Swing option trading involves adopting a strategic approach to profiting from short-term price fluctuations in the stock market. Armed with the knowledge of options and technical analysis, traders endeavor to capture gains within a few days to a few weeks, known as “swings.” Unlike conventional options trading, which employs short time frames measured in hours or days, swing option trading allows traders to maintain positions for an extended period, leveraging market trends to maximize profits. This guide provides a comprehensive exploration of swing option trading, empowering you with the insights and strategies to navigate the intricacies of this dynamic trading arena.

Image: www.srtrader.com

Understanding the Basics of Swing Option Trading

Swing option trading centers around identifying and capitalizing on price swings that occur over a period of several days to a few weeks. Traders seek to profit from these swings by buying options contracts, specifically calls and puts. Calls convey the right to buy an underlying security at a predetermined price within the contract’s lifespan, while puts grant the option to sell the security under similar conditions. Swing traders aim to enter and exit trades strategically, aligning purchases and sales with anticipated price movements.

Strikes, Premiums, and Expiry: Navigating the Option Landscape

When engaging in swing option trading, it’s paramount to grasp the concepts of strike prices, premiums, and expirations. Strike prices represent the predetermined prices at which you can exercise your call (to buy) or put (to sell) options. Premiums, measured in dollars, encapsulate the cost associated with purchasing an option contract. Option expirations define the specific date until which the option can be exercised and are instrumental in determining the option’s lifespan. Grasping these intricacies empowers you to make informed decisions when selecting options for your swing trading strategies.

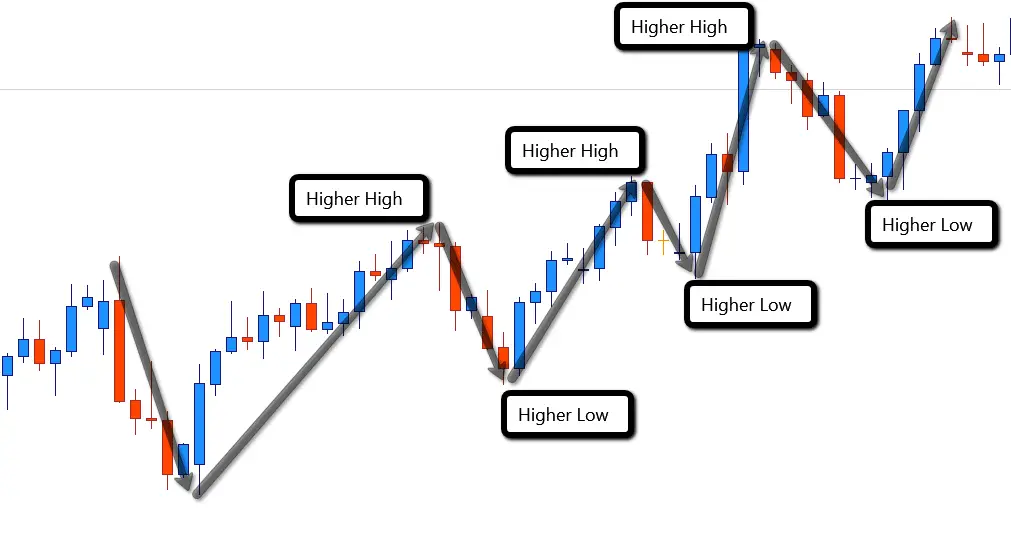

Technical Analysis: Unraveling Market Trends for Trading Success

In the realm of swing option trading, technical analysis flourishes as an indispensable tool for discerning market trends and predicting price movements. By employing a variety of charting and technical indicators, traders can pinpoint patterns, support, and resistance levels, enhancing their ability to identify profitable entry and exit points for swing trades. Moving averages, relative strength index (RSI), and moving average convergence divergence (MACD) are some of the widely utilized technical indicators that lend support to swing traders’ decision-making processes.

Image: www.norfolkfxtrader.com

Swing Trading Strategies: A Tactical Approach to Market Domination

Swing option trading empowers you with an arsenal of strategies tailored to capitalize on various market conditions. One popular approach involves identifying trends and exploiting momentum. Seasoned swing traders seek to purchase options aligned with the predominant market direction, riding the wave of price swings to their advantage. Alternatively, contrarian strategies engage in counter-trend trading, betting against the prevalent market sentiment to potentially profit from sudden trend reversals. Volatility-based strategies thrive on profiting from periods of elevated market volatility, whether through selling options during high volatility or purchasing them during low volatility conditions.

Risk Management: Shielding Your Profits from Volatility’s Wrath

In the dynamic world of swing option trading, where rapid price fluctuations are the norm, managing risk assumes paramount significance. Adhering to sound risk management principles safeguards your profits and longevity as a trader. Prudent position sizing ensures that a single losing trade does not jeopardize your trading capital, preventing emotions from overriding logical decision-making. Defined risk parameters, such as setting stop-loss orders, empower you to limit potential losses and preserve your trading equity. Diversification, achieved by spreading investments across different assets and trading strategies, further minimizes risks associated with market downturns or unfavorable price movements.

Choosing the Right Broker: A Foundation for Trading Success

When selecting a broker for swing option trading, you embark on a crucial path that can shape your trading endeavors. A reputable and reliable broker provides a stable platform, robust trading tools, and competitive pricing, laying the groundwork for successful swing trading. Consider factors such as the broker’s regulatory compliance, trading platform capabilities, fees, and customer support to ensure optimal trading conditions and seamless execution of your swing trading strategies.

Swing Option Trading

Conclusion: Leveraging Swing Option Trading for Trading Success

Swing option trading presents a powerful opportunity to capitalize on market trends and profit from short-term price fluctuations. Embarking on the path of swing option trading unlocks the potential for consistent returns, provided you possess a firm grasp of the underlying concepts, technical analysis, and risk management strategies. By honing your skills and adhering to sound trading practices, you can navigate the complexities of the market with confidence, maximizing your odds of success in this dynamic trading arena. Embrace the challenge, delve into the intricacies of swing option trading, and unlock the gateway to trading mastery.