Introduction

In the realm of financial markets, the allure of options trading captivates investors seeking to amplify potential returns while managing risks. Amidst this ever-evolving landscape, Python emerges as a formidable tool, empowering traders with the computational prowess to navigate the complexities of options trading. This guide delves into the intriguing world of options trading strategies in Python, illuminating the intricacies of these instruments and unraveling the secrets of successful strategy development.

Image: ibridgepy.com

Options, versatile financial instruments, bestow upon traders the اختیار (Urdu for “power”) to capitalize on market fluctuations without the onus of direct ownership. Python, with its panoply of sophisticated libraries, provides the ideal platform for crafting these strategies, enabling traders to automate complex calculations, backtest historical data, and optimize their approaches.

The Building Blocks: Understanding Options

Options are contracts granting the holder the privilege, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). This flexibility empowers traders to strategize around market movements, hedging against potential losses or amplifying potential gains.

Unveiling Popular Options Trading Strategies

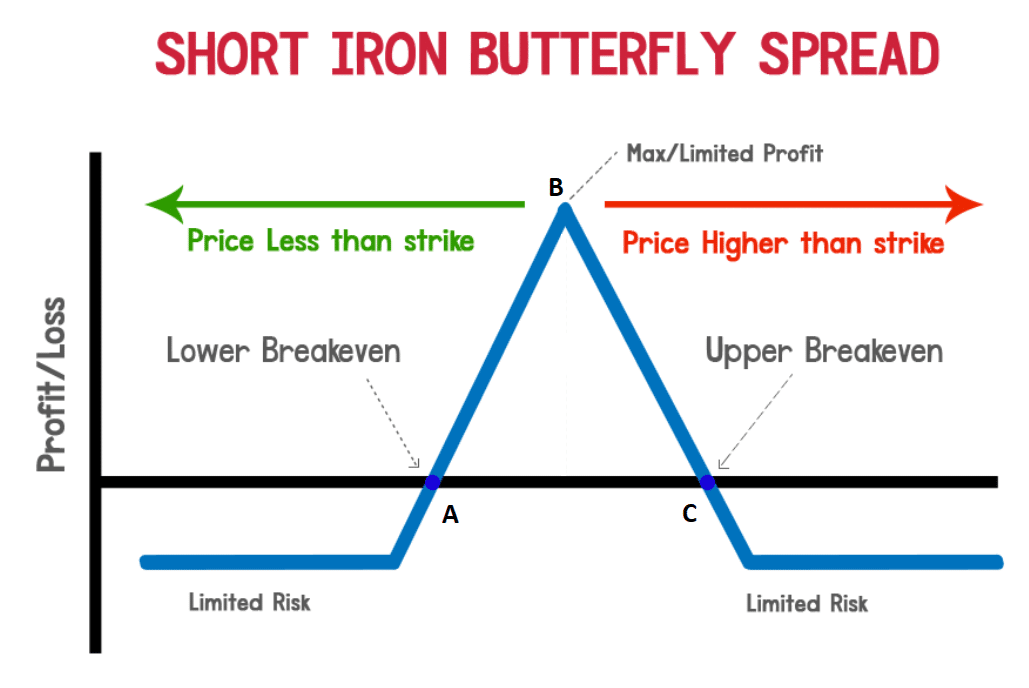

The realm of options trading strategies is vast and ever-expanding, with each strategy tailored to specific market conditions and trader objectives. Some of the most commonly employed strategies include:

- Covered Call Strategy: Generating income by selling call options against an underlying stock owned by the trader, profiting from a rise in the stock price while limiting upside potential.

- Cash-Secured Put Strategy: Receiving a premium for selling put options, concurrently obligating the trader to buy the underlying asset if the market price falls below the strike price.

- Bull Call Spread Strategy: Combining the purchase of a lower-strike call option with the sale of a higher-strike call option, aiming to profit from a moderate rise in the underlying asset’s price.

- Bear Put Spread Strategy: Involving the purchase of a lower-strike put option and the sale of a higher-strike put option, capitalizing on a decline in the underlying asset’s price.

Python’s Role in Options Trading

Python, an open-source programming language, has revolutionized the landscape of options trading through its versatility and user-friendliness. By leveraging its robust ecosystem of libraries such as NumPy, pandas, and matplotlib, traders can streamline complex tasks and gain invaluable insights.

Using Python, traders can:

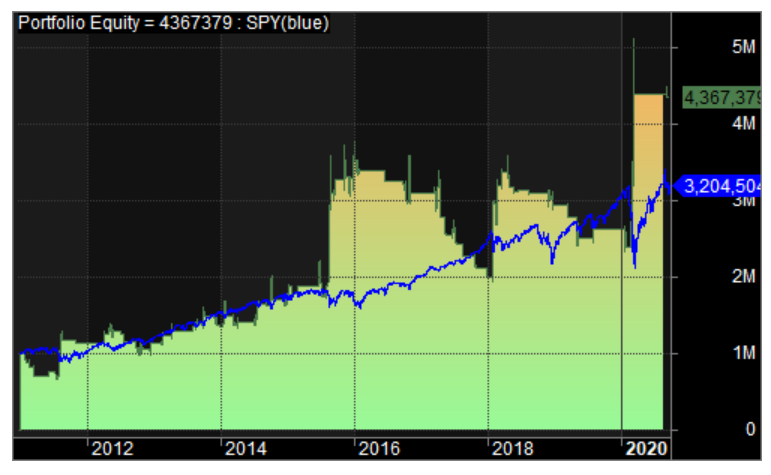

- Develop Custom Strategies: Build algorithmic trading systems to execute strategies based on historical data and real-time market conditions.

- Backtest Strategies: Evaluate the performance of different strategies using historical data, optimizing parameters and identifying the most effective approaches.

- Automate Trading: Set up trading bots to automatically place orders based on predefined criteria, removing the need for manual intervention.

- Analyze Market Data: Perform statistical and technical analysis using Python libraries, identifying patterns and trends that inform trading decisions.

Image: medium.com

Options Trading Strategies In Python

Conclusion

Options trading strategies in Python offer a wealth of oportunidades (Spanish for “opportunities”) for investors seeking to navigate the complexities of financial markets. By leveraging the power of Python, traders can unlock the potential of these strategies, harnessing computational power to make informed decisions, optimize their approaches, and maximize returns.