Introduction

Paper trading is a valuable tool for investors who want to learn about options trading without risking any real capital. It’s a simulation of real trading that allows you to practice trading strategies, test market theories, and gain experience in a safe and controlled environment.

Image: bullishbears.com

Options, on the other hand, are financial instruments that give you the right to buy or sell an underlying asset at a specific price on a specific date. They offer a flexible and potentially profitable way to speculate on the future movement of assets such as stocks, bonds, commodities, currencies, and indices.

Types of Paper Trading Platforms

There are numerous paper trading platforms available, each with its own set of features and capabilities. Some of the most popular platforms include:

- TD Ameritrade Thinkorswim: Offers a powerful paper trading platform with advanced charting capabilities, strategy creation tools, and realistic market data.

- Investopedia: Provides a simplified paper trading experience with a user-friendly interface and access to a wide range of asset classes.

- Tastyworks PaperMoney: Simulates the actual Tastyworks trading platform, allowing you to test out their advanced features and trading strategies.

Simulated Trading Vs. Real Trading

While paper trading offers many advantages, it’s important to remember that it’s a simulation and not a replacement for actual trading. Simulated trading lacks the emotional and psychological pressures that come with real-time market volatility.

How to Use Paper Trading Effectively

To maximize the benefits of paper trading, follow these best practices:

- Set Realistic Goals: Avoid setting unrealistic goals such as becoming a millionaire overnight. Focus on developing your skills and gaining experience.

- Simulate Real Conditions: Paper trading should closely resemble actual trading as much as possible. Use live market data, realistic commissions, and make decisions based on market conditions.

- Analyze Your Trades: After each trade, take some time to analyze what you did right and wrong. Identify patterns and improve your decision-making process.

- Practice Regularly: The more you practice, the better you’ll become. Consistent trading will help you build confidence and develop a disciplined approach.

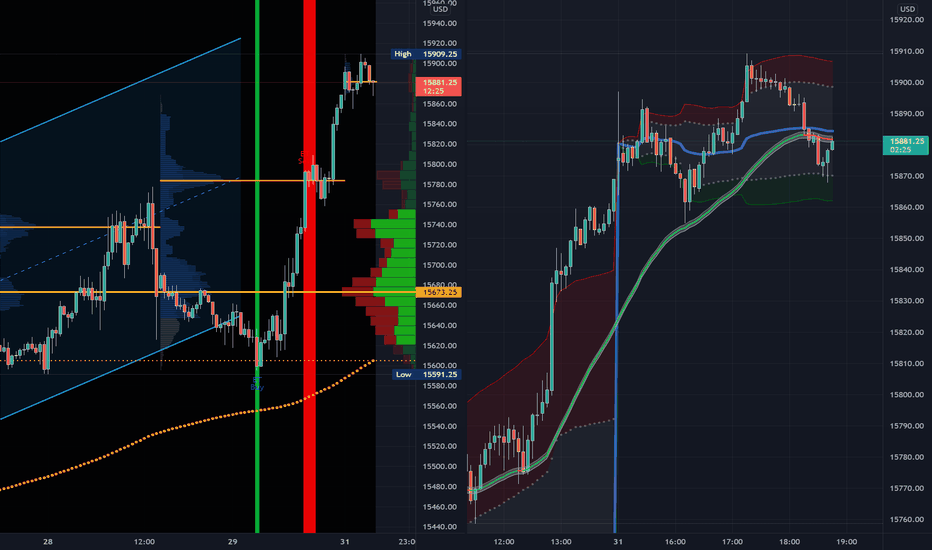

Image: www.tradingview.com

Strategies for Successful Paper Trading

- Start Small: Begin with small trades to minimize risk and gain confidence.

- Manage Risk: Use stop-loss orders to protect your capital and limit potential losses.

- Test Different Strategies: Experiment with various trading strategies and techniques to find what works best for you.

- Be Patient and Disciplined: Successful trading takes time and effort. Avoid impulsive decisions and stick to your trading plan.

Paper Trading In Options

Conclusion

Paper trading in options is an invaluable tool for investors who want to refine their trading skills, test strategies, and gain market experience without risking capital. By following the best practices discussed in this article, you can maximize the benefits of paper trading and improve your chances of success in the real market.