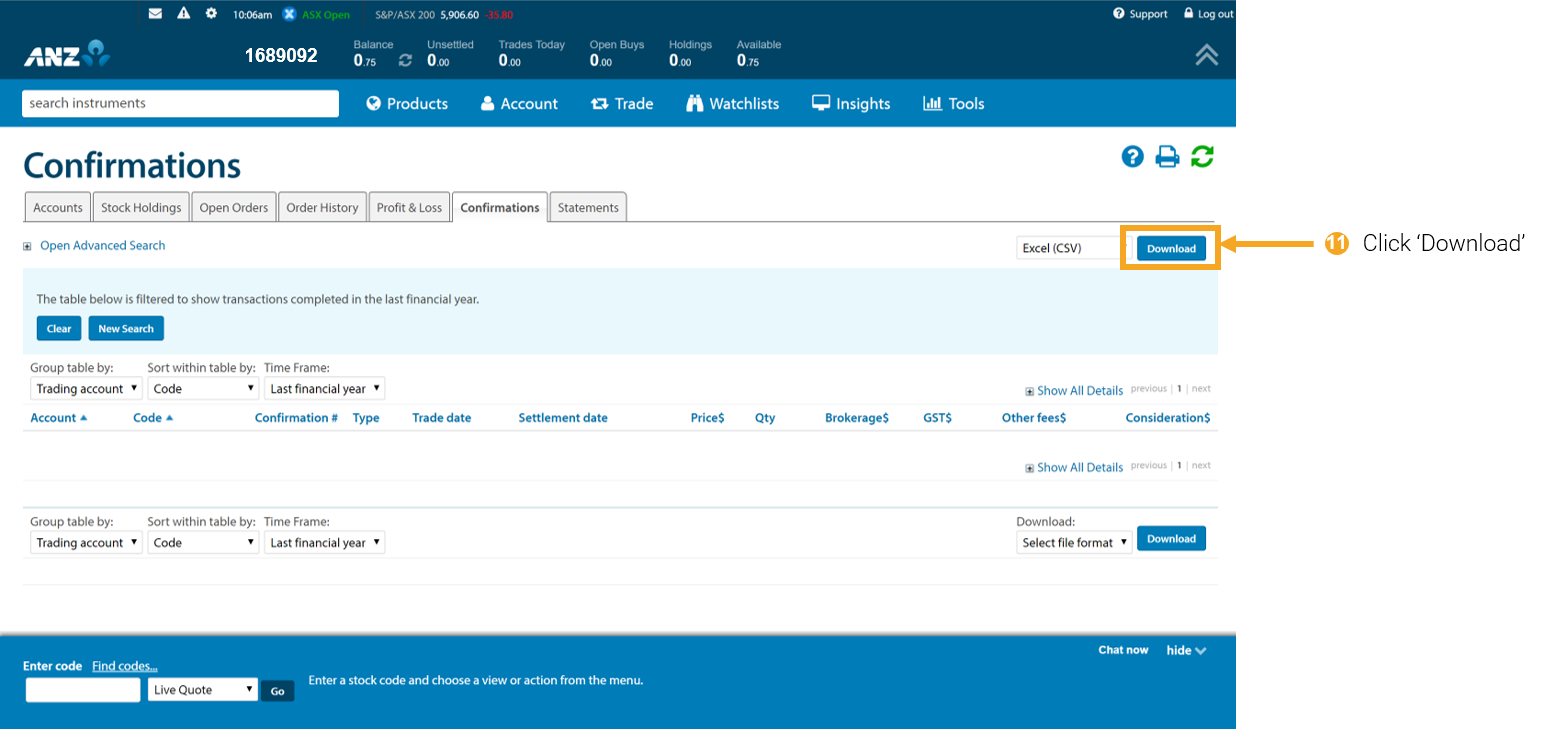

Image: transition.anzshareinvesting.com.au

Choosing the Right Options

The choice of ANZ share investing options depends on several factors, including:

- Investment objectives: Investors should consider their financial goals and risk tolerance before selecting an investment option.

- Investment horizon: The time horizon for the investment influences the choice of investment option.

- Available capital: The amount of available capital will determine the feasibility of different investment options.

- Investment knowledge and experience: Investors should assess their level of knowledge and experience before making investment decisions.

Anz Share Investing Options Trading

Risk Management

Regardless of the chosen investment option, it’s crucial for investors to adopt sound risk management strategies to protect their capital. This includes:

- Diversification: Invest in a diversified portfolio of shares to spread risk.

- Regular portfolio reviews: Monitor investments regularly and make adjustments as needed.

- Understand the risks: Inves